Czech VAT number

Knowing your Czech VAT number and its implications is key to compliant and efficient operations. For businesses operating within or looking to expand into this Central European nation, understanding the nuances of Czech VAT and its associated identification numbers is paramount. This guide aims to demystify these critical aspects, providing clear, reliable, and specific information without unnecessary fluff, directly addressing common questions for entrepreneurs and companies alike.

- Published on :

- Reading time : 17 min

- Updated on : 01/07/2025

What is the Czech tax identification number (DIČ)?

As a European Union member, the Czech Republic has a VAT system that complies with EU regulations while preserving national characteristics. VAT is a consumption tax that is applied to goods and services at every point of the supply chain. In Czech, it is known as Daň z přidané hodnoty (DPH). Understanding the prerequisites for VAT registration, applicable rates, and appropriate identification numbers is essential for businesses to maintain financial and legal compliance and goes beyond simple bureaucratic formalities.

The Tax Identification Number, or DIČ (daňové identifikační číslo), is the central component of the Czech VAT system for businesses. For businesses and individuals involved in taxable activities, this number is the official Czech VAT number.

Are you interested in VAT in the Czech Republic? Read more or schedule a free consultation

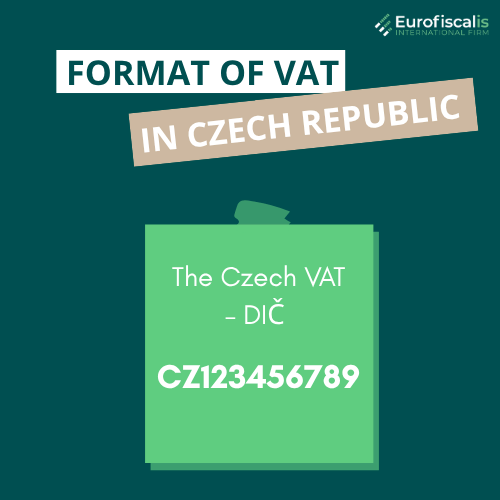

Czech VAT number - format and structure of DIČ

The Czech VAT – DIČ is easily recognizable due to its standardized format. It always starts with the country code “CZ”, signifying the Czech Republic.

The prefix is then followed by a series of digits, typically eight, nine or ten.

For instance, you might encounter a DIČ like CZ123456789.

In some specific or older cases, letters might also be integrated into the numerical sequence, though this is less common for newly issued numbers. For Czech companies, their DIČ is frequently identical to their income tax number, which can often be derived from their IČO, establishing a clear link between different identification systems.

Purpose of DIČ

The main purpose of the DIČ extends beyond mere identification. It is a essential for all intra-Community trade within the European Union. All businesses (a Czech entities or foreign companies) that are involve in the cross-border trade of goods and services among EU member states must possess a valid Czech VAT number.

The DIČ plays a crucial role in domestic transactions. It is mandatory inclusion on all invoices and tax documents issued by VAT-registered businesses in the Czech Republic, ensuring transparency and facilitating proper tax accounting.

Is there a VAT tax in the Czech Republic?

The Czech Republic does, in fact, have a VAT tax, and it accounts for a sizeable portion of the country’s total tax income. The multi-rate structure of the Czech VAT system is intended to classify different commodities and services according to their nature and necessity.

Czech VAT rates

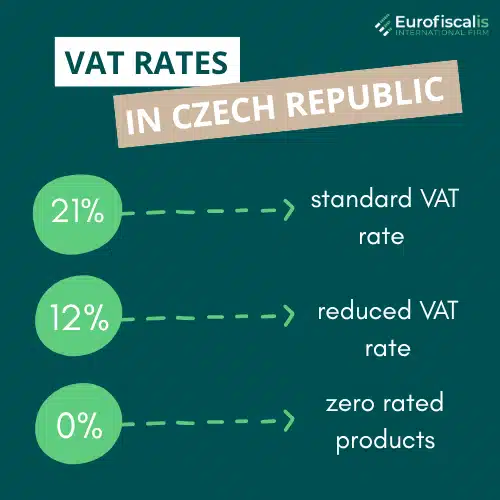

The Czech Republic applies different VAT rates, which are critical for businesses to correctly classify their sales and purchases:

- Ordinary Rate: 21% – this is the standard VAT rate, applied to the majority of goods and services that do not fall under the reduced categories.

