Belgium: Storage & E-Commerce for non-established companies

Are you an e-commerce company wishing to store & sell your products directly from Belgium ? Do you use warehouses of marketplaces such as Amazon or Zalando ? In both of these cases it is necessary to register to Belgian VAT, file periodic VAT returns and comply with all the VAT rules in Belgium.

Take a look at this article in which we will explain in a clear and concise way what are your tax obligations and demonstrate different cases and different rules of storing and selling your products from Belgium

- Posted :

- Reading Time : 10 min.

E-invoicing and e-reporting in Belgium for companies without a registered office in 2025

On February 20, 2024, the law establishing the duty was published in the Belgian official gazette, Belgisch Staatsblad (Moniteur Belge), as part of the statute of February 6, 2024. From that date companies which are not based in Belgium but registered for VAT purposes are exempt from the B2B e-invoicing requirement, which will come into effect on January 1, 2026.

The exemption applies to the issuance and receipt of e-invoices in the PEPPOL-BIS format for domestic transactions. Executive acts or detailed technical guidelines may still appear, so changes need to be monitored.

These companies may be subject to the obligation of e-reporting in the PEPPOL 5-corner model, which requires the transmission of transactional data in real time. The ViDA project has not yet been definitively adopted at the EU level, and there is no confirmed Belgian plan for the introduction of e-reporting for entities without a registered office. Negotiations are ongoing. The original date (January 1, 2028), speculative based on the European Commission’s project “VAT in the Digital Age” (which proposes the introduction of harmonized digital reporting requirements – DRR for intra-community transactions), we already know that it will be delayed.

B2C E-commerce in EU: Two ways of paying the VAT

If you are a B2C e-commerce company, for sure you know already, that as soon as you exceed the threshold of 10 000€/year of revenue from your e-commerce sales, you stop applying the VAT rules and paying the VAT in the country of your establishment but you need to start applying the rules and paying the VAT tax according to the rates and rules of your customer’s country.

To do that there are two ways, both having advantages and disadvantages to them :

- Registering to VAT in all the EU countries where you sell your products. You are then selling the products using your VAT number of the country you are selling to and then filing the VAT returns & paying tax periodically, separately in all countries you are dealing with.

- Using the OSS procedure which allows you to pay the tax directly to the administration of the country in which you are established, which then distributes the taxes to other EU Countries, according to the information you have provided.

Storing your merchandise in Belgium: VAT rules

If you are a company that wishes to store your products in Belgium (using warehouses of a Belgian storage service provider or Amazon/Zalando/Bol.com warehouses) you do have an obligation to register to VAT in Belgium and possess a Belgian VAT number.

Whether you are using the OSS procedure to pay your VAT tax or not, when storing and moving your merchandise to/from Belgium (Intra-community Sales/Acquisition or Import/Export), these transactions need to be declared in the periodic VAT declarations, EC Sales List, Intrastat in Belgium.

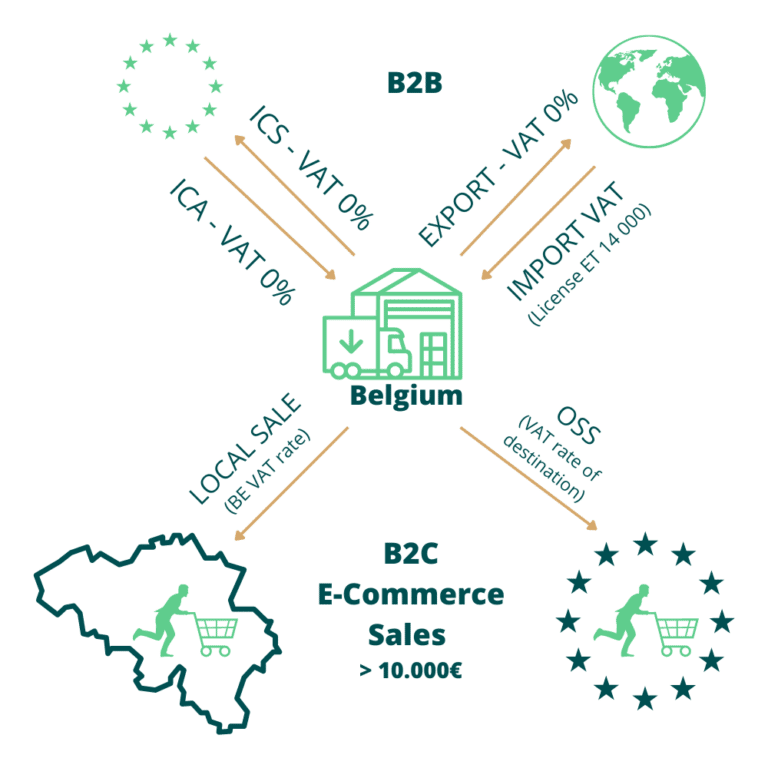

Storage & eCommerce: Moving stock to/from Warehouse in Belgium

The VAT rates to use for the movement of your stock to/from Belgium can differ depending on what type of transaction it is:

