Get French VAT recovery ?

How to get French VAT recovery ? In France, like in most countries, Value Added Tax (VAT) should not be a final cost for your company. However, the procedure for foreign businesses to reclaim it differs significantly from domestic ones, particularly when navigating cross-border VAT issues and international VAT compliance requirements. If your company […]

End of Amazon’s C.O.S Program

Amazon VAT Stopping Amazon’s C.O.S Program: Everything You Need to Know Amazon recently announced the cessation of its C.O.S (Call-Of Stock) program effective August 1, 2024, a crucial service for many sellers. Amazon’s C.O.S program allows sellers to store and sell in multiple European countries without having to register for VAT in those countries. The […]

Intrastat Thresholds

Intrastat Thresholds 2025: Comprehensive and Updated Guide Are you conducting commercial exchanges within the European Union? Then you’re likely familiar with Intrastat declarations, also known as EMEBI (Monthly Surveys on Intra-Community Trade in Goods). These declarations are essential for compiling trade statistics on external commerce. Understanding Intrastat thresholds is fundamental to staying compliant. No need […]

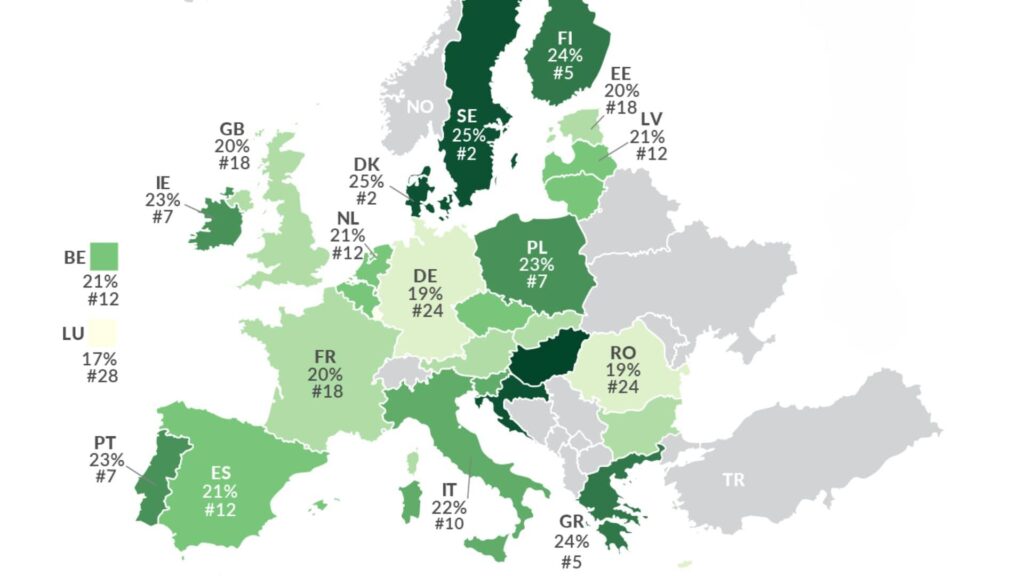

VAT Rates in UE

VAT Rates in the EU What Are the VAT Rates Across the European Union? Looking for the applicable VAT rates in the European Union for 2026? You’re in the right place. This article provides a comprehensive and up-to-date table of Value Added Tax (VAT) rates for each EU member state. The year 2026 brings notable […]

Quick Fixes 2020

Quick fixes guide Quick Fixes 2020: Conditions for VAT Exemption on Intra-Community Deliveries The VAT Quick Fixes redefine the rules of the game and harmonize the conditions for exemption from VAT on intra-community deliveries (ICD) carried out by companies within the European Union. The Quick Fixes 2020 were designed to simplify cross-border transactions and strengthen […]

VAT in France : the complete guide to French VAT

French VAT Guide VAT in France: everything you need to know about French VAT VAT or value added tax is an indirect consumption tax on goods and services. The tax was created by a senior French civil servant and tax expert, Maurice Lauré, in 1954. The French VAT quickly gained a following in many countries […]

German VAT: All you need to know about the Umsatzsteuer for your purchases and sales in Germany

German VAT Handbook German VAT: All you need to know about the Umsatzsteuer for your purchases and sales in Germany The German VAT, called Umsatzsteuer or Mehrwertsteur, was created in January 1968 with a standard rate of 10% and a reduced VAT rate of 5%. It replaced the turnover tax created in 1920. Since 1968, […]

Tax representatives in Switzerland

VAT Guide Tax representation in Switzerland This comprehensive guide to fiscal representation in Switzerland explains everything you need to know about your tax obligations in Switzerland. Find out about VAT regulations in Switzerland, how to open a customs account or what your delivery options are in Switzerland. Table of Contents All about tax representation in […]

How to invoice for export in E-commerce

E-commerce news How to invoice for export in E-commerce In the development of an e-commerce site, export sales represent an important growth vector. Like all sales, an invoice is issued to the end customer. To comply with the rules of VAT and customs export we have prepared this article that explains how to establish the […]

Payability of VAT on deposits in France in 2023

Regulatory news VAT on payments on account: VAT on deposits on account becomes payable in 2023 Since January 1, 2023, VAT becomes payable on the collection of down payments in proportion to the amount collected. Promulgated by the law n° 2021-1900 of December 30, 2021 of finance for 2022, for any collection of installments on […]