VAT in Norway: A Comprehensive Guide for Businesses

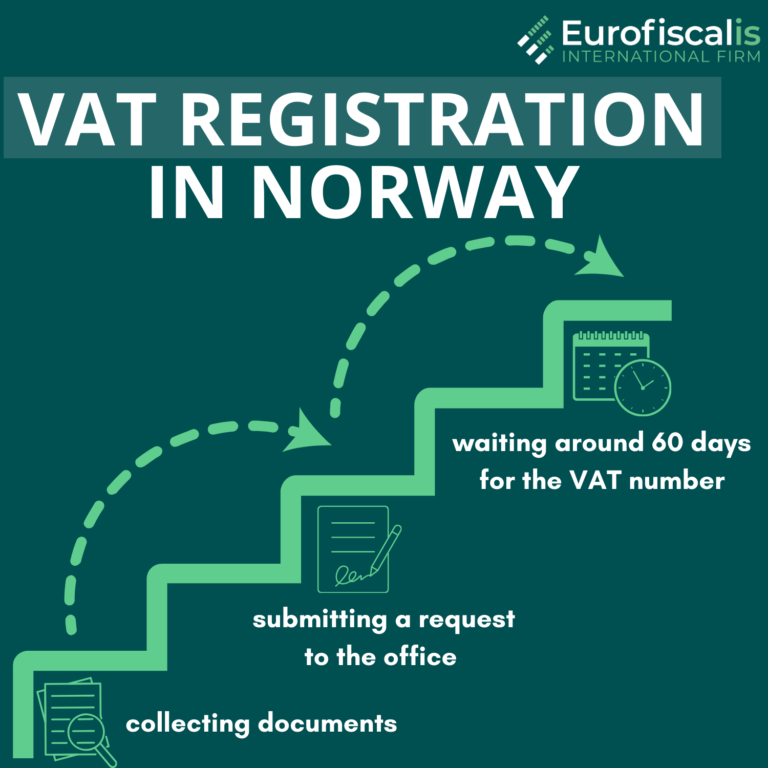

Norway is attracting more and more attention from businesspeople. Understanding the VAT system is crucial for businesses wishing to operate in this nation. In Norway, all companies with yearly sales surpassing 50,000 NOK are required to register for VAT. Getting a VAT number needs preparing documentation in advance and takes around 60 days.The following topics will be covered in detail throughout the article such as registration requirements.

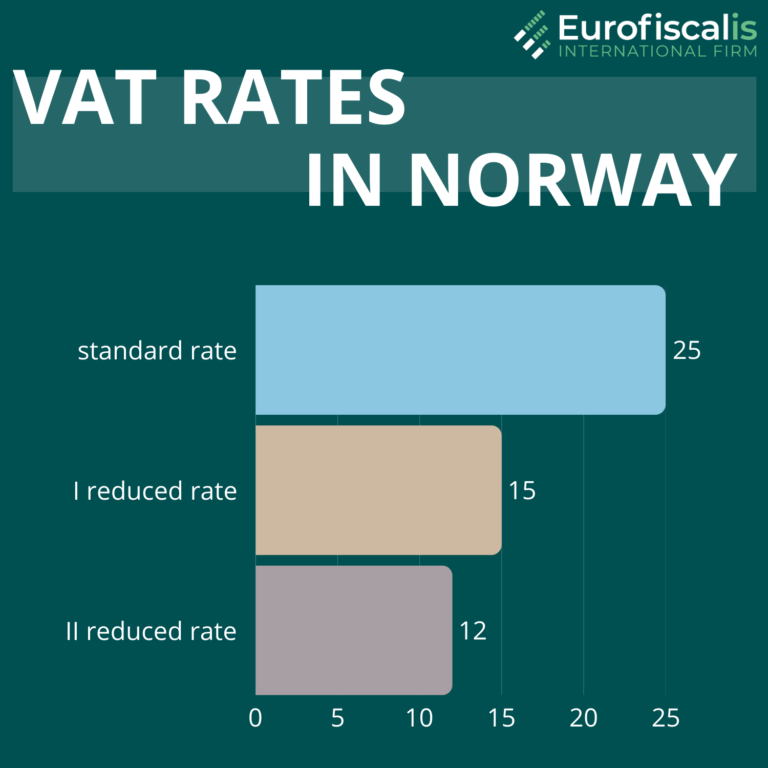

All businesses operating in Norway are required to register for VAT. The three primary VAT rates in Norway are 12% (the reduced rate for museum admission and transport services), 15% (the reduced rate for food), and 25% (the normal rate). In the article, you will find information about transactions that require VAT registration, such as the import and export of goods.

