One Stop Shop (OSS)

The guide to EVERYTHING about e-commerce VAT rules and the OSS Single Window reform

Since 1 July 2021, e-traders must declare their distance sales on the OSS (One-Stop-Shop). Eurofiscalis, an expert in intra-Community VAT, acts as a tax representative or tax agent in France on behalf of your company. On this page you will find all the information you need to learn more about our OSS service.

- Consultation: Free and without obligation

Need to declare your e-commerce VAT on the Guichet Unique OSS?

You make e-commerce sales to European customers. Do you have to file your VAT returns through the OSS Gateway and don’t know how to register? We have the solution for you!

- You don't know the VAT rules for e-commerce

- You don't know how to register for the OSS Desk

- Your company is outside the EU and you are unable to register with OSS

- Get your OSS registration and sell across the EU

- Secure your e-commerce VAT compliance and tax return processing

- A team of VAT rockstars at your side to help you grow your export business

Make an appointment via video conference with a member of our team to discuss your needs.

Our VAT services for e-traders

190€ HT / Quarter

12-month commitment (biannual billing)

- Registration at the OSS desk

- Filing of the 4 OSS statements

- Access to our VAT Ecommerce e-learning workshop worth € 290 HT

- 1 hour of VAT video consulting during the setting up of the file, worth €250 excluding VAT

- 1 video appointment per semester

- Access to our VAT data sheets

On Quote

12-month commitment (biannual billing)

- Registration at the OSS desk

- Filing of the 4 OSS statements

- Access to our VAT Ecommerce e-learning workshop worth € 290 HT

- 1 hour of VAT video consulting during the setting up of the file, worth €250 excluding VAT

- 1 video appointment per semester

- Access to our VAT data sheets

How our services work

- Contract signature: We will send you a contract to be signed via electronic signature (Pandadoc).

- Activation of your VAT OSS services: We activate your VAT OSS services with the tax authorities.

- Payment of the 1st term invoice and deposit if required: You will receive an invoice for the 1st term and for the deposit.

- 1 hour of consulting with a VAT expert: During this hour of consulting, we help you to better understand the VAT rules for e-commerce. The aim is to ensure that your website is correctly set up to ensure your VAT compliance.

- Submission of VAT returns: Each quarter, you must send us the sales report for your website. We will take care of declaring your sales to the One-Stop-Shop. To facilitate the management of your file, we would like to have access to your shopify admin (or others) to allow us to download the sales report.

- Reversal of VAT: After filing the return, we will send you a copy and the amount of VAT to be repaid to the relevant authorities.

- Semi-annual appointment: Each semester, we organise a video appointment to ensure that your file is "on track". During the year, if you have any questions you can of course ask us. The aim is for you to be VAT compliant so there are no bad questions 😉

- Access to the e-learning course and data sheets: We strongly recommend that you follow our e-learning workshop and read our data sheets to understand the VAT rules in e-commerce. The more you are trained and informed on the subject, the less risk there is that your business will not comply with the VAT rules.

Our additional services for e-traders

- VAT registration: If you are a foreign company, a French company that is not liable for VAT or if you want to set up a stock in one of the EU member states.

- Accounting expertise: Eurofiscalis is a firm specialised in e-commerce and Marketplace. You represent 40% of our customers.

- Intra-Community declarations: Entrust us with your EMEBI, Intrastat, EC Sales List and VAT recapitulative statements.

- Professional training: Our training organisation offers you the opportunity to develop your skills on VAT rules and your tax and declaration obligations in the EU.

- VAT audit: Secure your intra-Community flows with our audits, which summarise all your flows and give you the applicable rules.

