Norwegian Invoice

Invoice Requirements in Norway

Invoices play an important role in business transactions, acting as a critical record of sales. Invoices detail the goods or services provided, their costs, relevant taxes and the parties involved in the transactions and the terms of payment.

Turning our attention to Norway, the importance of invoices is especially highlighted. Norway enforces strict invoicing regulations that businesses must comply with, highlighting the country´s commitment to precise billing practices. Like in all other countries, invoices do more than just document transactions; they are tools of efficiency, ensuring a smooth flow of transactions and contributing significantly to the sustainable growth of businesses.

- Posted :

- Reading Time : 4 min.

Norwegian Invoice

Sending an invoice can be done both quick and easy. However, there are some easy but important requirements to invoices and how it should be sent. If you are registered in the Norwegian VAT register you have to make sure you are compliant with the requirements applicable.

Norwegian invoices have some specific requirements that distinguish them from invoices in other countries, primarily because of Norway´s tax regulations and business practises. These requirements ensure compliance with Norwegian accounting and tax laws and that all transactions are properly documented for tax and accounting purposes.

Key invoice requirements in Norway

Let’s have a look at the key requirements for creating a compliant invoice in Norway:

- Invoice number

Each invoice must have a unique number that follows in a sequential order.

- Invoice date

The date when the invoice is issued.

- Seller’s information

Complete name and address of the seller, as well as the organization number (VAT number if registered in “Merverdiavgiftsregisteret”).

- Buyers’ information

Complete name and address of the buyer. For sales where VAT is charged, the buyers VAT number is required if the buyer is VAT registered.

- Description of goods/services

A clear description of the goods or services provided.

- Quantities, rates and type of goods/services

The volume or quantity of the goods or services, including the unit price and the nature of the goods or services sold.

- Delivery date & Place

The date and place for when and where the goods have been delivered, or the services have been completed.

- Payment terms

Terms of payment including the due date for payment.

- Total invoice amount

The total amount to be paid by the buyer, including the breakdown of net amount, VAT and other applicable charges.

- VAT details

The VAT rate applied, and the total amount of VAT charged on the invoice. The VAT amount should be mentioned in VAT. Norway typically requires VAT to be specified separately on the invoice. If the same invoice includes several VAT rates, you must specify this on separate lines.

- Accounting system

Invoices should be made in an accounting system, and invoices should not be created in for example Word or Excel.

- Currency

You can invoice in other currencies, like Euro, but you should add the VAT amount in NOK. It is recommended to state the used currency rate on the invoice. The currency rate to be used is the official on the time of invoicing. But if you are using an accounting system, it should take care of that automatically.

What separates a Norwegian invoice from others?

Here are some key aspects that might typically separate Norwegian invoices from others:

Norwegian invoices must include the seller´s Norwegian organization number (Organisasjonsnummer). This is a unique nine-digit identifier for every registered entity in Norway. If VAT registered in Norway, your Norwegian VAT number should be mentioned: the VAT number is your Norwegian organization number followed with “MVA”. You are allowed to prefix with “NO”.

Norway has specific VAT rates that must be applied correctly and displayed on the invoice. You can learn more about Norwegian VAT here.

While not exclusive to Norway, invoices typically list amounts in Norwegian Kroner (NOK). The invoice may show another currency, but VAT must be calculated and shown in NOK, often alongside the original currency. The currency rate to be used is the official one at the moment of invoicing.

For services supplied to Norwegian businesses from abroad, the invoice may need to indicate that the reverse charge mechanism applies, meaning the recipient of the service (if VAT registered in Norway) is responsible for reporting and paying the VAT.

Norway encourages the use of electronic trading format invoices, especially for transactions with the public sector. The format is designed to streamline the invoicing process, ensuring compatibility and efficiency in electronic invoice exchanges. Most commonly used is EHF, based on the European standard (UBL, CEN, Peppol BIS).

While not a strict requirement, invoices in Norway are commonly issued in Norwegian, especially for domestic transactions. English is widely accepted, particularly for international business, but including a Norwegian version or summary can be beneficial for clarity and compliance.

Norwegian law requires a detailed breakdown of VAT on the invoice, showing the VAT rate applied, the base amount the VAT is calculated from, and the total VAT amount in NOK. This is essential for both domestic and international transactions involving Norwegian entities and foreign entities registered in the Norwegian VAT register