Additionally, we will present how Eurofiscalis can support your company in terms of VAT compliance in Norway. We reveal more in the article below. We invite you to read on!

- Published on :

- Reading time : 20 min

- Article updated on : 21/01/2025

What do you need to know about VAT in Norway?

General Overview of Norwegian VAT

In Norway, there are several types of transactions subject to taxation. If you want to make sure whether the activities conducted by your company in Norway are subject to tax reporting obligations in this country – contact us via the form or call.

Importance of Understanding VAT for Businesses

We will analyse your company’s situation, the transactions carried out, and if necessary – we will help with all formalities, including: VAT registration in Norway, filing declarations, representation before the Norwegian tax office, which is directly assigned to handle companies without a registered office in Norway: Skatteetaten

Are you interested in the topic “VAT in Norway“? Read on or take advantage of a free consultation on basic topics related to VAT in Norway.

VAT Rates in Norway

Overview of Current VAT Rates

In Norway, there are currently three VAT rates:

- 25% – the basic tax rate. It applies to most goods not subject to the reduced VAT rate

- 15% – the first reduced tax rate applies, among others, to:

- Food products

- Dietary supplements

- Over-the-counter (OTC) medicines

- 12% – second reduced tax rate applies, among others, to:

- Passenger transport services

- Admission to cultural events and museums

- Cinema tickets

- Hotel accommodations

In Norway, the 0% VAT rate is applied to products and services such as newspapers, books (both printed and e-books), funeral services, and international transport that starts in Norway but ends abroad, like typical airline tickets. Additionally, this rate also applies to goods and services supplied to the oil industry and exports.

What information must be on the invoice?

Norway enforces strict invoicing regulations that businesses must adhere to, highlighting the country’s commitment to precise billing practices. Check if you include all the items listed below on your Norwegian sales invoices. If any item is missing, you need to correct the invoice. This is particularly important from the perspective of a potential tax audit.

- Seller's details – name, address, VAT number

- Recipient's details – name, address, VAT numbe

- Invoice number

- Date of document issuance

- Delivery date of the goods

- Description of the delivered goods, quantity/weight,

- Net amount, VAT amount, gross amount

- If a 0% VAT rate was applied – a note on the provision exempting from VAT (along with the directive number)

- If reverse charge has been applied – an annotation regarding the regulations on VAT exemption (along with the directive number)

- Currency in which the invoice was issued (NOK)

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT Registration in Norway

Who Needs to Register for VAT?

VAT registration in Norway is necessary for absolutely all businesses that want to conduct taxable transactions in this country and whose planned annual turnover exceeds 50,000 NOK. Such a company does not need to have a registered office in the country to conduct its business in Norway, and after registering for VAT, it gains almost the same rights in Norway as local Norwegian companies.

Process of Obtaining a VAT Number

To obtain a VAT number in Norway, you must have your own tax representative in Norway. He will handle all formalities on behalf of the company and will represent it before the tax office in case of an audit. Check how a tax representative, such as Eurofiscalis, can help you run your business in Norway.

The tax office in Norway is known for the fact that just one small oversight is enough for penalties and interest to be automatically calculated. A tax audit may also be initiated immediately. Therefore, if you want to run a business in Norway, remember to plan the VAT registration process in Norway well in advance, before starting your activities in this country.

How long do you have to wait for a VAT number?

Timeline for VAT Registration

You have to wait about 60 days for a VAT number in Norway. As you can see, that’s almost two months, and on top of that period, you need to add the time required to gather the registration documents. Therefore, don’t hesitate to make a decision if you are sure that you will be conducting business in Norway.

If you are interested in registering a Norwegian VAT number, please contact us. After signing the contract, we will provide you with a complete list of documents that need to be gathered and translated, and we will also assist you throughout the entire procedure.

The same deadlines apply to VAT payments in Norway. In the event that the payment deadline falls on a Saturday, Sunday, or Norwegian public holiday, the VAT payment deadline in Norway is moved to the next business day.

