Quick Fixes 2020: Conditions for VAT Exemption on Intra-Community Deliveries

The VAT Quick Fixes redefine the rules of the game and harmonize the conditions for exemption from VAT on intra-community deliveries (ICD) carried out by companies within the European Union. The Quick Fixes 2020 were designed to simplify cross-border transactions and strengthen fiscal cooperation between Member States.

More than just administrative simplification, these “quick fixes” also aim to combat VAT fraud. As such, understanding and rigorously applying these new directives is no longer an option but an imperative necessity for businesses and transportation professionals.

In this article, we provide an overview of the “VAT Quick Fixes 2020“. B2B enterprises, carriers, and freight forwarders: this article was designed to help you familiarize yourselves with these new regulations and optimally integrate them into your intra-community operations.

- Published on

- Estimated Reading Time : 14 min

Understanding the VAT Quick Fixes 2020

The Quick Fixes are rules implemented to simplify and strengthen the conditions for exemption from VAT on intra-community deliveries.

Definition of Quick Fixes

The “VAT Quick Fixes 2020” are a set of measures adopted by the European Union to simplify intra-community transactions and combat VAT fraud. These provisions, introduced on January 1, 2020, aim to harmonize and simplify certain VAT rules for businesses conducting sales of goods between multiple EU member states. The initiative is part of a broader effort by the EU to modernize the VAT system and encourage closer fiscal cooperation among member states.

Measures Introduced for the Exemption of Intra-Community Deliveries of Goods

EU Directive 2018/1910 highlighted three major axes to optimize and clarify intra-community transactions regarding VAT. First, it emphasized the need to increase the importance of the VAT identification number in the context of deliveries between member states. Second, it sought to more clearly define the rules governing “chain” sales. Lastly, a third focal point is the simplification of procedures related to stocks kept under deposit agreements. In this context, we will explore in this article how these improvements have been articulated and implemented through the VAT Quick Fixes 2020.

Don’t miss the opportunity to ensure your business is fully compliant with the latest VAT regulations. Contact us today to schedule a comprehensive VAT audit with one of our specialized consultants.

VAT Exemption Conditions for Intra-EU Deliveries Provided by the 2020 Quick Fixes

As part of implementing the “VAT Quick Fixes 2020,” companies must comply with three essential conditions to exempt their intra-community deliveries from VAT:

- The purchaser must provide a valid VAT number in the delivery country.

- The supplier must be able to prove the exit of the goods from the national territory by retaining two transport proofs, a measure aimed at further securing transactions and preventing fraud.

- Finally, the supplier is required to carefully complete the VAT Summary Statement (formerly known as DEB), thus ensuring optimal traceability of operations.

It is imperative that these three criteria are met to invoice VAT-free.

Verifying the Purchaser's Valid VAT Number

Since January 1, 2020, the requirement for the buyer to have a valid VAT number in the destination country of the goods, registered in the VIES (VAT Information Exchange System) database, has become mandatory for suppliers to benefit from VAT exemption on intra-community deliveries.

It is crucial that this number is not only valid but also active at the exact time of delivery; ongoing registration is not accepted as proof.

What are the Risks if the Purchaser's VAT Number is Invalid?

In case of non-compliance, meaning if the buyer’s VAT number is not valid at the time of the transaction, the supplier is obliged to apply the VAT of the departing member state on the invoice. Choosing not to apply this VAT exposes the seller to the risk of adjustments in the case of a tax audit: in addition to penalties, the net amount of your invoice will be considered by the tax authorities as an inclusive amount, resulting in a loss equivalent to 20% of the VAT on your concerned turnover.

Moreover, the application of VAT on an intra-community delivery invoice puts the buyer in a delicate position, depriving them of the ability to reclaim the invoiced VAT and exposing them to the risk of financial sanctions in the destination member state if they do not quickly rectify their situation.

To avoid these complications and ensure secure and regulated collaboration, it is necessary to integrate a systematic verification of your clients’ VAT numbers into your company processes. Use the VIES platform for this verification or our VAT number verification tool. Make it a non-negotiable step in your invoicing procedure to guarantee compliance and peace of mind in all your intra-community commercial transactions.