- Reduced Rate: 12% – food items as well as animal fodder. automobile seats for children. Trees, seeds, and plants. medications as well as veterinary or medical equipment. several tools that help people with disabilities, including braille devices. periodicals (electronic or print), newspapers, magazines, and associated audio recordings. devices, such as those connected to braille, that are used to treat or lessen disease or handicap.

- Zero rated products: 0% – Intra-community supplies, Exports, International transport of persons

You can book a free consultation with our VAT experts in time that is suitable for you!

When is VAT registration required for foreign businesses in the Czech Republic?

Knowing when they must register for VAT and acquire a Czech VAT number is one of the most important things for foreign organisations. In general, as soon as a foreign company that is not based in the Czech Republic makes a taxable supply within the country, it must register for VAT. The absence of a turnover criterion for new businesses is a significant distinction from many other nations. This implies that the registration requirement may be triggered by a single taxable transaction.

Taxable transactions triggering registration in the Czech Republic

Several types of transactions commonly necessitate VAT registration for foreign companies:

- Importing goods into the Czech Republic from outside the EU for onward supply.

- Exporting goods from the Czech Republic to countries outside the EU.

- Domestic supply of goods and services where the reverse charge mechanism does not apply.

- Intra-Community acquisition of goods (receiving goods from another EU member state) if the threshold for intra-Community acquisitions is exceeded, or in certain other scenarios.

- Intra-Community supply of goods or services (sending goods or providing services to another EU member state).

- Distance sales to Czech consumers that exceed the EU-wide threshold (or if the company opts into the OSS scheme).

- Owning inventory in the Czech Republic, often in a consignment or call-off stock arrangement where certain simplifications might not apply.

- Performing specific services in the Czech Republic that do not fall under the reverse charge rule.

VAT registration for Czech established companies

For foreign businesses, Czech established companies (those with a seat or fixed establishment in the Czech Republic) benefit from a VAT registration exemption threshold.

Companies with an annual turnovers below CZK 2,000,000 (this threshold requires registration on the first day of the year following the year the threshold is exceeded) and CZK 2,536,500 (a new, higher threshold that triggers immediate mandatory registration the day after it is exceeded) are exempt from mandatory VAT registration though they can opt to register voluntarily. This threshold provides a significant simplification for small and medium-sized local enterprises.

Czech VAT number - how to find and verify?

Verifying a Czech VAT number is a critical step for businesses engaging in cross-border transactions, ensuring the validity of their partners and compliance with VAT rules.

Using the VIES tool

The most widely used and reliable method for verifying a Czech VAT number is the VIES (VAT Information Exchange System) tool. Developed by the European Commission, VIES allows you to validate VAT numbers across all EU member states. By simply entering the VAT ID you wish to check into the VIES VAT number validation link, you can quickly ascertain its existence and validity.

Verifying a company’s legal registration and reputation is essential for accurate VAT invoicing and preventing any fraud, and this tool is a great way to do it. If a VAT number cannot be located, it may not exist or may not have been activated or registered yet.

Check our own VIES system:

Other verification methods

For Czech companies, their tax numbers (which are often their DIČ) can sometimes be verified on the official homepages of the Czech Ministry of Finance.

What is IČO in the Czech Republic?

Beyond the DIČ, businesses in the Czech Republic will frequently encounter another important identification number: IČO. It’s crucial to understand the distinction between the two.

Difference between DIČ (VAT ID) and IČO (Identification Number)

While DIČ is specifically the Czech VAT number used for VAT-related purposes, IČO (Identifikační číslo osoby – Identification Number of a Person/Entity) is a broader, general identification number.

In the Czech Republic, the IČO is given to all natural persons conducting business (sole traders) and legal entities (companies, associations, etc.). In other nations, it works similarly to an enterprise ID or generic business registration number.

In the Czech legal and administrative system, a corporate entity is uniquely identified by its IČO.

