Change in the Belgian VAT Intervat Portal: Vital Updates

Eurofiscalis, a leading tax representation service across EU countries, is dedicated to keeping our clients well-informed about crucial changes that may impact their operations. One such important change involves the Belgian VAT Intervat portal. The recent official communication from Belgian tax authorities underscores a significant transformation scheduled to take effect on January 31, 2024. This change specifically refers to the methods of access to the Intervat portal.

- Posted :

- Reading Time : 4 min.

Transition from Isabel and Globalsign Certificates

Commencing from January 31, 2024, the use of Isabel and Globalsign commercial certificates to access the Intervat portal will no longer be available.

Businesses relying on these certificates must explore alternative means to continue their operations smoothly following this transformation.

Considering the tight deadlines in Belgium as well as risk of penalites for late filing of the VAT return – get prepared already now and go into the new year with a calm state od mind !

Alternative Access Methods to Belgian VAT Intervat Portal

Thankfully, the communication provides a clear roadmap for affected businesses to adapt and continue operations:

- Belgian Electronic Identity Cards (eID) or Electronic Cards for Foreigners : Clients can continue accessing the Intervat portal using their eID or electronic cards for foreigners. This remains a reliable and direct method for login.

- itsme®: To utilize itsme®, clients will need a Belgian electronic identity card for activation. This method provides a user-friendly and secure login process.

- eIDAS Recognition: Users without Belgian eID or electronic cards for foreigners can employ their national electronic identification means, recognized at a European level, to log in through eIDAS. However this method can only be utilized by the legal representative of the company in question.

- Registration Office: In cases where physical presence in Belgium is possible, clients can register at specified offices. This results in receiving a username, password, and a 'digital key' via email, SMS, or mobile app for subsequent logins.

- Online Registration Module: While still under construction, an online registration module will enable remote registration. This option might prove to be beneficial for foreign companies unable to visit Belgium physically.

If you are not sure which option would be best for your company, do not hesitate to get in touch with us, we will be more than happy to help you !

Future Developments for Intervat Portal

The communication further outlines future advancements:

Submission via API: In a few months, a new feature will be introduced, enabling clients to submit periodic VAT returns directly from their accounting software via an Application Programming Interface (API). This enhancement will alleviate the need for manual e-service logins, streamlining the process significantly.

Stay Informed: Detailed information regarding the change in the Belgian VAT Intervat Portal and ongoing developments will be available on the FPS Finances webpage.

How to submit the VAT return in Belgium

All taxpayers registered to VAT in Belgium are obliged to submit periodic VAT returns. Depending on the turnover, these might be monthly, quarterly or yearly.

The deadline for the VAT return in Belgium is the 20th day of the month following the declarative period. For example, the deadline for VAT Return for 3Q2023 is October 20th 2023.

The only way to submit the VAT return in Belgium in doing it online via the Intervat portal. It is no longer possible to file the paper version of the declarations. This also applies to other VAT-related declarations such as the EC Sales List and the Annual Listing Clients declaration.

What is Intervat portal in Belgium?

Intervat is an online platform dedicated to VAT-registered individuals and companies in Belgium. This application offers the possibility of submitting various documents, such as:

- Periodic VAT returns,

- Annual listing clients declarations,

- Intra-Community statements,

- VAT refund claims,

- Statements of intra-Community deliveries for new means of transport,

- Any special VAT returns,

- Registration and declarations via the OSS one-stop shop.

In addition, it facilitates the manual or XML filing of declarations.

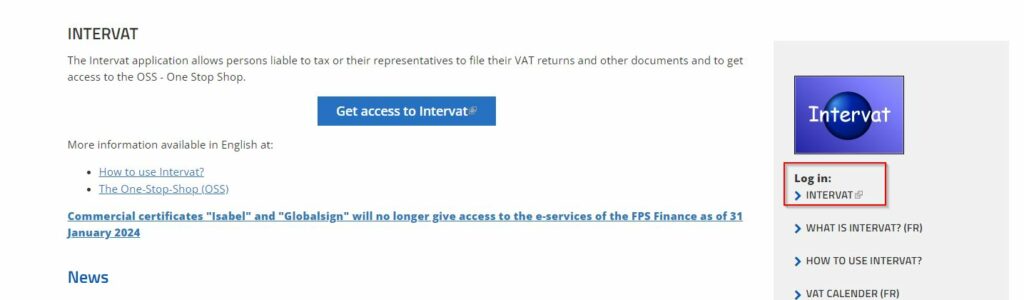

How to access Intervat in Belgium?

To access the Intervat application, first go to the Federal Public Service FINANCE Belgium website – >E-services -> Intervat and then click on the Intervat link that will appear on the right-hand side of your page:

Then, depending on your situation, you need to choose the appropriate method for connecting to the Intervat portal in Belgium.

How Eurofiscalis Can Help

At Eurofiscalis, we recognize the significance of this transformation. Our dedicated team is ready to assist our clients in navigating this transition seamlessly. We aim to ensure that our clients’ VAT returns and obligations in Belgium continue without interruption, providing guidance and support throughout the adaptation process.

We are also ready to assist new clients by becoming your tax agent or tax representative and being able to submit all the necessary VAT returns on the Intervat portal on your behalf. Do not hestitate to get in touch with us.

Schedule a free consultation with our expert

Change in the Belgian VAT Intervat Portal: Conclusion

As the Belgian VAT Intervat portal prepares for a significant transformation, Eurofiscalis remains committed to keeping our clients informed and equipped for these changes. Our team is ready to support and guide you through this adaptation to ensure minimal disruption to your business operations.

For further inquiries or assistance in understanding and adapting to the change in the Belgian VAT Intervat Portal, do not hesitate to contact us. We are here to help our clients stay compliant and efficient in their cross-border operations.

Stay tuned for further updates and information regarding this transformation.

Rising VAT rockstar at Eurofiscalis I have a passion for unraveling the complexities of VAT regulations in the European Union (especially Benelux region). My mission is to empower readers to navigate the ever-changing VAT landscape with ease and to answear your questions in a clear and concise way.