VAT registration in France: A step-by-step guide

Foreign businesses in France – are you VAT compliant? This essential guide covers when you need to register (importing, selling to French customers, storing goods), what’s changing in 2025 and why you might need a tax agent in France. Get the information you need to navigate French VAT successfully. Whether you’re an e-commerce seller, an importer, or a service provider, this guide will equip you with the knowledge you need for seamless VAT compliance in France.

- Published on :

- Reading time : 12 min

Introduction to VAT in France

We have created a dedicated page on VAT in France, therefore the information about VAT in France in this article will be presented in the form of a condensed summary.

What is VAT (Value Added Tax)?

Value Added Tax (VAT) is a consumption tax applied to the sale of goods and services at every point of production and distribution. While businesses collect and remit the VAT to the government, the final consumer ultimately bears the cost. This system ensures a steady revenue stream for infrastructure and public services.

Overview of the French VAT System

France was the first country to introduce modern VAT taxation in 1954. Over time, VAT has evolved into a crucial element of France’s fiscal policy, contributing significantly to the national budget. The VAT system taxes consumption while allowing businesses to deduct previously paid VAT on inputs, preventing tax cascading.

Who needs to register for VAT in France?

Domestic businesses in France

In France, businesses are required to register for VAT if their annual turnover surpasses specific thresholds.

The threshold, according to the most recent legislation, is €34,400 for services and €85,800 for goods sales.

When these thresholds are surpassed, companies are required to fulfil their VAT responsibilities, which include charging VAT on sales, submitting regular returns, and keeping thorough records.

Foreign businesses in France

Foreign companies conducting specific activities in France must register for VAT in the following cases:

- Importing goods: Register for VAT to account for import VAT on goods entering France from non-EU countries.

- Selling products or services to French customers: Ensure VAT compliance for direct sales to customers in France, especially through e-commerce platforms.

- Holding stock in France for sale: Comply with VAT requirements when storing goods in French warehouses for future sales.

- Planning live events in France with paid admission: Register for VAT when hosting fee-based conferences, workshops, or concerts.

It’s important to note that non-EU businesses may be required to appoint a tax representative in France to manage VAT compliance on their behalf.

Step-by-step guide to VAT registration in France

Step 1: Determine the need for VAT registration in France

Determine whether your company’s operations are covered by French VAT laws by evaluating them.

Take into account elements like your customer base, the type of transactions you conduct, and your turnover in relation to the predetermined benchmarks.

Determine whether VAT registration is mandatory for your company’s operations in France. To simplify this determination, answer the following questions:

Quick VAT registration assessment:

- Do you import goods into France from outside the EU?

* Yes

* No

- Do you sell goods or services directly to French customers?

* Yes

* No

- Do you store goods in France for sale?

* Yes

* No

- Do you organize live events in France with paid admission?

* Yes

* No

- Are you established outside the EU?

* Yes

* No

Interpreting your answers:

→ If you answered “Yes” to any of questions 1-4 and are established within the EU, you likely need to register for VAT in France.

→ If you are established outside the EU, it is most likely that you will need to appoint a Tax Representative.

Step 2: Gather necessary documentation

To simplify the registration process, prepare the following documents:

- Articles of Association: This is the founding document outlining your company’s structure, purpose, and ownership. It should be translated into French by a certified translator if the original is not in French.

- Extract from the Trade Register (EU): This official document confirms your company’s legal status and registration details in your home country.

- Extract from the Trade Register in France

- Certificate of VAT Liability from the Home Country: This document, issued by your home country’s tax authority, proves that your business is registered for VAT in your country of origin. You can usually obtain this certificate from your local tax office.

- Documents in France

- Proof of Business Activities in France: This includes contracts, invoices, purchase orders, or other documents demonstrating your commercial engagements within France. Examples include signed contracts with French clients, invoices issued to French customers, or purchase orders for goods to be stored in France.

- Power of Attorney (if using a tax representative and tax agent): If you’re appointing a tax representative and tax agent, you’ll need to provide a Power of Attorney authorizing them to act on your behalf with the French tax authorities.

