German VAT: All you need to know about the Umsatzsteuer for your purchases and sales in Germany

The German VAT, called Umsatzsteuer or Mehrwertsteur, was created in January 1968 with a standard rate of 10% and a reduced VAT rate of 5%. It replaced the turnover tax created in 1920. Since 1968, the VAT rates in Germany have evolved to the rates we know today, which are 19% for the standard rate and 7% for the reduced rate.

- Published :

- Reading Time : 15 min

- Updated on : 18/02/2025

German VAT rates and application

Evolution of VAT rates in Germany since 1968

1992 was a key year for value added tax in the European Union. After the ratification of the Maastricht Treaty in February 1992 and the European Union, a directive deals with taxation within the customs union. This European directive, published on October 18, 1992, and taken up in the 2006 directive, provides for arrangements on the VAT rates in force in the EU countries:

- The normal VAT rate cannot be lower than 15%.

- The reduced VAT rate cannot be lower than 5%.

The German VAT rates at the time were 16% and 5% before being raised to the rates we know today of 19% for the standard rate and 7% for the reduced rate.

Eurofiscalis takes care of your VAT registration in Germany and the filing of your periodic VAT returns in Germany.

German VAT rates applicable in 2023

If several VAT rates are applicable in France, there are only 2 VAT rates in Germany.

Goods and services subject to VAT in Germany can be taxed at :

- Reduced rate of 7%: these are the products listed list in this ,

- Standard rate of 19%: all products subject to VAT for which no other rate is provided.

Not all products are subject to VAT in Germany. Goods and services not subject to VAT in Germany are :

- Vehicles that are fiscally new, i.e. less than 6 months old or less than 6,000 km from the date of delivery,

- The services of a German craftsman on a building in France,

- Orders and deliveries with a value of more than 35.000€ excl.

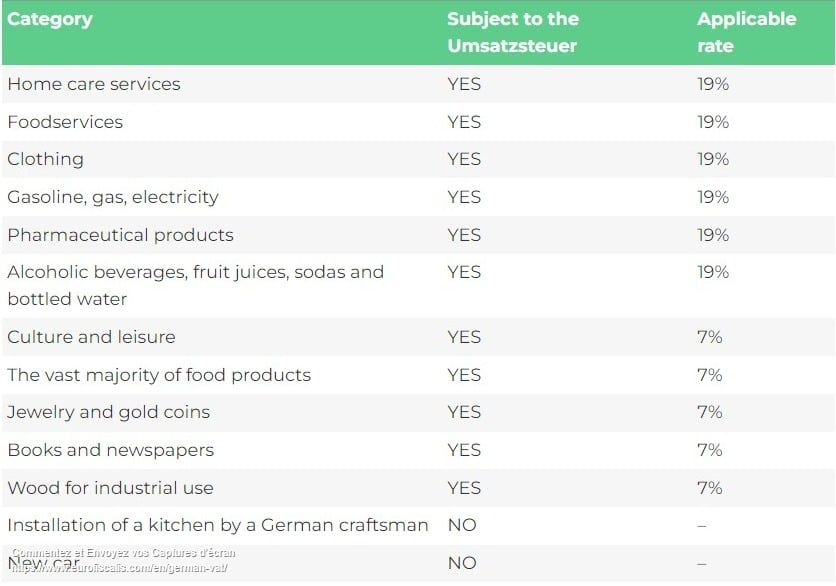

Here are some examples:

