How to check an intra-community VAT number EU?

Do you want to know how to check an intra-community VAT number? You are in the right place! We offer you a quick and easy way to verify a VAT number in one of the 27 EU member states and in Northern Ireland. We also inform you of the reflexes to adopt when the number is invalid.

To confirm the validity of a customer’s or supplier’s intra-Community VAT number, nothing could be easier: select the country in which it is registered and then enter the VAT number to be validated.

Check the validity of an intra-community VAT number EU

Validation du numéro de TVA par le VIES :

Etat membre :

Numéro de TVA :

Nom de l'entreprise :

Adresse :

- Your search confirms the validity of the VAT number: save the result of your search or print it! You may need it in case of a tax audit.

- What to do in case of an invalid intra-community VAT number?

Consult our table below to check that the structure of the VAT number corresponds to the format in force in your country. Then report it to your customer or supplier, an invalid result does not necessarily mean that your partner is in bad faith. It is important to know that VAT registration systems vary from country to country: it may be that the company has a VAT number in its country but that it has not been activated for intra-Community transactions, or simply that it has not yet been integrated into the databases used by the VIES system (VAT Information Exchange System). If the company confirms its VAT identification but the number is invalid, you will have to ask it for proof before invoicing VAT and making your declarations (DEB, DES, Intrastats): ask it to contact the tax authorities of its country.

What is the purpose of the VIES system?

Our VAT number verification tool uses the same databases as the VIES system. What is it about? VIES is a search engine set up by the European Commission. It verifies the validity of intra-Community VAT numbers by drawing on the databases of the 27 EU countries and Northern Ireland. Each Member State lists the companies identified for VAT purposes in their country, particularly for intra-Community trade in goods and services. The VIES tool makes it possible to link these national databases: it is a unique tool allowing to check the intra-Community VAT numbers registered in 28 countries (EU and Northern Ireland).

What is an intra-community VAT number EU?

It is an individual identification number assigned to all European companies that have to pay VAT: all taxable persons in the EU have an intra-community VAT number in their country. It is assigned by the national tax authorities (the SIE in France) when the company is registered or according to its activities.

The intra-community VAT number is therefore individual, per company and per country. Each taxable person is identified for VAT purposes in his own country, but may also have VAT numbers in other Member States depending on the operations they carry out.

Eurofiscalis takes care of your VAT registrations and declarations in all European Union countries.

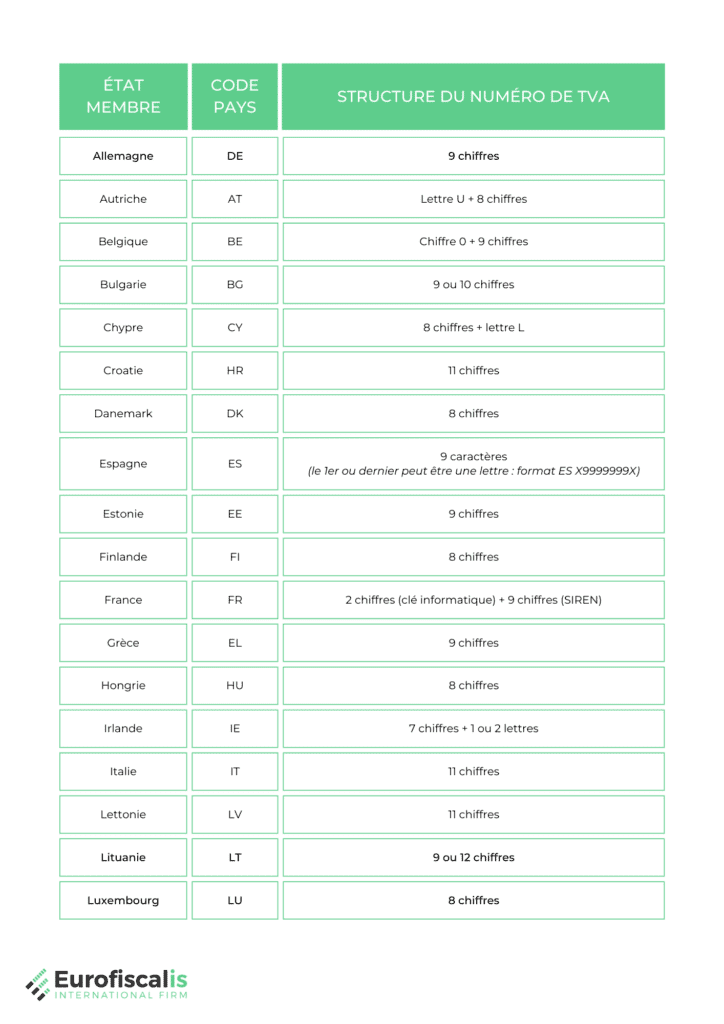

What is the structure of the intra-Community VAT numbers?

The structure of intra-Community VAT numbers is different in each country. Before using our validation tool, you can first check that your customer’s VAT number respects the format in force in his Member State.