VAT declarations and VAT payments in Norway

Submission Schedule for VAT Returns

VAT returns in Norway are submitted on a bi-monthly basis. The deadline for submitting VAT returns in Norway is according to the schedule.

An annual VAT return is not required in Norway.

- T1 (January-February): The declaration must be submitted by April 10.

- T2 (March-April): The declaration must be submitted by June 10.

- T3 (May-June): The declaration must be submitted by August 31

- T4 (July-August): The declaration must be submitted by October 10.

- T5 (September-October): The declaration must be submitted by December 10.

- T6 (November-December): The declaration must be submitted by February 10 of the following year.

VAT number in Norway - taxable transactions

Types of Transactions Subject to VAT

Below we present some of the transactions that require registration for VAT purposes in Norway:

- Import of goods to Norway

- Export of goods from Norway

- Storing goods in Norway and then reselling them

- Purchase of goods, followed by their resale in Norway (local sales)

- Provision of services not exempt and not exempted from VAT in Norway

Norwegian sales invoices - the most common mistakes

Below we present the most common mistakes on Norwegian sales invoices:

1. Lack of proper numbering: Invoices must have continuous numbering. Errors often occur when numbering is not continuous or is changed manually.

2. Lack of the correct date: Invoices must include the issue date, the sale date, and the payment due date. A common mistake is the absence of one of these dates or their incorrect entry.

3. Incorrect contractor data: Contractor data, such as the company name, address, or VAT number, must be current and accurate. Errors in this information are often encountered.

4. Lack of required information: The invoice must include all elements required by regulations, such as the invoice number, seller and buyer details, description of goods or services, quantity, net price, VAT rates, amounts of price reductions and discounts, tax amount, and the total amount due.

5. Marking documents as originals and copies: Current regulations do not require invoices to be divided into originals and copies, yet many entrepreneurs still make this mistake.

6. Signing invoices: Signing invoices is not required by regulations, however, some entrepreneurs still do it, which is unnecessary.

7. Lack of indicated VAT rates: The VAT rates must be correctly marked on the invoices. Missing or incorrectly marked VAT rates may lead to tax issues.

8. Late issuance of a pro forma invoice: Pro forma invoices must be issued no later than the seventh day after receiving the advance payment. Failure to issue such invoices on time is a common mistake.

Import Norway - what requirements apply?

Requirements for Importing Goods

To import goods into Norway, you must meet a number of requirements and comply with the applicable customs and tax regulations:

1. VAT registration in Norway: you must have a VAT number to be able to import in Norway, and your annual turnover exceeds 50,000 NOK.

2. Customs declaration in Norway: All goods imported into Norway must be declared to the Norwegian customs authorities using the so-called Single Administrative Document (SAD).

3. EORI Number: Companies outside the European Economic Area (EEA) must have an EORI (Economic Operator Registration and Identification) number for customs declaration of goods.

4. Import VAT in Norway: on imported goods is usually 25% in Norway, except for food, for which the rate is 15%. All goods, regardless of whether they are subject to customs duties, are subject to VAT taxation.

5. Customs duties and excise taxes in Norway: Some goods may be subject to import duties, especially food products and textiles. Moreover, excise duties may be levied on products such as alcoholic beverages, tobacco products, or vehicles.

6. Restrictions and prohibitions: The import of certain goods is restricted or prohibited. For example, the import of alcohol, tobacco, food, plants, animals, medicines, or hazardous materials may require special permits from the relevant Norwegian agencies.

7. Documentation and labelling: Goods must be properly labelled and have complete documentation. For agricultural and food products, specific labelling and composition standards apply.

8. Exemptions and reductions in Norway: Norway has free trade agreements that may entitle goods to reduced customs duties or complete exemption from customs duties. These agreements, however, do not cover VAT or excise duties.

How to claim VAT on imports in Norway?

Process for Reclaiming Import

To be able to reclaim import VAT, you must be a registered taxpayer in Norway. Companies can recover import VAT by submitting an application to the Norwegian tax administration. If a company does not have a registered office in Norway, it can do so through a tax representative, such as Eurofiscalis. All required documents, such as original invoices and receipts, must be attached to the application. VAT refund applications must be submitted annually by June 30, covering the period from January to December of the previous year. The refund process may take up to four months for EU companies and five months for non-EU companies.