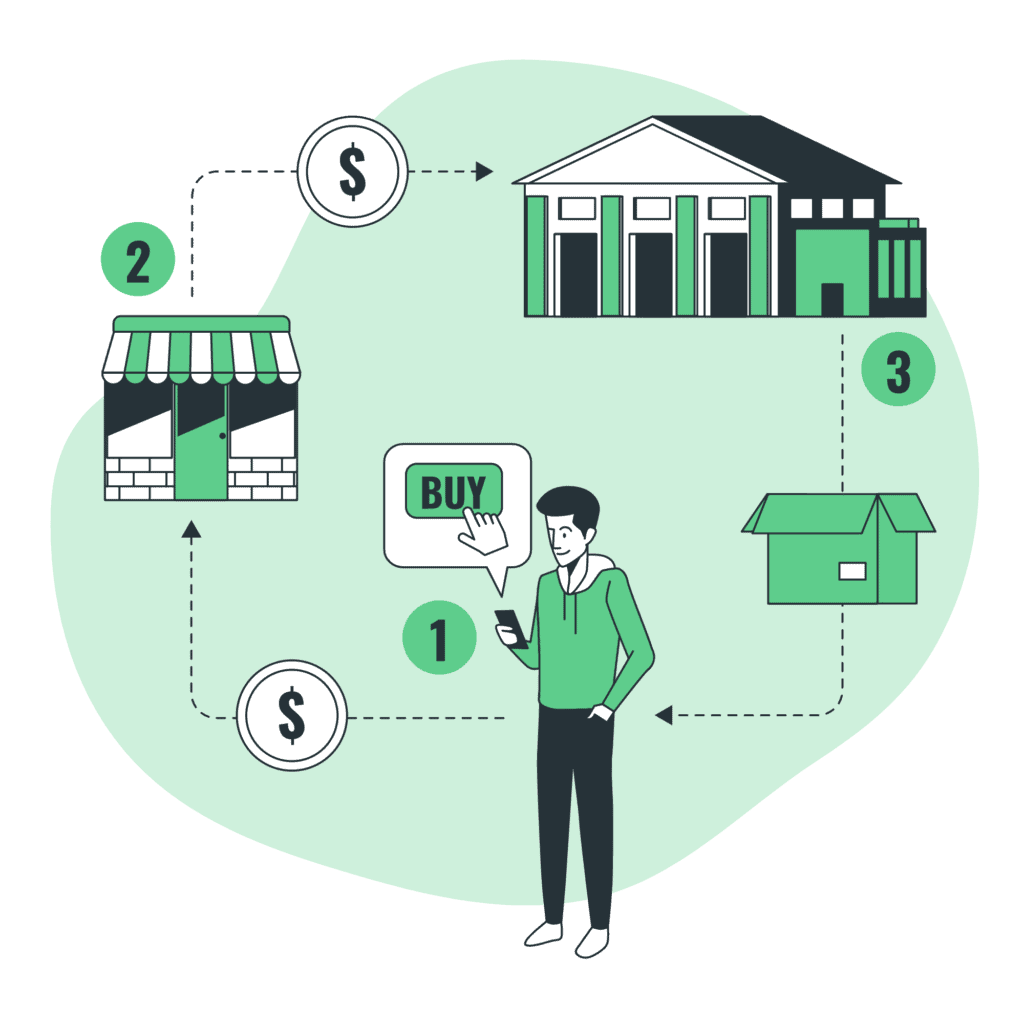

How the new e-commerce VAT package reform works

This “e-commerce VAT package” will come into force on 1 July 2021 for all EU and non-EU businesses that sell goods online to European consumers. The main measures expected are as follows:

- Lowering and standardising the threshold for distance selling to €10,000 in all Member States: from 1 July, all EU countries will apply this single threshold of €10,000, above which businesses will have to pay the VAT of the country where their goods are delivered;

- Establishment of a One Stop Shop (OSS): businesses will be able to declare and pay VAT from all the countries where they sell via the OSS in a single Member State, which will simplify their administrative formalities;

- Introduction of an import regime and abolition of the VAT exemption for imported goods under €22;

- Introduction of the liability of marketplaces with the notion of "deemed supplier": marketplaces will notably be liable to pay VAT for their sellers for imported parcels with a value of less than €150. With this reform, it will no longer be possible for non-EU companies to avoid VAT;

- New record keeping requirements for e-commerce platforms: platforms will have to leave these records available to tax administrations for 10 years to enable them to verify that VAT has been correctly applied.

We were on TV on Bsmart to talk about the VAT reform of the one-stop shop

- Explanation of the one-stop shop

- Support for e-traders

- The challenges for accounting firms

- Ian Smith | Directeur Administratif et Financier

- Collabore avec Eurofiscalis : Depuis 2021

- Services : Déclarations TVA, Audit TVA

- Chiffre d'affaires : +70 000 000 €

- Web : ping.com

“The service Eurofiscalis provide us, give me the confidence and trust that we have a compliance process to Europe for our VAT and customs…”

Follow our training courses on the one-stop shop

Training is the essence of success. We have created two free-access e-learning courses to help you understand all aspects of the Single Window reform. Also, we have developed a distance learning programme with a VAT expert trainer to train you on e-commerce VAT rules and answer all your questions.

VAT Training for E-commerce: OSS / IOSS Single Window Reform

- Know the new VAT rules for e-commerce sales and apply the appropriate VAT regime to your operations;

- Declaring and paying VAT via the OSS/IOSS One-Stop Shop;

- Applying the VAT mechanism to e-commerce sales made via Marketplaces.

Level: Basic

Duration : 1 day

Intra : On request

Inter : 790 € HT

- Distance: 3 Mar. 2022

- Distance: 21 Apr. 2022

- Remote: 16 Jul. 2022

E-commerce & VAT : Everything you need to know about the VAT rules applicable to e-commerce: OSS & IOSS one-stop shop

- Define the main measures of the e-commerce VAT package 2021 and evaluate the stakes of the reform;

- Know the OSS, IOSS and Non-EU OSS regimes and know how to apply the appropriate VAT regime to your operations;

- Declaring and paying VAT via OSS, IOSS and Non-EU OSS ;

E-learning

Level: Intermediate

Duration: 3 hours

Price: € 290 excl.

Last update: 10/01/22

Date: Start immediately

VAT Training for Ecommerce: OSS / IOSS Single Window Reform

- Know the new VAT rules for e-commerce sales and apply the appropriate VAT regime to your operations;

- Declaring and paying VAT via the OSS/IOSS One-Stop Shop;

- Applying the VAT mechanism to e-commerce sales made via Marketplaces.

Level: Basic

Duration: 3 hours

Price: € 290 excl.

Date: Start immediately

Call on our firm to handle VAT and your OSS single window

Take advantage of our firm’s experience and outsource the management of your VAT obligations

- Consultation: Free and without obligation