Category | Subject to the Umsatzsteuer | Applicable rate |

|---|---|---|

Home care services | YES | 19% |

Foodservices | YES | 19% |

Clothing | YES | 19% |

Gasoline, gas, electricity | YES | 19% |

Pharmaceutical products | YES | 19% |

Alcoholic beverages, fruit juices, sodas and bottled water | YES | 19% |

Culture and leisure | YES | 7% |

The vast majority of food products | YES | 7% |

Jewelry and gold coins | YES | 7% |

Books and newspapers | YES | 7% |

Wood for industrial use | YES | 7% |

Installation of a kitchen by a German craftsman | NO | – |

New car | NO | – |

The German intra-Community VAT rules for your flows with Germany

Intra-Community VAT applies in all 27 Member States with common territoriality rules. The VAT Directive of 2006 aims to standardize taxation between all EU member states. In Germany, as in all other EU member states, the rules of intra-Community VAT apply to the exchange of goods and services between businesses (B2B) and between businesses and consumers (B2C). If you continue reading this guide you will discover all your tax and declaration obligations for your intra-Community flows with Germany.

Intra-Community sales and purchases with Germany in B2B

The general VAT regime for intra-Community B2B transactions is the reverse charge of VAT by the customer: sales of goods and services to companies located in another Member State are invoiced net of tax, and the buyer is responsible for the reverse charge of VAT in his country (articles 138 and 196 of the Directive 2006/112/EC).

Sales of goods and services to a taxable customer in Germany

This reverse charge system applies when a company sells goods or services to a German company from another Member State. You deliver goods from your warehouse in Marseille to a company in Berlin: this France-Germany shipment is an intra-Community supply (ICS) exempted in France. In this case, the value added tax is due in the country of delivery, i.e. Germany, and must be self-assessed by your customer.

If you are a French service provider and you supply your advice to a German company, the VAT is due in the country of establishment of your client: the service recipient must self-clear the VAT in his country of establishment, in our case Germany.

In both cases, intra-Community deliveries to Germany and services provided to a German company, you can issue an invoice without VAT. Your customer is responsible for paying the VAT in Germany. However, there are certain conditions that must be met in order to invoice without VAT:

- Apply for and verify your customer's German VAT ID number. The verification is done on the VIES database of the European Union, which lists all European VAT numbers. We have developed a form for you to check your VAT number in the VIES database. Be careful because checking the number is not enough: you must keep a proof of this verification to anticipate a tax audit.

- Mention on the invoice: the name, address and German VAT number of your customer as well as the VAT rate and amount to 0. You must justify the absence of VAT by indicating the mention "Reverse charge by the purchaser - Article 138 of Directive 2006/112/EC" for a supply of goods, or the mention "Reverse charge by the customer - Article 196 of Directive 2006/112/EC" for a supply of services.

- File a tax declaration: an EC SALES LIST (ERTVA in France) for intra-Community delivery or a DES for a service provision.

- Declare the shipment of the goods to Germany in a statistical declaration: the INTRASTAT (EMEBI in France) if you have exceeded the INTRASTAT threshold on shipment to your country.

Purchases of goods and services from a German supplier

Purchases of goods

The same VAT regime applies if you buy goods from a German company and the goods are delivered in your country. In this case, you make an intra-Community acquisition (ICA) which is taxable in your country (the country of delivery).

What are your tax and reporting obligations when purchasing goods in Germany?

Let’s take an example: you are a company established in France and you buy televisions in Germany. Your German supplier delivers the goods to you in France and sends you an invoice excluding VAT.

To receive an invoice without VAT, you must:

- Provide your French intra-community VAT number to your German supplier.

- Self-charge the VAT on your local VAT return (line B2 of the CA3 in France)

- Declare the introduction of the goods in your country in a statistical declaration if you exceed the threshold at the introduction: the INTRASTAT (the EMEBI in France if you exceed the threshold of 460.000€)

What are your tax and declaration obligations when purchasing a service from a German provider?

Let’s take an example: you are a company established in Spain purchasing a consulting service from a German service provider.

The so-called “non-localizable” services are subject to the reverse charge of VAT by the customer in the country where he is established. You must provide your Spanish VAT number to the service provider to receive a tax-free invoice and reverse charge the VAT on your local VAT return (equivalent to the CA3 in France: line E2).

Eurofiscalis will take care of your VAT registration in Germany and file your periodic VAT returns in Germany.

