Invoicing in the Czech Republic: what you need to know

Invoicing in the Czech Republic aligns with EU and local laws (VAT Act, Accounting Act). It is mandatory for VAT-registered and non-VAT businesses in specific cases like intra-EU trade or reverse charge. You have to issue invoices, within 15 days, must include key details and be stored for 10 years. Foreign might need currency invoices in CZK. Read the article and get more information about invoicing and e-invoicing.

- Published on :

- Reading time : 15 min

Invoicing in the Czech Republic: what you need to know

If you run a business in Prague or elsewhere in the Czech Republic invoice clients across borders – you need to understand how invoicing works in the Czech Republic. While local rules align with EU legislation, but there are also country-specific details that can trip up even experienced traders.

Are you interested in VAT in the Czech Republic? Read more or schedule a free consultation

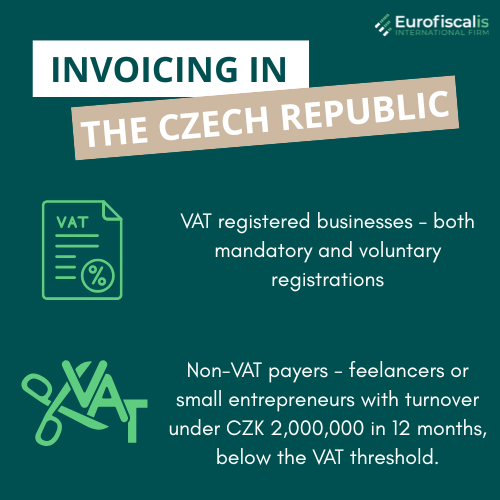

Who needs to issue invoices in the Czech Republic?

Issuing proper invoices is a legal obligation, it is not optional whether you’re selling goods or services in the Czech Republic. This applies whether you’re a Czech-registered business, a freelancer, or a foreign company.

- VAT registered businesses – both mandatory and voluntary registrations must issue invoices for taxable supplies of goods or services to other taxable persons B2B transactions including freelancers and self employed

-

- Non-VAT payers – for example small entrepreneurs or freelancers not exceeding the VAT registration threshold of CZK 2,000,000 in turnover over 12 consecutive months

Invoices must be issued if:

- You are supplier of goods or services to other taxable business/person

- You make a distance sales or intra-EU supplies if VAT is applicable (not obligatory for OSS distance sales)

- You make transactions in which you can apply the reverse charge mechanism

Invoices can be issued, but are not mandatory, in the following cases:

- Sales to private individuals (B2C) when the customer requests an invoice.

- Activities exempt from VAT, such as healthcare, education, or financial services, where the supplier may still request an invoice.

Key legal framework governing invoicing in Czech Republic

Is Czech Republic in EU for VAT?

The Czech Republic’s invoicing regulations are based on both domestic and EU VAT laws:

- Czech VAT Act (No. 235/2004 – Zákon o dani z přidané hodnoty) lays out local obligations.

- EU VAT Directive (2006/112/EC) defines standard invoice elements across the EU.

- Accounting Act (No. 563/1991)

- The Czech Civil Code (Act No. 89/2012 Coll.)

You can book a free consultation with our VAT experts in time that is suitable for you!

Invoicing in Czech Republic – what are the requirements?

Regardless of whether you are VAT-registered or not, your invoices in the Czech Republic must adhere to a number of legal requirements. Remember that mistakes can lead you to have penalties or VAT deduction refusals.

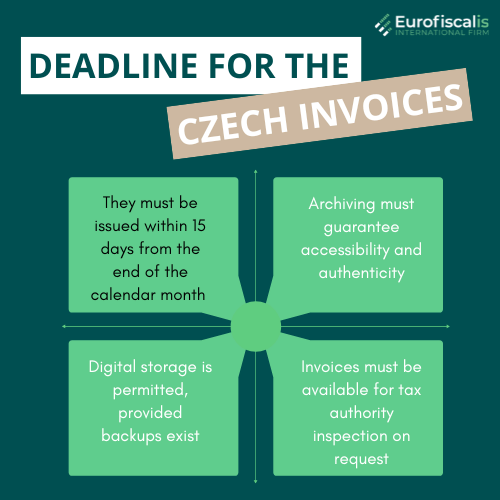

When the Czech invoices must be issued?

Within 15 days from the end of the calendar month in which the taxable supply (uskutečnění zdanitelného plnění) took place or the payment (or part of it) was received before the day of the supply.

