Invoicing in France - learn how to do it right

If your business operates in France or you’re about to start invoicing French clients, getting familiar with the invoicing rules is more than just a good idea – it’s a legal must. France has strict requirements when it comes to VAT invoicing, deadlines, and the mandatory rollout of electronic invoicing for B2B transactions.

- Published on :

- Reading time : 10 min

Are you obliged to issue an invoice in France?

If the client is a business, an invoice must be issued for each sale of goods or provision of services. Typically, it must be issued at the time of delivery of the goods or completion of the service.

However, an invoice may be issued at a different time in the following situations:

– For the supply of goods exempt from VAT, the invoice must be issued no later than the 15th day of the month following the month in which the delivery took place.

– For services where the client is liable to pay VAT, the invoice must be issued no later than the 15th day of the month following the period in which the service was performed.

– If a business makes multiple separate deliveries of goods or services to the same client, the invoice may be issued no later than the end of the month in which the deliveries or services were made. This applies only to deliveries for which VAT is due in the month of the transaction.

Invoicing in France - mandatory information on French invoices

What is the mandatory information on an invoice in France?

A French invoice must meet very specific formal requirements. Whether you’re billing a local partner or a foreign client, every invoice issued under French law must include:

- Date of issue

- Unique number of the invoice

- Seller information

- The invoice must contain the seller’s company name, representative’s name, registered office address, SIRET number, legal form, and share capital amount.

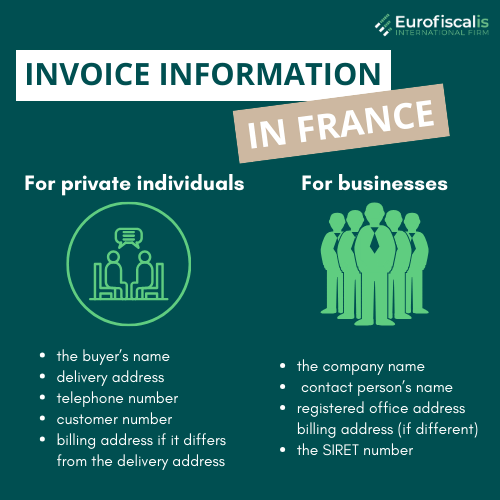

- Buyer information

- For private individuals: The invoice should include the buyer’s name, delivery address, telephone number, customer number, and billing address if it differs from the delivery address.

- For businesses: Include the company name, contact person’s name, registered office address, billing address (if different), and the SIRET number (a unique French business identification number).

- VAT identification numbers (for both the seller and the buyer, if applicable)

- EU VAT number (TVA intracommunautaire) for intra-community transactions, for both the seller and the buyer.

- Description of goods or services (it has to be precisely)

- Unit price and quantity

- Net amount, VAT rate(s), and VAT amount

- Total payable amount including VAT

- Payment terms and due date

- Late payment penalties and possible discounts

- Reference to applicable exemptions, if any

The seller (or supplier) and the client must each keep a copy of every invoice. Invoices must be issued with a certain level of formality.

Invoices must be issued in French or accompanied by a French translation if requested by authorities, and they’re usually denominated in EUR, though other currencies are accepted with proper VAT calculation.

The amount of VAT payable or to be settled must be stated in euros. To convert this amount into euros, the latest exchange rate published by the European Central Bank (ECB) must be used. The exchange rate must be indicated on the invoice.

VAT invoicing requirements in France

Invoicing in France – requirements

There are few key rules to follow when it comes to VAT requirements in France:

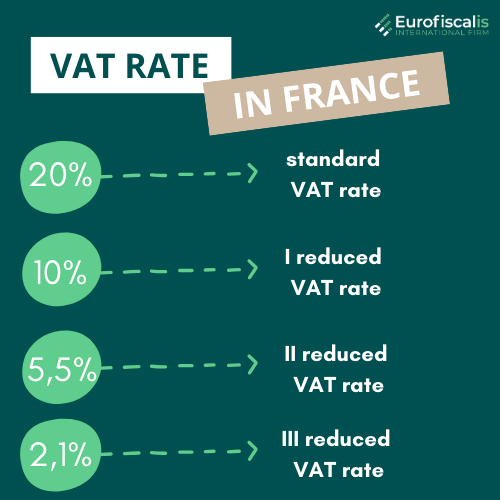

- Correct VAT rate

- Standard Rate (20%) – most goods and services in France

- Reduced Rate (10%) – specific categories such as unprocessed agricultural products, firewood, certain home improvement services, passenger transport, and restaurant services.