VAT rules for e-commerce sales and marketplaces in Germany

A quick reminder: the reform of the “e-commerce VAT package” which came into force on July 1, 2021 has profoundly changed the VAT rules applicable to e-commerce.

The VAT rules applicable to e-commerce sales in Germany depend on two factors:

- The location of the stock

- The distance selling threshold

Explanation on the stock location: the stock location is important because if you store your goods in Germany, and you make a sale to a private person in Germany, you must :

- Register for VAT in Germany

- Invoice including VAT and apply the German VAT rate

- Collect and pay the VAT in Germany via the German VAT return

This sale is considered as a local sale in Germany, as if you had a physical store in Germany.

Explanation on the distance selling threshold: if you sell to private persons in Germany from another stock (outside Germany) and you make, in the whole of the European Union, more than 10.000€ e-commerce sales you must :

- Register at the OSS One-Stop-Shop in your country of establishment

- Invoice including VAT and apply the German VAT rate

- Declare and pay the VAT via the One Stop Shop in your country.

To illustrate these rules we will take an example that we will develop further. Your Belgian company sells to German customers through its own website and/or marketplace (Amazon). You make less than 10.000€ of remote sales in the EU and you store the goods in your warehouse in Belgium.

You have 2 options:

- Invoice including VAT with the Belgian VAT rate and declare this VAT on your VAT return in Belgium.

- Invoice with the German VAT rate and declare this VAT on the OSS One-Stop-Shop in Belgium.

Your Belgian company sells to German customers through its own website and/or marketplace (Amazon). You make more than 10.000€ of distance sales in the EU and you store the goods in your warehouse in Belgium.

You are obliged to apply the VAT of the country of your customers from the month you cross the 10.000€ threshold. You must :

- Register at the One Stop Shop in Belgium

- Invoice including VAT with the German VAT rate

- Declare and pay this VAT to the One Stop Shop in Belgium

Your Belgian company sells to German customers through its own website and/or marketplace (Amazon). You store the goods in Germany in a warehouse or a logistics service (Amazon FBA). In this case the distance selling threshold does not apply. Only the location of the goods defines your obligations.

Your obligations are :

- To register for VAT in Germany

- Invoice including VAT with the German VAT rate

- To file VAT returns in Germany

When to register for German VAT?

If your company performs taxable operations in Germany, it is mandatory to register for VAT in Germany and to declare and pay the VAT on your taxable operations in Germany on the local return. This requirement applies to all companies operating in Germany, including those not established in Germany.

EU companies have the option of doing this themselves or with the help of a German tax representative (tax agent).

If your company is not established in Germany, but conducts business in Germany, it must comply with the rules for “non-established companies” for VAT purposes. If your foreign company carries out any of the following transactions, it is mandatory to register for VAT and obtain a local or German intra-community VAT number (list not exhaustive):

- Remote sales from stock in Germany

- Intra-Community deliveries of goods

- Provision of services in Germany

- Imports of goods into Germany

- Stock of goods or consignment stock

How do I get a German VAT number?

To be able to operate in Germany and comply with your tax obligations, you must identify for German VAT purposes by completing the registration form at the German tax office and providing the following documents

- Your commercial register (K-bis) dated less than 3 months

- The articles of association of your company (a translation may be requested by the tax authorities)

- A copy of the identity card of the managing director of the company

- Proof of activity in Germany

- Registration form for non-established foreign companies

Once you have submitted these documents, you will receive a local DE VAT number (Steuernummer) which can be used to apply for a German Intracommunity VAT number if required. The German VAT number consists of 2 letters and 9 digits, and you can check its validity on a dedicated page.

In general, it takes 3 to 4 weeks to get a German VAT number. Make sure you provide all the required documents to avoid any delay or refusal of the German VAT registration application.

How often should I file German VAT returns?