Check the validity of an intra-community VAT number EU

Validation du numéro de TVA par le VIES :

Etat membre :

Numéro de TVA :

Nom de l'entreprise :

Adresse :

How to Verify Your Client's Intra-Community VAT Number? Quick Fixes VAT: Strengthening Transport Evidence

In the context of the “Quick Fixes VAT 2020”, particular attention has been paid to the evidence of transport for intra-Community deliveries. This is one of the mandatory conditions that must be met to allow for the exemption of VAT on cross-border operations. In this regard, European lawmakers have opted for strengthening obligations concerning evidence of transport to attest to the effective realization of the intra-Community transaction.

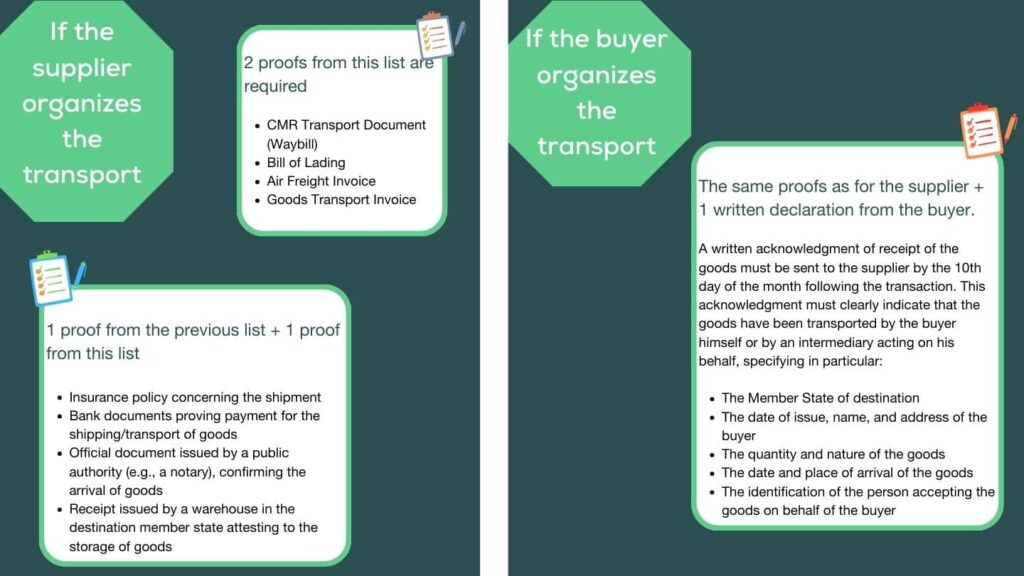

Evidence of Transport if the Supplier Organizes the Transport

In this situation, the supplier is obligated to provide a minimum of two non-contradictory pieces of transport evidence from two distinct categories of documents.

The seller may provide two documents from the following list:

- CMR Transport Document (Waybill)

- Bill of Lading

- Air Freight Invoice

- Goods Transport Invoice

In the absence of providing two proofs from the list above, the supplier may provide one document from the previous list and one document from the following list:

- Insurance policy related to the shipment

- Bank documents proving payment for the shipment/transport of goods

- Official document issued by a public authority (for example, a notary), confirming the arrival of the goods

- Invoice for the transportation of goods"

If you need further assistance, feel free to ask.

Transport Evidence When the Buyer Organizes Transport

When the buyer is responsible for organizing the transport, they are obligated to provide their supplier with copies of two proofs of transport, under the same conditions as when the seller handles the transport (as mentioned above). In addition to these two pieces of evidence, the buyer must also provide a written acknowledgment of receipt of the goods and send it to their supplier before the 10th day of the month following the transaction. This acknowledgment must clearly indicate:

- The Member State of destination

- The date of issue, name, and address of the buyer

- The quantity and nature of the goods

- The date and place of arrival of the goods

- The identification of the person accepting the goods on behalf of the buyer

The absence of these proofs, whether due to an omission, delay, or any other obstacle, has direct tax implications. Without these transport documents, the supplier cannot invoice without VAT and must apply the VAT rate in effect in the country from which the goods originate.