In the case of returning goods abroad due to defects or incorrect delivery, one can also apply for a VAT refund. Goods must be returned within a year of import, and the Norwegian tax administration may extend this period in exceptional circumstances. To apply for a VAT refund, businesses must meet certain conditions and go through a detailed procedure, which includes both filing with the Norwegian tax office and ensuring that all documents are complete and compliant with the requirements.

You can book a free consultation with our VAT experts in time that is suitable for you!

What is the VOEC system?

Overview of the VOEC (Value-Added Tax On E-Commerce) System

VOEC (Value-Added Tax On E-Commerce) is a simplified tax system introduced by the Norwegian Tax Administration, facilitating the collection of VAT from foreign companies selling low-value goods and digital services to consumers in Norway. This system applies to B2C sales, covering goods below 3000 NOK. Registration for VOEC is mandatory for companies that have achieved sales exceeding 50,000 NOK within 12 months. This system streamlines tax procedures and prevents double taxation.

Future Changes to the VOEC System

From January 1, 2024, companies must digitally provide the unique VOEC number to the entity responsible for transporting goods. The transporter sends this number to the Norwegian customs authorities, ensuring proper documentation. Additionally, companies must provide detailed information about the contents of the shipment, including the value of the goods, a description of the products, and their quantity.

Tax penalties in Norway

Overview of Potential Tax Penalties

In Norway, tax penalties can be imposed for various violations of tax regulations, including delays in filing returns or delays in paying VAT.

1. Delay in filing the declaration: Companies that do not file their tax declaration on time may be fined. The amount of the fine depends on the length of the delay and can be significant, including additional administrative fees and penalty interest. Additionally, for repeated violations, penalties can be doubled and a tax audit will be initiated.

2. Delay in VAT payment: If the VAT is not paid on time, interest will be charged on the overdue amount. The interest rate on overdue payments in 2025 is 12.5% per annum. These interest charges are applied until the debt is settled. Most often, the delay will also be accompanied by a tax audit.

Eurofiscalis Services in Norway

Conclusion - What are the key takeaways from the article about Norway's VAT?

Recap about VAT in Norway

Understanding VAT in Norway is essential for businesses operating within the country. We discussed the requirements for VAT registration, the various Norwegian VAT rates, and the obligations related to filing. The importance of accurate invoicing and the consequences of non-compliance were also highlighted.

Key Points:

1. VAT Registration in Norway:

- Mandatory for all businesses with an annual turnover exceeding 50,000 NOK.

- A tax representative is required for companies without a registered office in Norway

2. VAT Number Processing Time in Norway::

- Expect a waiting period of approximately 60 days to obtain a VAT number, plus additional time for document preparation.

3.Mandatory Declarations in Norway:

- VAT returns are submitted bi-monthly, with specific deadlines for each period. An annual VAT return is not required.

- VAT returns are submitted bi-monthly, with specific deadlines for each period. An annual VAT return is not required.

4. VAT Rates in Norway:

- Norway has three main VAT rates: 25% (standard), 15% (reduced for food and certain goods), and 12% (for services like transport and cultural events). A 0% rate applies to specific items such as books and international transport.

5. Invoicing Regulations in Norway:

- Strict requirements must be adhered to, including seller and buyer details, invoice numbers, dates, and applicable VAT rates. Common mistakes can lead to tax issues.

6. Import Requirements in Norway

- Businesses must comply with customs regulations, including VAT registration and customs declarations for imported goods.

7. Reclaiming Import VAT in Norway:

- Registered taxpayers can reclaim import VAT by submitting applications to the Norwegian tax administration, with required documentation.

8.VOEC System in Norway::

- The Value-Added Tax On E-Commerce (VOEC) system simplifies VAT collection for foreign sellers of low-value goods, requiring registration for companies exceeding 50,000 NOK in sales within a year.

9. Tax Penalties in Norway:

- Delays in filing or paying VAT can result in significant fines and interest charges, along with the initiation of tax audits.

Seek Professional Assistance

Understanding the intricacies of VAT in Norway is essential for compliance and successful business operations. In the end, working with an experienced tax agent can help businesses focus on their core operations while successfully managing the intricacies of taxation by streamlining the registration process and guaranteeing compliance with local laws.

If you need help with VAT registration or filing, contact us for a free consultation Eurofiscalis is here to support your business in Norway!

Find out how we can help you with our services:

You can book a free consultation with our VAT experts in time that is suitable for you!

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.