Changes on the Dutch taxpayer portal NL from July 1st, 2024

VAT News Changes on the Dutch taxpayer portal NL from July 1st, 2024 The Dutch tax system is evolving. The traditional VAT filing portal is being phased out, and the new “Mijn Belastingdienst Zakelijk” is stepping in to facilitate a more streamlined tax management process. This transition is crucial for all entities required to file […]

Intrastat Thresholds

Intrastat news 2024 Intrastat 2024 thresholds Intracommunity trade, that is to say between member countries of the European Union, is subject to a statistical declaration called INTRASTAT. This declaration allows European authorities to collect data on the flow of goods between different EU countries. INTRASTAT thresholds are values in euros that determine whether a company […]

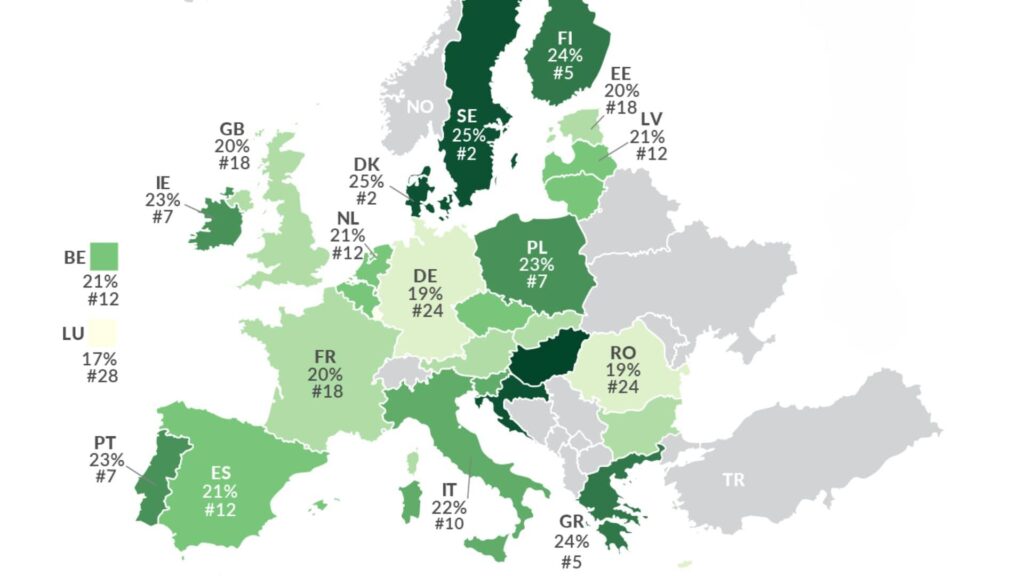

VAT Rates in UE

VAT RATES What are the VAT rates in the EU VAT, or value added tax, is an indirect tax that is levied on most products and services sold in the European Union. VAT rates applied in the EU vary from country to country, but are generally between 15 and 27%. For 2024, several EU countries […]

Change in the Belgian VAT Intervat Portal: Vital Updates

Tax News Change in the Belgian VAT Intervat Portal: Vital Updates Eurofiscalis, a leading tax representation service across EU countries, is dedicated to keeping our clients well-informed about crucial changes that may impact their operations. One such important change involves the Belgian VAT Intervat portal. The recent official communication from Belgian tax authorities underscores a […]

Quick Fixes 2020

Quick fixes guide Quick Fixes 2020: Conditions for VAT Exemption on Intra-Community Deliveries The VAT Quick Fixes redefine the rules of the game and harmonize the conditions for exemption from VAT on intra-community deliveries (ICD) carried out by companies within the European Union. The Quick Fixes 2020 were designed to simplify cross-border transactions and strengthen […]

Alcohol Excise Duties in France in 2024

Tax News Alcohol Excise Duties in France – New Rates 2024 With the start of the new year, the French government has updated the rates of excise duties on alcohol beverages in France in 2024. These changes are applicable for all companies importing alcoholic product on the French territory, from January 1, 2024. In this […]

Temporary VAT Reduction in Luxembourg

Tax News VAT Luxembourg – Reduction of VAT Rates 2023 VAT Luxembourg – Temporary Reduction of VAT Rates in 2023 The Luxembourg government has announced an amendment to the VAT law. The amendment consists of a temporary reduction of VAT rates by 1% in 2023. The reduction will be effective as of January 1, 2023 […]