Filing the Tax Statement: EC Sales List

Each month, suppliers are required to file a tax statement for the intra-community deliveries they have made. In France, this is called the VAT Summary Statement (État Récapitulatif TVA or ERTVA), and in other European countries, it is known as the EC Sales List.

This statement lists intra-community deliveries made by a supplier to buyers in other EU Member States, with an important tax purpose: to indicate to European administrations the VAT numbers that will be subject to reverse-charge VAT on these operations.

With the introduction of Quick Fixes in 2020, this regulation has changed, tightening the conditions for exemption from VAT on intra-community deliveries. Now, declaring an operation on the VAT Summary Statement is mandatory for the supplier to claim the VAT exemption: if they do not declare their intra-community deliveries in the EC Sales List, they simply do not have the right to invoice without VAT.

If the supplier fails to submit this tax statement for a given month, they risk facing tax adjustments during an audit. However, the Directive offers some flexibility: if the supplier declares the operation in the EC Sales List of the following period, then the exemption remains valid.

The Quick Fixes Checklist for Intra-Community Delivery Exemptions

- Verify the Buyer's VAT Number on the VIES Database of the European Union: Before initiating any intra-community transaction, make sure to validate your buyer's VAT number through the VIES (VAT Information Exchange System) database.

- Provide Two Valid Transport Proofs: You need two non-contradictory proofs of transport from two distinct categories of documents.

- Complete the 'VAT Summary Statement': File the appropriate tax statement every month for your intra-community sales. This statement is known as the VAT Summary Statement (État Récapitulatif TVA) in France, or the EC Sales List in other European Union countries.

- Include All Mandatory Information on Your Sales Invoices: To substantiate invoicing without VAT, ensure that your sales invoices carry all the mandatory information required by tax authorities.

Following this checklist will help to ensure that you are in compliance with the regulations, thereby making your intra-community transactions exempt from VAT.

Benefit from a Deep Analysis of Your VAT Compliance

The Rules Defined by the 2020 Quick Fixes for Stocks under Consignment or Deposit Contracts

Since the implementation of the Quick Fixes, the management of intra-community VAT for consignment and deposit contract stocks has seen significant improvements aimed at simplifying and harmonizing transactions within the EU. Before these changes, this type of stock transfer required the supplier to register for VAT in the storage country (the buyer’s EU Member State). However, with the introduction of the Quick Fixes, notable easing has been observed:

- No VAT registration in the storage country: if the goods are stored for a period of less than 12 months

- No immediate invoicing upon sending the goods: unlike the previous system, the shipping of goods for consignment stocks no longer requires immediate invoicing. This eliminates much of the initial administrative hassle, thus facilitating transaction fluidity.

- Declaration via the EC Sales List under regime 20: Although initial invoicing is dispensed with, the supplier must report the transfer of its goods in the VAT Summary Statement under regime 20. This declaration keeps tax authorities informed of the movement of goods between Member States.

- Keeping a record of goods on deposit: To ensure transparency and tracking, companies are now required to keep a record of goods on deposit. This record should specifically mention the date of the transfer of the goods, thus ensuring clear and orderly traceability.

- Excluding VAT when invoicing the sale of goods: The transfer of ownership of goods stored in consignment or deposit occurs later on, when the customer dips into the stock as needed or resells the goods to a sub-purchaser. At this point, the supplier must issue an invoice without VAT for the intra-community delivery made. This step is crucial for confirming the effective sale of the goods.

- Declaration of intra-community delivery: At the time of transfer of ownership, the supplier must declare the sale as an intra-community delivery on his VAT return and in the EC Sales List under regime 21. At this time, it also declares the shipment of goods to the client’s country in the INTRASTAT statistical survey. It is also appropriate to indicate the sale in the goods record.

- Upon the return of unsold goods: when unsold goods return to the supplier, they must declare the return in their EC Sales List under regime 10 and update their deposit goods record.