It aims to support industries considered essential or beneficial to society.

- Reduced Rate (5.5%) – most food products, certain hygiene products, books, gas and electricity subscriptions, and social housing improvements.

It reflects the government’s effort to make essential goods and services more affordable.

- Specific Rate (2.1%) – highly specific items, such as certain medicines reimbursable by social security, sales of live animals for butchery, television license fees, and some press publications.

It is designed to reduce the financial burden on essential or culturally significant services.

2.Businesses must apply VAT if the supply is taxable in France

3. Intra-community transactions must include customer’s VAT number and mention of reverse charge mechanism

4. If you’re exempt, your invoice must clearly state the legal reason for exemption (e.g. “Exonération de TVA, article 262 ter I du CGI”)

Deadlines and archiving

All invoices must be archived for 10 years, both digitally or in paper form.

You can book a free consultation with our VAT experts in time that is suitable for you!

Understanding B2B invoicing in France

When it comes to B2B invoicing in France, there are important aspects to know:

- Issuing French invoices – Businesses must issue invoices to other businesses (and public entities) for every taxable supply.

- Receiving French invoices – Companies must also be able to accept e-invoices through certified platforms.

Public administrations in France use Chorus Pro, which is the French state’s e-invoicing portal. However, in the private sector, businesses will need to use certified PDPs (Plateformes de Dématérialisation Partenaires) or the public portal (PPF) to send/receive e-invoices. These portals are described later in the article.

Payment terms and deadlines for invoices in France

The standard rule is:

- 30 days after invoice date

- Can be extended to 60 days maximum, or 45 days end-of-month, if specified in the contract

If you do not issue the invoice for the first time:

- For an individual business, the fine can amount to up to €75,000.

- For a company, the fine can amount to up to €375,000.

If, after receiving a penalty, the entity fails to fulfill its obligation again within two years from the imposition of the first penalty, it is subject to a fine in the amount of:

- For an individual business, the fine can amount to up to €150,000.

- For a company, the fine can amount to up to €750,000.

If you made a mistake in inaccuracy of mandatory information on invoice:

- For each omission or inaccuracy, a fine of €15 will be imposed.

- The total amount of fines imposed on an invoice cannot exceed 25% of the invoice amount.

- In the case of concealing or altering the address or personal details of the client or supplier, the fine will amount to 50% of the total amount of the invoices affected.

If you issue invoice for fictitious sales/services:

- If an invoice pertains to a fictitious sale or service, a fine of 50% of the invoice amount will be applied.

- If the seller or supplier provides proof within 30 days that the transaction was conducted and properly settled, the fine will be reduced to 5% of the transaction amount.

What is the difference between e-billing and e-invoicing?

Even though they sound similar e-billing and e-invoicing, the meaning behind them is a little bit different:

E-billing is when you are sending PDF invoices by email or uploading to a customer portal

E-invoicing is when you have structured, machine-readable XML or UBL formats and are sent directly through certified French platforms.

You can book a free consultation with our VAT experts in time that is suitable for you!

How to invoice a French company?

If you are invoicing a French client you have to:

- Collect the correct company details such as business name, address, and VAT number

- Include all of the mandatory invoice elements – it was written above

- What kind of VAT is it? – determine VAT treatment (local, intra-EU, or outside EU)

- Apply the correct VAT rate or exemption

- Use the right currency

- Send the invoice using approved French channels

Foreign companies invoicing French clients should also check if they need a French VAT registration or a fiscal representative.

Payment methods in France

How can you pay invoices in France?

France is said to be modern and flexible. Your business can pay invoices in various ways such as:

- Bank transfer (Virement Bancaire)

- Direct debit (Prélèvement SEPA)

- Cheque

- Credit/Debit card

- Cash

- Digital payment platforms

B2B transactions are typically settled via bank transfer.

Always include IBAN and BIC/SWIFT on your invoices.

Is e-invoicing mandatory in France?

Yes, and it’s coming faster than you think. France is right now in a major digital shift. Starting from July 2024, e-invoicing will gradually become mandatory for all B2B transactions between companies established in France. The state will support the widespread adoption of electronic invoicing between companies.

- the provision of goods or services to another taxable person in France that is not VAT-exempt;

- the upfront payments associated with certain operations;

- the public sale of antiques, collector’s items, artwork, and used products.