- A template Power of Attorney document in France

- Company Bank Details: Provide your company bank details in order for the French Tax authorities to reimburse you if your company is due VAT refunds.

For a comprehensive assessment tailored to your specific business activities

Step 3: Submit application

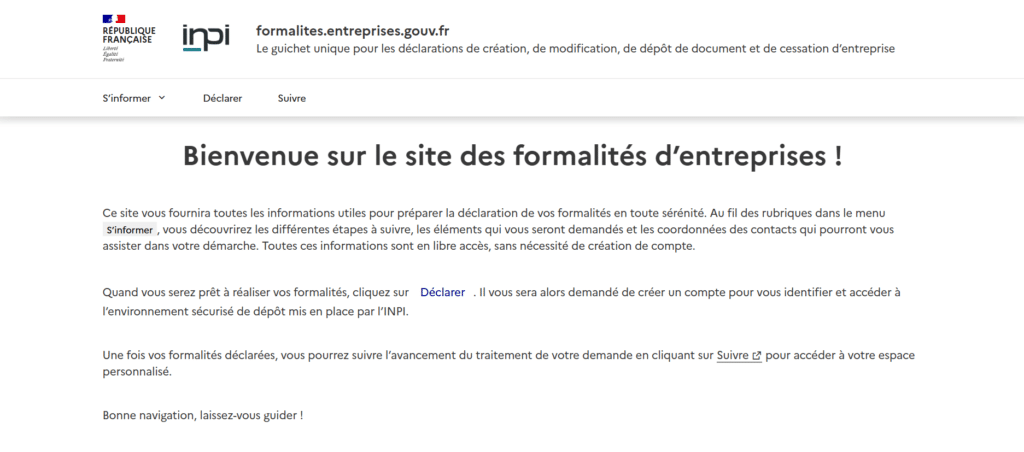

Proceed to register through the Electronic Business Formalities Counter (Guichet Unique). This centralized online portal streamlines the registration process for businesses operating in France.

If your company is based outside the European Union, appointing a tax representative within France is mandatory to handle VAT matters.

The Guichet Unique requires you to create an account and upload the documentation mentioned in the previous step.

Step 4: Await processing

Your application will be reviewed by the French tax authorities after it has been submitted. Although processing periods can vary, it’s wise to plan on a few weeks.

Ensure that your business operations remain VAT-compliant during this period.

Step 5: Receive your French VAT number

You will receive a distinct French VAT number upon approval.

The format of this identifier is:

FR + 2-digit verification code + 9-digit SIREN number (FR12 345678901, for example).

All official documents and invoices related to your business activities in France must include this number.

Post-registration obligations in France

Issuing VAT-compliant invoices in France

Each VAT-compliant invoice must include the following details:

- Your French VAT number.

- The VAT rate applied to the transaction.

- A clear breakdown of the VAT amount charged.

- Detailed descriptions of the goods or services provided.

Filing VAT returns in France

French VAT returns are normally submitted either monthly or quarterly, depending on your particular situation and turnover.

These returns must include the VAT collected on sales, the deductible VAT on purchases, and all taxable transactions.

Timely submission is crucial, as late filings may result in penalties and interest.

Record-keeping requirements in France

According to French regulations, companies must save all documentation pertaining to VAT transactions for at least ten years. This covers contracts, invoices, receipts, and any other paperwork that backs up your VAT claims.

Check it out yourself!

- Simulator – How long should a company keep its documents?

Maintaining well-organized, accessible records is essential for audits and VAT compliance.

What is the difference between Tax Representative and Tax Agent?

The tax agent supports companies in business development in the entire European Union. The tasks include VAT registration, submission of VAT returns and conducting tax audits.

The tax representative is appointed by companies that are based outside the European Union. The representative is responsible for completing all tax formalities on behalf of the company, including VAT registration, filing VAT returns, conducting tax audits. The tax representative is held jointly responsible for his client’s tax obligations.