Schedule a free consultation with our expert

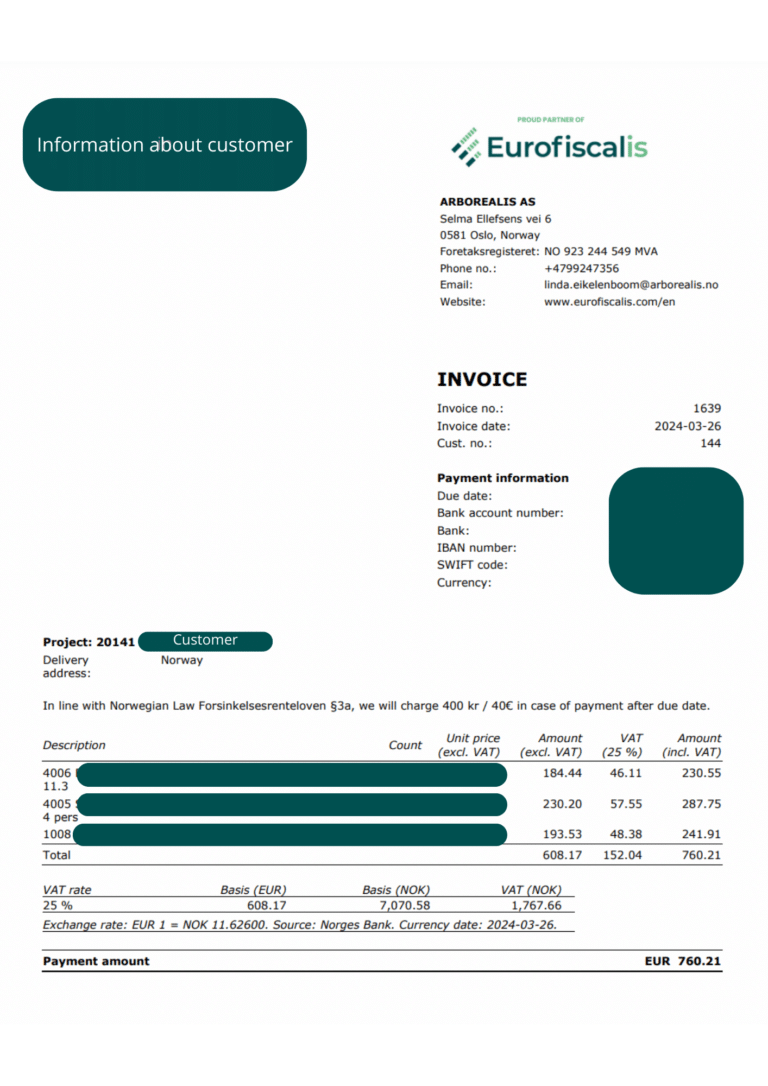

Compliant Norwegian Invoice: Example

To illustrate this – let´s have a look at what your invoice could look like when meeting all the requirements for a Norwegian invoice.

Importance of creating a compliant invoice in Norway

Creating compliant invoices in Norway is not just a matter of meeting legal requirements. It also has implications for the financial reputation of a business. Compliant invoices in Norway ensure accurate financial records and are crucial for accurate tax reporting and potential VAT reclaim.

Non-compliant invoices can lead to tax errors, penalties and even damage to business relationships. If invoices are not compliant, businesses may struggle to get paid on time or could face disputes with costumers.

Compliance with invoicing in Norway reflect a business´s commitment to professionalism and integrity. Therefore, understanding and applying the rules for creating compliant invoices in Norway is an essential business practice.

Common mistakes to avoid

When it comes to invoices in Norway, avoiding common mistakes is important for maintaining business compliance and ensuring smooth transactions.

By being aware of the common mistakes and taking steps to avoid them, businesses can ensure that their invoicing process aligns with the regulatory requirements of invoices in Norway.

In the process of creating invoices in Norway, businesses often make certain common mistakes:

- Incorrect or missing information: This includes typical errors or missing information about the sellers or buyer’s details – typically the wrong VAT number.

- VAT amount in the wrong currency: For invoices in Norway make sure you have the correct VAT amount for the correct country – In this case it will be in “NOK”.

- Wrong invoice number or date: Make sure to double check all information for accuracy.

- Incorrect description of goods or services: The invoice should provide a clear and precise description of what the costumer is paying for. Vague or incomplete descriptions can create confusion. Also make sure to have the correct place of delivery.

- Incorrect VAT calculation: VAT should be correctly calculated and applied. Errors in VAT calculation can lead to compliance issues and financial losses.

Navigating the legal landscape of invoicing can be difficult, particularly in a market as regulated as Norway´s.

We hope that with this article you can better form your Norwegian invoice.

Click now to unlock your international potential!

Navigating the Italian VAT system can be complex. Are you clear on the difference between periodic (LIPE) and annual VAT returns in Italy? Don’t risk costly penalties for late or incorrect VAT declarations. Our comprehensive guide breaks down the entire process, from understanding taxable transactions and VAT rates to meeting crucial deadlines and claiming refunds

Struggling with Polish VAT returns? This guide breaks down how to file the mandatory JPK_V7, meet deadlines, and successfully claim your VAT refund. Get clear on the requirements and ensure you get your money back.

Navigating the French VAT system can be complex, and getting your VAT declarations wrong can lead to penalties of up to 80%. Our definitive guide to VAT returns in France covers everything you need to know: from filing deadlines and avoiding common errors to the step-by-step process for claiming your VAT refund.

Correct invoicing in the Netherlands is a legal necessity. Our guide breaks down the key requirements, from mandatory details and VAT rules to the latest on e-invoicing, helping you stay compliant and avoid penalties.

Slovakia’s invoicing is transforming! Prepare for mandatory B2B eInvoicing by 2027. Our guide covers current VAT rules and the digital shift, helping you stay compliant.

Navigating VAT in Ireland can be complex. From understanding the various rates (23%, 13.5%, 9%, 4.8%, 0%) to registration thresholds and compliance obligations, getting it right is crucial for your business. Dive into our comprehensive guide to master Irish VAT, avoid penalties, and ensure smooth operations.