Mandatory information on French e-invoices

New details that are required:

Additionally, invoices issued until the 1st of September 2026 for large and mid-market corporations (MID-cap) and until the 1st of September 2027 for small and medium-sized businesses (SMEs) and micro organizations will need to have new entries added:

- the delivery address of the items, if it differs from the customer’s address;

- proof that the transactions for which an invoice is generated are solely related to the supply of goods or services, or both types of transactions;

- the debit-based payment of VAT where the provider has chosen to do so

- the SIREN number.

Timeline for a major digital shift in France:

According to Article 91 of the Public Finance Act for the year 2024 (No. 2023-1322 of December 29, 2023), the implementation of electronic invoicing will occur gradually:

- From September 16, 2024, in the partner zone on the French website, companies can access a list of registered PDPs under certain conditions, which is regularly updated with new players.

- September 1, 2026 – the obligation to enable all entrepreneurs to receive electronic invoices, and for large and medium-sized enterprises, the obligation to issue electronic invoices;

- The obligation for small and medium-sized enterprises as well as micro-enterprises to issue electronic invoices comes into effect on September 1, 2027.

E-invoicing B2C

Future e-invoicing obligations do not apply to transactions outside of France (including those within and outside the EU) or business-to-consumer (B2C) transactions. In parallel, an eReporting system that covers those transactions is developed (see the section on “Digital reporting requirements” below).

On October 15, 2024, the General Directorate of Public Finances (DGFiP) of France announced significant changes to e-invoicing and reporting systems. The Public Invoicing Platform (PPF) will discontinue the distribution of invoices and focus on data collection and analysis.

What is the e-invoicing format in France?

France accepts three ways for e-invoices submission:

1. The manual entry of invoices on the platform, download of PDF

2. The manual entry of invoices on the platform, download XML invoices (signed or not),

3. Electronic Data Interchange (EDI) in direct connection or via a service operator.

Deadlines, archiving and e-signature

All invoices must be archived for 10 years, both digitally or in paper form. No electronic signature is required for e-invoices, but it is commonly used.

France’s national e-invoicing platforms

PDP, OD, and PPF – what does it mean?

- PDP (Partner Dematerialisation Platform) – Certified by the French tax authorities to manage invoice exchanges and e-reporting.

- OD (Opérateur de Dématérialisation) – A non-certified operator who can assist with invoice creation or formatting but they are required to work with a PDP for transmission.

- PPF (Portail Public de Facturation) – Run by the state’s public invoicing portal, which will prioritize data collection and auditing instead of transmission.

Together, these platforms form the 5-corner model, streamlining e-invoicing and ensuring real-time tax control.

Chorus Pro

In 2017, France began requiring B2G e-invoicing for vendors supplying government agencies. Chorus Pro was selected by the French government as the official and required platform for companies to send electronic invoices to government agencies.

Electronic invoices are mandatory for all public sector (B2G) providers since January 2020. The PPF is the B2B e-invoicing portal for all businesses founded or functioning in France, while Chorus Pro is the B2G e-invoicing portal of the French government.

What is a PDP in France?

A PDP (Plateforme de Dématérialisation Partenaire) is a certified private e-invoicing platform authorized by the French tax administration. From 2026, businesses will need to use a PDP to transmit and receive e-invoices and submit transaction data for both domestic and cross-border deals. PDPs will replace direct connections to the public platform, creating a decentralized system.

What is the role of the National Directory?

The national directory in France’s e-invoicing system stores company identification data and their chosen PDPs. It ensures invoices are routed correctly between sender and receiver, regardless of the platforms used. This directory is managed by the tax administration and is key to secure, seamless e-invoice flows.

How does ViDA affect invoicing in France?

ViDA – VAT in the Digital Age is the European Commission’s initiative to modernize VAT processes across the EU, emphasizing digital reporting. ViDA’s objectives are in line with France’s embrace of electronic reporting and invoicing. The national 5-corner model and mandatory e-invoicing rules help France comply with future EU-wide requirements, reinforcing transparency and combating VAT fraud.

Penalties in e-invoicing in France

The French Parliament passed the 2022 Finance Law, which includes the gradual implementation of electronic invoicing. A late addition to the law is a penalty system for omitted electronic invoices, as follows:

⇒ For taxpayers €15 per invoice, with a cap of €15,000 annually.

⇒ For certified agents’ electronic invoices (PDP – Partner Dematerialization Platforms) €15 per invoice, up to a maximum of €45,000 annually.

Why is it important?

The widespread use of electronic invoicing represents an important step forward in the dematerialization of trade exchanges and will strengthen the competitiveness of enterprises by shortening payment terms and streamlining invoicing processes. It will also help simplify the relationships between the tax administration and professional users.

Source: E-invoicing in France

Eurofiscalis Services in France:

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.