It is important to file a German VAT return periodically to avoid penalties for failure to do so. This return must be filed electronically by the 10th of the month following the relevant period. The reporting frequency can be monthly or quarterly, and an annual return must also be filed by May 31 of the following year.

Failure to do so may result in penalties of up to 10% of the VAT due (+12% interest per year).

VAT declarations and VAT payment in Germany

VAT declarations in Germany follow three possible schedules:

1. Monthly: Standard reporting (Umsatzsteuer-Voranmeldung – UStVA).

2. Quarterly: If VAT payable in the previous year was between €1,000 and €7,500. (Umsatzsteuer-Voranmeldung – UStVA).

3. Annually: If VAT liability was below €1,000 and the company regularly submits zero declarations.

Umsatzsteuer-Voranmeldung 2025 declarations.

The tax office determines the reporting frequency and informs taxpayers by mail.

- If a company conducts intra-EU transactions, it must also submit the Zusammenfassende Meldung (ZM) declaration periodically.

The deadline for submitting monthly and quarterly VAT returns in Germany is always the 10th day of the month following the accounting period. In the case of an annual rhythm, the company submits only one annual declaration (and not an annual + summary)

German VAT for local B2B sales by non-German companies

In Germany, the reverse charge system applies to local B2B sales by foreign companies not established in Germany.

Example: Your French company not registered for German VAT stores goods in Germany in a warehouse in Munich. You sell it to a company in Berlin. The goods are delivered from Munich to Berlin. This is a local sale, as the goods do not leave Germany.

If you sell goods that do not leave the national territory and your customer is also based in Germany, you will have to charge VAT and mention article 194 of the Directive 2006/112/EC. Your customer is responsible for self-assessing German VAT on his local VAT return.

Freistellung - exemption from the construction tax

If you run a construction business in Germany, you are subject to one of the most complex tax laws in Germany. Uncertainties often arise from the fact that the nature of the construction service performed can be interpreted in various ways.

However, you also have certain rights, such as the right to exemption from the construction withholding tax (Bauabzugsteuer). To obtain it, you need to get the so-called Freistellung, which is a confirmation of exemption from the construction withholding tax.

Importantly, if you hire subcontractors on a construction site in Germany – they should also obtain a Freistellung to benefit from their entitled exemption from the construction tax.

Business developer at Eurofiscalis, my goal is to simplify and popularize VAT rules for e-traders and companies exporting internationally. I know how complex and tedious it can be, and I am convinced that my experience and knowledge can help companies understand and comply with the current tax regulations.

Click now to unlock your international potential!

Navigating the Italian VAT system can be complex. Are you clear on the difference between periodic (LIPE) and annual VAT returns in Italy? Don’t risk costly penalties for late or incorrect VAT declarations. Our comprehensive guide breaks down the entire process, from understanding taxable transactions and VAT rates to meeting crucial deadlines and claiming refunds

Struggling with Polish VAT returns? This guide breaks down how to file the mandatory JPK_V7, meet deadlines, and successfully claim your VAT refund. Get clear on the requirements and ensure you get your money back.

Navigating the French VAT system can be complex, and getting your VAT declarations wrong can lead to penalties of up to 80%. Our definitive guide to VAT returns in France covers everything you need to know: from filing deadlines and avoiding common errors to the step-by-step process for claiming your VAT refund.

Correct invoicing in the Netherlands is a legal necessity. Our guide breaks down the key requirements, from mandatory details and VAT rules to the latest on e-invoicing, helping you stay compliant and avoid penalties.

Slovakia’s invoicing is transforming! Prepare for mandatory B2B eInvoicing by 2027. Our guide covers current VAT rules and the digital shift, helping you stay compliant.

Navigating VAT in Ireland can be complex. From understanding the various rates (23%, 13.5%, 9%, 4.8%, 0%) to registration thresholds and compliance obligations, getting it right is crucial for your business. Dive into our comprehensive guide to master Irish VAT, avoid penalties, and ensure smooth operations.