Important Information

If the merchandise remains stored at the client’s location for more than 12 months, the supplier becomes liable for fiscal and reporting obligations in the storage country:

- Registration in the storage country

- Issuing a proforma invoice

- Declaring an intra-community delivery in France

- Declaring an intra-community acquisition in the storage country

Changes Brought by VAT Quick Fixes on Chain Sales

Definition of Chain Sales

Chain sales involve commercial transactions that include at least three companies established in different Member States, with only one intra-community delivery of goods taking place. This means multiple financial flows but only one physical flow. That is, the goods are delivered directly from the initial seller or an intermediary to the final customer, without going through the various actors involved in the transaction.

For example, in the triangular sales scheme, although the goods are physically delivered only once (from supplier A to customer C), there are two legal transfers of ownership: the first between A and the buyer/reseller B, and the second between B and C.

It is essential to understand chain sales as they pose particular challenges in terms of VAT, especially to identify the operation exempted from VAT as an “intra-community supply.” The rules for chain sales have been developed to ensure that VAT is correctly applied at each stage of the chain, avoiding both double taxation and non-taxation.

The Contribution of 2020 Quick Fixes on Chain Sales

The rule defined by the Quick Fixes is as follows: Only one sale can be exempted from VAT and considered as an intra-community delivery (ICD); the intra-community delivery is attributed to the supplier who organizes the transport. All other sales are local sales.

Let’s take an example to explain the rule: A chain transaction is made with 4 companies.

- A French supplier (A)

- A Belgian intermediary (B)

- A Dutch intermediary (C)

- A final German customer (D)

In the case where the French supplier (A) organizes the transport:

The delivery between A and B is considered as an intra-community delivery and therefore exempt from VAT. The other operations are considered as local sales in the destination country. The intermediate companies B and C must thus register in Germany.

- Sale from A to B: Intra-community delivery France - Germany. A issues a VAT-free invoice to B; B provides A with its German VAT number.

- Sale from B to C: Local sale in Germany. B issues an invoice including German VAT to C.

- Sale from C to D: Local sale in Germany. C issues an invoice including German VAT to D.

In the case where the final customer D organizes the transport:

The delivery between C and D is considered as an intra-community delivery and therefore exempt from VAT. B and C must register for VAT in France.

- Sale between A and B: Local sale in France. A issues an invoice with French VAT to B.

- Sale between B and C: Local sale in France. B issues an invoice with French VAT to C.

- Sale between C and D: Intra-community delivery France - Germany. C issues a VAT-free invoice to D.

Reminder:

Each intra-community delivery must be reported in a VAT Summary Statement or EC Sales List in the country of origin of the goods.

I hope this translation meets your needs. If you have any further questions or need additional clarifications, feel free to ask.

Schedule an appointment with one of our experts in intra-community VAT.

Business developer at Eurofiscalis, my goal is to simplify and popularize VAT rules for e-traders and companies exporting internationally. I know how complex and tedious it can be, and I am convinced that my experience and knowledge can help companies understand and comply with the current tax regulations.

Click now to unlock your international potential!

Navigating the Italian VAT system can be complex. Are you clear on the difference between periodic (LIPE) and annual VAT returns in Italy? Don’t risk costly penalties for late or incorrect VAT declarations. Our comprehensive guide breaks down the entire process, from understanding taxable transactions and VAT rates to meeting crucial deadlines and claiming refunds

Struggling with Polish VAT returns? This guide breaks down how to file the mandatory JPK_V7, meet deadlines, and successfully claim your VAT refund. Get clear on the requirements and ensure you get your money back.

Navigating the French VAT system can be complex, and getting your VAT declarations wrong can lead to penalties of up to 80%. Our definitive guide to VAT returns in France covers everything you need to know: from filing deadlines and avoiding common errors to the step-by-step process for claiming your VAT refund.

Correct invoicing in the Netherlands is a legal necessity. Our guide breaks down the key requirements, from mandatory details and VAT rules to the latest on e-invoicing, helping you stay compliant and avoid penalties.

Slovakia’s invoicing is transforming! Prepare for mandatory B2B eInvoicing by 2027. Our guide covers current VAT rules and the digital shift, helping you stay compliant.

Navigating VAT in Ireland can be complex. From understanding the various rates (23%, 13.5%, 9%, 4.8%, 0%) to registration thresholds and compliance obligations, getting it right is crucial for your business. Dive into our comprehensive guide to master Irish VAT, avoid penalties, and ensure smooth operations.