E-Invoicing in Belgium: What Your Business Needs to Know

Tax News Upcoming Changes in E-Invoicing in Belgium: What Your Business Needs to Know As we continue to embrace digital transformation, more and more countries start to implement e-invoicing systems with the goal of streamlining financial transactions and ensuring compliance with VAT regulations. Belgium is no different with its plans of mandatory implementation of e-invoicing […]

End of Amazon’s C.O.S Program

Amazon VAT Stopping Amazon’s C.O.S Program: Everything You Need to Know Amazon recently announced the cessation of its C.O.S (Call-Of Stock) program effective August 1, 2024, a crucial service for many sellers. Amazon’s C.O.S program allows sellers to store and sell in multiple European countries without having to register for VAT in those countries. The […]

Finnish Tax Rates

Finnish Tax Rates Not long from now, there will be some changes to the VAT in Finland. We are providing you with the information you need now so that you can enter the new year well prepared! Content Changes for the Finnish VAT The changes for VAT in Finland will not take effect immediately, but […]

Changes on the Dutch taxpayer portal NL from July 1st, 2024

VAT News Changes on the Dutch taxpayer portal NL from July 1st, 2024 The Dutch tax system is evolving. The traditional VAT filing portal is being phased out, and the new “Mijn Belastingdienst Zakelijk” is stepping in to facilitate a more streamlined tax management process. This transition is crucial for all entities required to file […]

Intrastat Thresholds

Intrastat Thresholds 2025: Comprehensive and Updated Guide Are you conducting commercial exchanges within the European Union? Then you’re likely familiar with Intrastat declarations, also known as EMEBI (Monthly Surveys on Intra-Community Trade in Goods). These declarations are essential for compiling trade statistics on external commerce. Understanding Intrastat thresholds is fundamental to staying compliant. No need […]

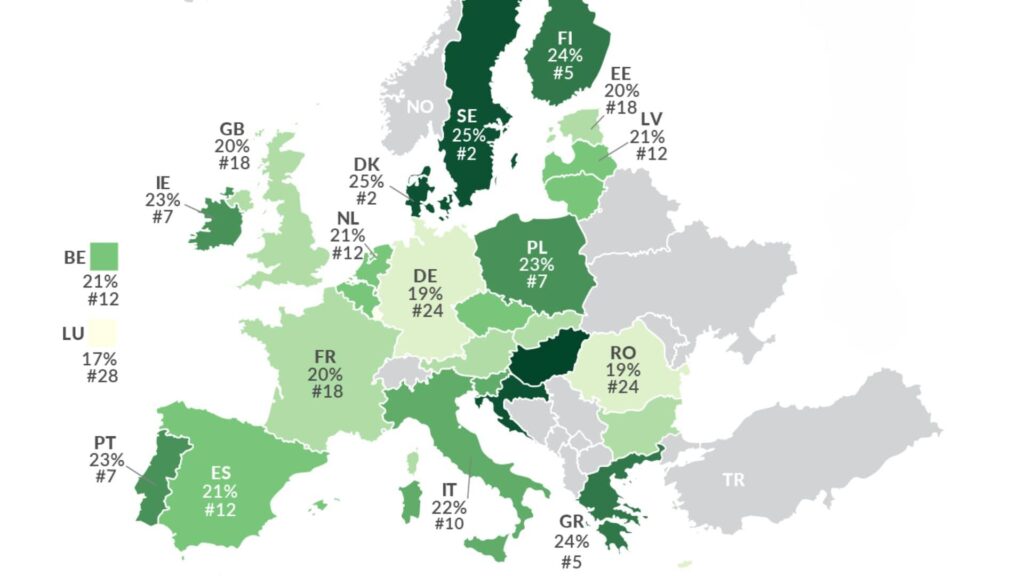

VAT Rates in UE

VAT Rates in the EU What Are the VAT Rates Across the European Union? Looking for the applicable VAT rates in the European Union for 2026? You’re in the right place. This article provides a comprehensive and up-to-date table of Value Added Tax (VAT) rates for each EU member state. The year 2026 brings notable […]

Change in the Belgian VAT Intervat Portal: Vital Updates

Tax News Change in the Belgian VAT Intervat Portal: Vital Updates Eurofiscalis, a leading tax representation service across EU countries, is dedicated to keeping our clients well-informed about crucial changes that may impact their operations. One such important change involves the Belgian VAT Intervat portal. The recent official communication from Belgian tax authorities underscores a […]

Quick Fixes 2020

Quick fixes guide Quick Fixes 2020: Conditions for VAT Exemption on Intra-Community Deliveries The VAT Quick Fixes redefine the rules of the game and harmonize the conditions for exemption from VAT on intra-community deliveries (ICD) carried out by companies within the European Union. The Quick Fixes 2020 were designed to simplify cross-border transactions and strengthen […]

VAT rates in Norway

Norwegian VAT rates are changing! Are you ready for 2025 and 2026? Don’t get caught by surprise. Read our essential update now.

Alcohol Excise Duties in France in 2024

Tax News Alcohol Excise Duties in France – New Rates 2024 With the start of the new year, the French government has updated the rates of excise duties on alcohol beverages in France in 2024. These changes are applicable for all companies importing alcoholic product on the French territory, from January 1, 2024. In this […]