After then, the invoice needs to be kept for ten years in a safe archive.

- Remember

- Archiving must guarantee accessibility and authenticity

- Digital storage is permitted, provided backups exist

- Invoices must be available for tax authority inspection on request

Invoicing in the Czech Republic - requirements for invoices

The invoice provided after the sale of products and services in the Czech Republic must include the following information:

Czech Invoicing as a non-VAT payer

- Invoice number

- Information about Supplier and Subscriber

- Date of issue, Due date, and Variable symbol

- Information to facilitate export, reverse charge, or intracommunity supply with zero VAT

- DIČ Number – not mandatory, however it might be helpful for the subscriber

- Description of goods or services

To calculate the exchange rate, reference the Czech National Bank on the day of issuance. You may also include this in the invoice as an extra note. For instance, incorporate – Exchange Rate of CNB on Date 1 EUR = X CZK

As a non-VAT payer, you will always invoice without VAT, even if your client is a registered VAT payer.

Invoicing in the Czech Republic as a VAT payer

- The date of release

- Invoice number (must be sequential and unique)

- A distinct, sequential number that serves as both the supplier’s and the customer’s VAT number

- The supplier’s and customer’s information. This includes: IČO (Company Registration Number), business name, business address, supplier bank details, and payment terms

- DIČ Number

- IBAN

- BIC / SWIFT

- Variable Symbol

- Complete description of the products or services rendered specifications of the product quantities, if any.

- If the supply date and the invoice date disagree,

- Unit price and any applicable discounts (if not already included)

- The supply’s net, taxable value

- The amount of VAT (in CZK) and the applicable VAT rate

- Information to facilitate export, reverse charge, or intracommunity supply with zero VAT

- Mentioning any unique program, such as the margin program for travel agencies, the second-hand goods, art, or antiques programs.

- The invoice’s total gross value

The tax base and the amount of tax are specifically mentioned in the law. The total amount (celkem) is their sum and is typically included on invoices – nevertheless, it is not included in the VAT Act §29 as a distinct, required element (it is part of, for example, a simplified document). However, in practice, this is the standard.

To calculate the exchange rate, reference the Czech National Bank on the day of issuance. You may also include this in the invoice as an extra note. For instance, incorporate – Exchange Rate of CNB on Date 1 EUR = X CZK

Only the following details are needed for bills under CCK 10,000:

- Date of the supplier’s invoice and their VAT number

- Description of the products or services

- The amount of VAT charged

You can book a free consultation with our VAT experts in time that is suitable for you!

Foreign currency and exchange rate rules in the Czech Republic

Invoices can be issued in EUR, USD, or other currencies, but:

- VAT amount must also be shown in CZK

- Use the Czech National Bank (CNB) exchange rate valid on the date of supply

Specific VAT/businesses phrases:

Přenesení daňové povinnosti → Reverse-Charge

Osvobozeno od daně → Tax-Exempt Supplies

Živnostenský List → Activity Licence

Identifikační Číslo Osoby (IČO) → Personal Identification Number

Daňové Identifikační Číslo (DIČ) → Taxpayer Identification Number

They are typically in Czech but can be accompanied by English equivalents for example “Reverse-Charge”.

Invoicing in Czech Republic in English or in other language?

Yes, you can issue invoices in English. Moreover, Czech-registered businesses can issue invoices in any language. It is not mandatory to only issue in Czech.

If your business undergoes a tax inspection, the Czech Financial Authority (Finanční úřad) may request a Czech translation. The best practice is to use bilingual invoices for example in Czech and English, because it is possible to avoid delays.

E-invoicing in the Czech Republic

The majority of the e-invoicing process is thought to be automated. The usage of electronic invoices and electronic filing of the VAT Control Statement are supported by the majority of accounting programs and Enterprise Resource Planning (ERP) systems.

Key legal e-invoicing in Czech Republic

The Czech Republic is gradually adopting e-Invoicing, in line with EU directives (Act no. 134/2016 Coll. on Public Procurement transposes the Directive 2014/55/EU on electronic invoicing in public procurement into national legislation)

You can book a free consultation with our VAT experts in time that is suitable for you!

Archiving and e-signature

You must store e-invoices for 10 years – just like paper versions. An e-Signature is not required to send an e-invoices in Czechia.

When e-invoicing is mandatory or voluntary in the Czech Republic?