Structure of the intra-Community VAT numbers in the 27 Member States

MEMBER STATE | COUNTRY CODE | VAT NUMBER STRUCTURE |

Germany | DE | 9 digits |

Austria | AT | Letter U + 8 digits |

Belgium | BE | number 0 + 9 digits |

Bulgaria | BG | 9 or 10 digits |

Cyprus | CY | 8 digits + letter L |

Croatia | HR | 11 digits |

Danmark | DK | 8 digits |

Spain | ES | 9 characters (the 1st or last character can be a letter: ES format X9999999X) |

Estonia | EE | 9 digits |

Finland | FI | 8 digits |

France | FR | 2 digits (computer key) + 9 digits (SIREN) |

Greece | EL | 9 digits |

Hungary | HU | 8 digits |

Ireland | IE | 7 digits + 1 ou 2 letters |

Italia | IT | 11 digits |

Latvia | LV | 11 digits |

Lithuania | LT | 9 or 12 digits |

Luxembourg | LU | 8 digits |

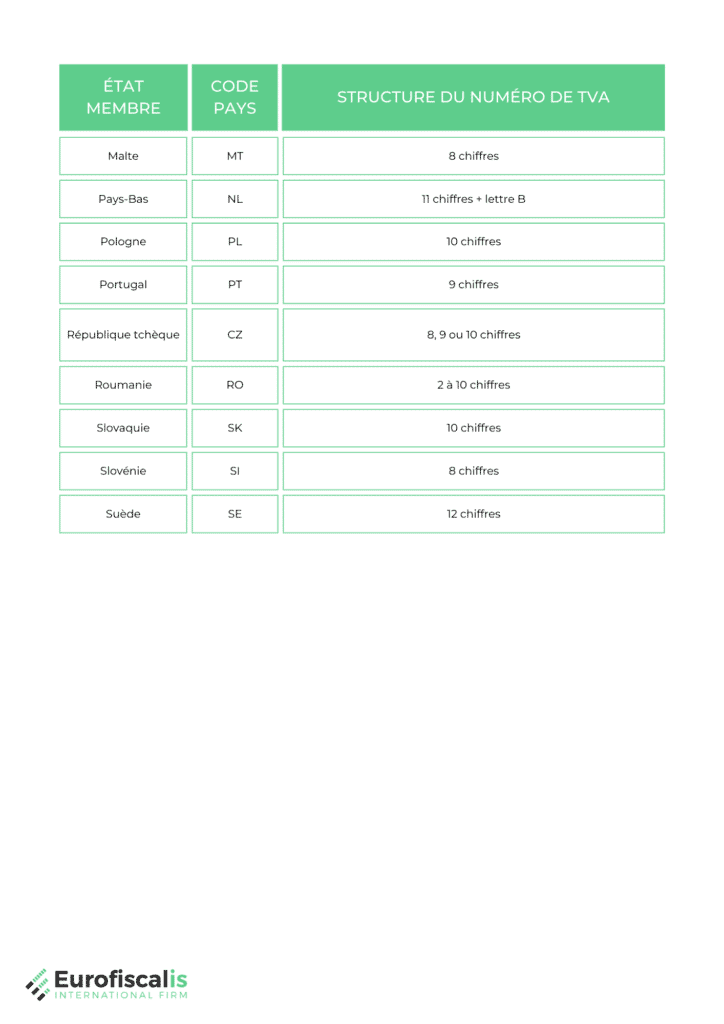

Malta | MT | 8 digits |

Netherlands | NL | 11 digits + letter B |

Poland | PL | 10 digits |

Portugal | PT | 9 digits |

Czech Republic | CZ | 8, 9 or 10 digits |

Romania | RO | 2 to 10 digits |

Slovakia | SK | 10 digits |

Slovenia | SI | 8 digits |

Sweden | SE | 12 digits |

Eurofiscalis takes care of your VAT registrations and declarations in all European Union countries.

Northern Ireland VAT Number Structure

Do you have a customer or supplier in Northern Ireland who has provided you with a VAT number beginning with “XI”? You should know that even though they have left the EU, these Irish companies are still subject to the intra-Community VAT system for goods. When they trade goods with companies established in the EU, they receive a specific intra-Community VAT number starting with the new country code “XI” created with the Brexit. Thus, when you sell goods to a customer in Northern Ireland, he must therefore send you a VAT number that respects the following structure:

Country code « XI » + 9 digits

Our tool allows you to check the validity of these VAT XI numbers.

What is the purpose of an intra-community VAT number?

Your VAT number must appear on your invoices, on your VAT declarations as well as on your declarations of exchanges of goods or services made with other EU Member States. VAT identification is indeed mandatory for all intra-Community transactions you carry out.

Why this obligation ? In the framework of your intra-Community deliveries in B2B, you must issue an invoice without VAT: the VAT is self-assessed by your customer in his country. To be able to invoice without VAT, you must respect the three conditions defined by the Quick Fixes 2020:

- Check the validity of your customer's VAT number EU in the country of delivery, and mention it on your invoice;

- Keep two proofs of transport attesting that the goods have left the national territory to be delivered in another Member State (CMR, invoice, insurance policy...). If the transport is organized by the buyer, he must also send you a written certificate of receipt of the goods;

- Declare the intra-community delivery in your monthly EC Sales List, to allow the administrations to make cross-checks and verify that the VAT is self-assessed in the country of delivery.

If your customer has not given you his VAT number or if it is invalid, you cannot invoice without VAT: you must issue an invoice with the VAT of your country.

This VAT rule requires that the supplier has a VAT number in the country of departure, and the customer in the country where the goods are delivered. If you are shipping goods from another member state, you will have to identify yourself for VAT in that country. This is also the case if you make local sales, stock transfers or imports into another EU country.

In general, you must have an intra-Community VAT number in all the Member States where you are liable for VAT and where you are subject to declarative obligations (local and Intrastat VAT declarations).

How to obtain a VAT number in another Member State?

You can apply for an intra-Community VAT number in another Member State by contacting the local tax authorities. The procedures vary from country to country. You can also use fiscal representation. This is an obligation if you are established in a third country such as Switzerland. The tax representative or agent will take care of your VAT registration and all your tax and declaration obligations in this country.

Our team offers you a free and non-binding appointment to analyze your needs