Consultation – Free and without obligation

The most important VAT dates to remember in France

The deadlines:

1. For EU companies paying French VAT

When registering directly with the tax authorities, the deadline is the 19th day of the month after the reporting period, regardless of whether your company is obliged to file monthly, quarterly, or infrequently.

2. For non-EU companies paying French VAT

The deadline for non-EU companies using a Fiscal Representative is often extended to the 24th day of the month after the reporting period, though this can change based on the tax office in question.

3. For the intra-EU statement to be filed

At the latest on the 10th day of every month, the business must submit an electronic intra-community listing.

4. For the Intrastat declaration to be submitted

Even if there is no actual movement of products in a given month, companies chosen by the French government based on a sample are required to reply to the statistical survey. It must be submitted by the 10th day of the subsequent month at the latest.

The specific VAT rate applicable to your goods or services can be complex. Consult with a VAT expert like Eurofiscalis to ensure you are applying the correct rate.

Recent changes and updates in France

2025 VAT registration threshold adjustments in France

France will impose new VAT registration thresholds on March 1, 2025. While the VAT threshold for companies selling goods remains at €85,000, the threshold for service providers will be lowered from €37,500 to €25,000.

These changes align with EU-wide efforts to harmonize VAT thresholds, ensuring that small businesses operating in multiple EU countries comply with uniform regulations. Companies nearing these thresholds should closely monitor their revenue and prepare for VAT registration if necessary.

Upcoming EU VAT reforms (Effective January 1, 2025)

In 2025, the European Union will implement major VAT reforms to streamline cross-border tax compliance. Among the major changes are:

- The introduction of a single VAT registration for EU-wide sales – allowing businesses to manage VAT in multiple countries via one registration.

- New digital reporting requirements – increasing transparency and efficiency in VAT reporting.

- Changes to the VAT treatment of cross-border services – affecting e-commerce sellers and service providers.

These reforms aim to reduce VAT fraud, simplify administration, and support the growth of businesses operating internationally. Companies selling in multiple EU markets, including France, should stay informed and adapt their VAT compliance strategies accordingly.

Common challenges and tips in France

Avoiding common pitfalls

Delays in VAT registration, inaccurate VAT rates, or late submission of declarations cause many businesses to face compliance problems. Businesses should:

- Start the VAT registration process early to account for administrative delays and avoid fines or operational disruptions.

- Monitor any transactions that may result in the need for VAT registration.

- To guarantee compliance, confirm VAT rates and invoicing specification.

- To stay on top of VAT obligations, use digital accounting software or consult a VAT specialist.

Fines, penalties, and even prohibitions on doing business in France may follow noncompliance with VAT requirements.

Seeking professional assistance in France

Handling VAT in France—especially for foreign businesses—can be complex due to language barriers, frequent regulatory changes, and the need for a tax representative or tax agents in some cases. Partnering with a VAT expert or a tax consultancy firm can provide businesses with:

- Expert guidance on VAT compliance.

- Assistance with registration, filings, and invoicing rules.

- Regular updates on tax law changes that could affect operations.

- Support with VAT audits and representation if required.

Frequently asked questions (FAQs)

1. What are the consequences of not registering for VAT in France?

Businesses risk fines, penalties, and potential legal action from French tax authorities if they fail to register for VAT when required. Additionally, unregistered companies might not be allowed to trade in France and can have trouble getting their VAT claims for business expenses processed.

2. Can foreign companies recover VAT paid in France?

Yes, international corporations can claim French VAT under the 13th Directive (for non-EU businesses) or the EU VAT refund procedure (for EU-based organisations). Claims must be submitted to the French tax authorities, usually by June 30 of the subsequent year. However, the sort of expenses incurred and the nature of the company activity determine eligibility.

3. How does the reverse charge mechanism work in France?

Businesses can transfer the burden of paying VAT from the supplier to the buyer by using the reverse charge technique. This applies to specialised domestic supplies (such as subcontracting services in the construction industry) as well as cross-border transactions. This mechanism shifts the responsibility for VAT payment from the supplier to the buyer, who must declare both the deductible and payable VAT.

Find more information about reverse charge mechanism in France:

Source: VAT registration in France

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.