The usage of automated and integrated technologies, semi-automated procedures, or even manual processing varies throughout public contracting authorities. The NEN permits the internal systems of contracting authorities to be connected in order to receive and process electronic invoices.

- Mandatory for:

- B2G (Business-to-Government) transactions.

- Voluntary for:

- B2B (Business-to-Business) – There is no mandate; however, it may be required by specific contractual agreements, especially in global trade sectors.

- B2C (Business-to-Consumer) – There is no mandate.

Czech digital reporting - what are the requirements?

Articles 101(c) through 101(i) of Act No. 235/2004 Coll., commonly referred to as the VAT Act, specify the digital reporting requirements in Czechia and require the electronic filing of a VAT Control Statement. Introduced in January 2016, this statement mandates the electronic reporting of comprehensive transactional data by all taxable individuals registered for VAT, including non-resident enterprises.

- The VAT Control Statement must outline all transactions, regardless of value, although those below CZK 10 000 (approximately EUR 380) must be reported on a per-customer basis.

- The reporting applies to B2B, B2G, and B2C transactions, including both sales and purchases within domestic and intra-EU contexts.

- Reports must be submitted monthly, with invoices documented on a transaction-by-transaction basis, except for lower-value transactions, which can be summarized.

- The required information includes the invoice date, number, type of transaction, tax rate, taxable amount, VAT amount payable, and trading partner name.

- Secure data boxes or the Tax Portal must be used to send data in XML format.

Better electronic connection between taxpayers and the tax office has been made possible by the launch of the MY TAX portal. Moreover, Information System Document (ISDOC) is used alongside European standards for document exchange, ensuring compliance in the reporting process.

E-invoicing channel NEN

The complete e-procurement life-cycle can be processed by central, regional, and municipal public contracting agencies using the operating model for e-invoicing which is the Národní elektronický nástroj (NEN) platform.

History of the Národní elektronický nástroj - NEN

The complete eProcurement life-cycle may be processed by central, regional, and municipal public contracting authorities thanks to the Národní elektronický nástroj (NEN) platform, which was introduced in 2015.

The Public Procurement and Concessions Portal (Portál VZ) has been replaced by the platform, which was created by the Ministry of Regional Development. Unless they are authorised to use their own procurement tool, all contracting authorities must utilise the NEN platform once it is fully operational by the end of 2017.

The NEN platform will continue to be used, and no structural modifications should be made, according to the existing Public Procurement Strategy 2024–2028.

What is the e-invoicing format in the Czech Republic?

The only formats that are accepted for all transactions with non-domestic providers are the national ISDOC as well as EDIFACT and UBL.

Reason for the Czech e-invoicing

To improve administrative efficiency, cut expenses, and increase transparency in public transactions, the Czech Republic implemented electronic invoicing in its public procurement operations.

Payment methods in the Czech Republic

When invoicing in Czech Republic, you’ll commonly deal with:

- Bank transfers – the most used method, both in CZK and foreign currencies

- For a SEPA payment, the account number must be entered in IBAN format. You must enter the account number in the manner that you received from the payment beneficiary for a standard foreign payment.

- SWIFT/BIC details are standard on invoices. The international bank code must be entered for a standard foreign payment. The bank’s name and address can also be used to identify payments made outside of the European Economic Area. In this situation, you can select Unknown SWIFT/BIC and enter the bank’s name and location in the Beneficiary’s Bank boxes.

- QR codes like QR platba are widely used for faster B2C payments

- FIK/BKP codes were part of the now-defunct EET system, but some platforms still support them

- The Financial Administration of the Czech Republic generates the FIK code, which is a distinct code for every single sale.

- The BKP code is the taxpayer’s security code, which the Financial Administration uses to connect the taxpayer to the receipt he provided.

Source: Czech payment methods

Czech invoicing for cross-border and EU trade

Czech Republic is part of the EU, so as it was written at the beginning of the article the EU VAT rules apply for cross-border transactions including with the Czech Republic.

- For intra-EU B2B trade, VAT may be zero-rated if both parties have valid VAT IDs

- Use the reverse charge mechanism – Companies based outside the Czech Republic providing services to customers based in the Czech Republic – who are VAT registered, do not charge VAT, and the tax liability rests with the customer through the reverse charge.

- For e-commerce, use the One Stop Shop (OSS) procedure which simplifies VAT across multiple EU countries

If you want to learn more about it, we encourage you to read our article on VAT registration in the Czech Republic

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.