Moving to Begian Warehouse:

- Local Purchases : as a rule you will pay Belgian VAT but there are exceptions – do not hesitate to get in touch with us to learn more

- Intra-Community Acquisitions : The VAT rate for ICA transaction is 0% as long as all the conditions are met

- Import : when importing products to your Belgian warehouse from a country outside the EU (f.ex. your company is established in Switzerland and you want to move your stock to Belgium) you may need to pay the import tax. However there are different procedures to use in order not to pay or delay the payment of the tax – such as License ET 1400 in Belgium

Moving from Belgian Warehouse:

- Local Sales : when selling your products to a Belgian company, as a rule you will need to use reverse charge

- Intra-Community Sales: The VAT rate for ICS transaction is 0% as long as all the conditions are met

- Export: If you are selling/moving your products from your Belgian warehouse to a country outside of the EU, the VAT rate will always be 0% .

Selling from your Belgian warehouse : B2C Sales

You now have your products in a storage/warehouse in Belgium and you are selling them online and sending to your clients. How should you prepare the invoices? What VAT number should you use in the invoice ? What VAT rate you should apply? Where should you declare the sale ?

As with everything concerning VAT, it depends. Mostly it will depend on two factors – where your client is located and if you are using the OSS procedure or not. In the table below we show a few situations and what VAT number and VAT rate to use :

| Exceeded threshold of 10 000€/year ? | OSS | The consumers’ location | VAT rate | VAT number you should use | Where to declare |

|---|---|---|---|---|---|

| no | no | EU | The one of the country of your establishment | Your national | In your country |

| Outside EU = Export | 0% | BE | Belgium | ||

| Belgium = local sale | Belgium’s VAT rate | BE | Belgium | ||

| yes | no | EU | The one of the country where consumer is located | The one of the country where consumer is located | In the country where consumer is located |

| Outside EU = Export | 0% | BE | Belgium | ||

| Belgium = local sale | Belgium’s VAT rate | BE | Belgium | ||

| yes | EU | The one of the country where consumer is located | Your national | OSS = in your country | |

| Outside EU = Export | 0% | BE | Belgium | ||

| Belgium = local sale | Belgium’s VAT rate | BE | Belgium |

What if my company is not established in the EU? Can I still register to OSS?

If your company is NOT located in one of the EU Member States, after exceeding the above-mentioned threshold of 10.000€ sales, you can still register to the OSS procedure with the help of your tax representative in Belgium. You just need to remember to use your BE VAT number for all your e-commerce sales in this case.

OSS & Storing In Belgium : Key rules to remember

Let’s say you are using the OSS procedure for your e-commerce sales in the European Union & you are now storing your products in a warehouse in Belgium.

Below we regroup the key rules, when it comes to VAT, that you need to remember (& apply!):

- You need to register to Belgium VAT

- You need to file periodic VAT returns in which you will declare the movement of your stock, sales to Belgian customers and sales to customers outside of EU (!The remaining sales you declare in OSS procedure!)

- When moving your products between your country and your Belgian warehouse you can use the 0% VAT rate, just remember to put both your VAT numbers on the invoice/proforma and document the transport of the stock

- When importing merchandise directly to the Belgian warehouse, you will probably need to pay the VAT import tax. In order to defer the payment of this tax you could use a Belgian procedure License ET 1400.

Click here to read everything you need to know about VAT in Belgium : VAT Returns, Listing Clients, Tax Agent etc.

Get in touch with our Eurofiscalis Benelux Team

Get French VAT recovery ?

How to get French VAT recovery ? In France, like in most countries, Value Added Tax (VAT) should not be a final cost for your

VAT returns in Italy: Learn about Italian rules

Navigating the Italian VAT system can be complex. Are you clear on the difference between periodic (LIPE) and annual VAT returns in Italy? Don’t risk costly penalties for late or incorrect VAT declarations. Our comprehensive guide breaks down the entire process, from understanding taxable transactions and VAT rates to meeting crucial deadlines and claiming refunds

VAT returns in Poland: requirements and deadlines

Struggling with Polish VAT returns? This guide breaks down how to file the mandatory JPK_V7, meet deadlines, and successfully claim your VAT refund. Get clear on the requirements and ensure you get your money back.