Significance and use of IČO in the Czech Republic

The IČO is used across a wide range of administrative, legal, and financial contexts. It is on business licenses, in commercial registers and required for various official communications and contractual agreements.

For many Czech businesses, the DIČ is derived from corresponds to their DIČ. While DIČ is specific to VAT obligations, IČO serves as the fundamental identifier for any entity operating legally within the Czech Republic.

The process of obtaining a Czech VAT number

A foreign company must carefully prepare and submit certain documentation to the Czech Tax Administration as part of a structured application process in order to receive a Czech VAT number.

Required documents for foreign companies:

- Certificate of VAT registration from their home country

- Business license (for natural persons)

- Extract from the commercial register

- Documents proving the obligation to register for VAT in the Czech Republic, such as: pro-forma invoices, business plans, contracts

- Copy of a bank account statement

- Power of attorney (if you need to)

- Cover letter with VAT registration dates in other EU countries

It is critical that all attachments are either originals or officially certified copies. Any documents not originally in Czech must be accompanied by a certified Czech translation to be accepted by the tax authorities.

Application procedure and timeline

The VAT registration pack for non-established companies is typically submitted electronically, often via a secure “Data Box” system used by the Czech authorities.

Once submitted, the registration procedure usually takes one to two weeks, assuming all documentation is in order and no further clarifications are required.

Czech VAT number compliance and simplifications

Once a Czech VAT number is obtained, ongoing compliance with reporting obligations is essential. The Czech Republic also offers certain simplifications to ease the administrative burden for businesses.

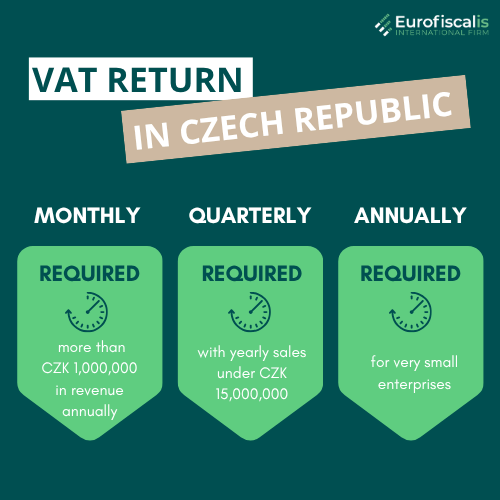

Czech VAT return frequency

In the Czech Republic, a company’s yearly turnover determines how frequently it must file VAT returns:

- Monthly returns: Required for companies that generate more than CZK 1,000,000 in revenue annually.

- Quarterly returns: These are offered to companies with yearly sales under CZK 15,000,000.

- Annually: For very small enterprises, however VAT-registered entities are more likely to do so on a monthly or quarterly basis.

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT grouping in the Czech Republic

In the Czech Republic, VAT grouping is a useful simplification for well-established companies. For VAT reasons, this enables entities that are connected financially, organisationally, and economically to be considered as a single taxable person. This can save administrative overhead and streamline business-to-business interactions.

Call-off stock simplification in the Czech Republic

The Czech Republic has implemented the EU call-off stock simplification rules. This is particularly beneficial for businesses operating under a consignment stock structure, as it can avoid the need for VAT registration in the country of destination (in this case, the Czech Republic) for certain movements of goods, provided specific conditions are met.

Bad debt relief and postponed import VAT accounting

Businesses can reclaim VAT on unpaid invoices thanks to the Czech VAT system’s bad debt relief provisions, which are subject to certain restrictions. Additionally, importers who are registered for VAT have access to a postponed import VAT accounting method. This improves cash flow by enabling companies to declare import VAT immediately on their regular VAT returns rather than paying it at the point of import. Businesses can further streamline international trade by taking use of customs and VAT warehouses, which allow zero-rated sales within the warehouse and deferral of VAT and excise charges until items leave the regime.

Source: Czech VAT number

Eurofiscalis services in the Czech Republic:

- VAT registration Czech Republic – obtaining a VAT number

- Filing VAT returns in the Czech Republic

- Tax representative and tax agent in Czech Republic

- Filing INTRASTAT declarations in the Czech Republic

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.