VAT forms and tax return Norway

Submitting a tax return Norway is essential for all VAT-registered businesses. Knowing the correct VAT forms, due dates, and regulations is essential to maintaining compliance, regardless of whether you are a domestic business or an international organisation doing business in Norway. Everything you need to know to confidently handle Norwegian tax regulations is covered in this guide, from routine VAT returns to refunds and penalties.

- Published on :

- Reading time : 17 min

- Article updated on : 07/04/2025

Tax return Norway and more Norwegian VAT forms

Overview of Value Added Tax (VAT) in Norway

If you’re a business navigating for example the tax return in Norway, understanding the correct VAT forms is crucial. In Norway, VAT (merverdiavgift or MVA) applies to the majority of imported or sold goods and services. Businesses operating in Norway are required to register for VAT once they exceed the NOK 50,000 turnover threshold and must then submit regular VAT declaration.

These reports help the Norwegian Tax Administration (Skatteetaten) track the amount of VAT is deducted and collected. Submitting the correct forms on time is a key part of complying with tax return requirements in Norway.

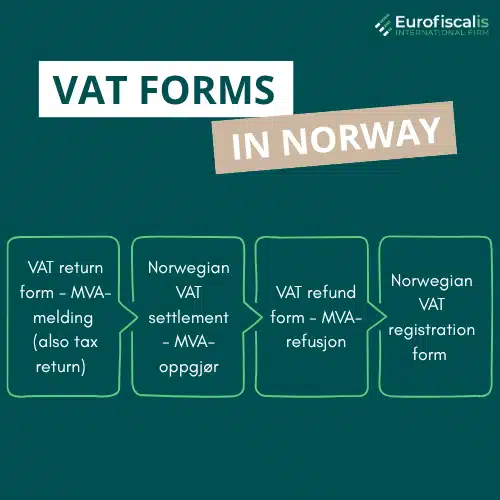

All VAT forms in Norway

Norwegian VAT return form - MVA-melding (MVA-opgave)

The MVA-melding is the standard VAT return form used by majority of companies registered in the VAT Register. It provides a summary of the VAT collected on sales and the deductible VAT paid on purchases within a given period.

When am I required to file a VAT return in Norway?

All businesses registered for VAT in Norway.

A VAT declaration can be completed and submitted if you have one of these roles:

- Limited signing rights

- Contact person NUF

- Accountant with signing rights

A VAT return can be filled but not submitted if you have one of these roles:

- Responsible auditor

- Accounting employee

- Accountant without signing rights

- Assistant auditor

VAT return for reverse tax liability (RF-0005)

Public businesses and independent contractors not listed in the VAT Register are required to file a VAT return if, within a given time frame:

- purchased services subject to VAT from abroad, Svalbard or Jan Mayen for more than NOK 2,000 (without VAT).

- made domestic purchases of emission allowances for more than NOK 2,000 (without VAT).

- made domestic purchases of gold for more than NOK 2,000 (without VAT).

Check our article on VAT registration number:

When should I file my VAT declaration in Norway?

Most enterprises must submit the VAT return every other month.

Small enterprises may apply to only submit the VAT return once a year.

What must be included?

Totals for sales, imports, purchases, and the resulting VAT payable or refundable.

How to submit VAT return form?

Electronically via Altinn, using form RF-0002 (or RF-0004 / RF-0005 for special cases).

Who can subcontract Norwegian VAT declarations to?

- accountants or accounting firms

- VAT representatives

- tax advisors or tax consultants

- internal staff or third-party employees

You can book a free consultation with our VAT experts in time that is suitable for you!

Can I retroactively regularize my VAT returns in Norway?

You can make changes within 3 years after the original deadline:

- Identify the mistake

- Log into the Altinn portal

- Submit corrected Norwegian VAT return

- Pay any additional VAT or request a refund if it is overpaid

If you have mistakes beyond 3 years or very complex cases – reach out to the Tax Administration – Skatteetaten

What is the VAT return filing deadline in 2025?

Period | Months Covered | Deadline |

1st Period | January – February | 10 April 2025 |

2nd Period | March – April | 10 June 2025 |

3rd Period | May – June | 31 August 2025 |

4th Period | July – August | 10 October 2025 |

5th Period | September – October | 10 December 2025 |

6th Period | November – December | 10 February 2026 |

The return must be submitted and outstanding VAT must be paid within one month and ten days after the end of each period.

The tax return for VAT must be submitted even if there were no sales during the period concerned.

Tax return Norway

Who can claim VAT compensation -(tax return for VAT compensation)?

- Municipalities

- County councils

- Intermunicipal companies

- Child day care centres

- Joint church and parish councils

- Private or non-profit enterprises that provide statutory health, education and social services for municipalities or county councils

Tax return deadlines in Norway in 2025

Tax return online applications – are granted automatically.

When is the deadline for tax return in Norway?

Deadline for businesses: 31 May

This deadline applies to:

- sole proprietorships and companies

- share owners in businesses assessed as a partnership

- foreign businesses with a permanent place of business in Norway (branch)

If you want to have extended deadline you may be granted an extended deadline:

- income recipients and pensioners

- self-employed persons and businesses

- share owners in businesses assessed as a partnership

- foreign businesses with a permanent place of business in Norway (branch)

You can apply for one month’s extension. They do not grant longer extensions.

You can be subject to additional tax or an enforcement fee if you are a business or self-employed person and fail to file your tax return or request an extension by the due date.

What happens if you miss my Norwegian tax return deadline?

Wage earners’ pre-filled returns are automatically submitted with no penalties if they are accurate, even if you miss the Norwegian tax return deadline (April 30 for individuals and May 31 for enterprises). Missed deductions or additional taxes may result from mistakes or late adjustments. Businesses or self-employed people who are late without requesting an extension risk fines, anticipated tax obligations, or interest.

Can you change tax return in Norway for previous years?

Yes, you are able to make modifications to your company’s tax return for the previous three fiscal years. You can accomplish this by using your accounting system or yearly accounts application to file a fresh, comprehensive tax return for the applicable income year. The submission format that was first utilised for the relevant year must be followed.

You can book a free consultation with our VAT experts in time that is suitable for you!

Norwegian VAT settlement - MVA-oppgjør

The MVA-oppgjør is less a separate form and more a settlement statement generated after your VAT return (known as the MVA-melding) is processed. It shows the final payable or refundable VAT amount.

Why does it matter?

The MVA-oppgjør is crucial because it confirms how much VAT you owe (or are due to be refunded).

Who is required to submit the Norwegian VAT settlement form?

No one is required to submit the MVA-oppgjør because it’s not a submission form – it’s issued automatically by the Tax Administration. However, the process starts with submitting the MVA-melding. Once the MVA-melding is filed, the MVA-oppgjør follows as part of the settlement process.

How should I use it?

- If you owe VAT: Use the amount, payment deadline, and bank details from the MVA-oppgjør to transfer the funds (typically via bank payment with the KID number).

- If you’re due a refund: Confirm the amount and ensure your bank details are updated with the Tax Administration to receive the refund promptly.

- Record-keeping: Keep the MVA-oppgjør for your records, as it’s an official tax document.

How should I submit it?

Since the MVA-oppgjør is not a form you fill out (it’s generated by the authorities), there’s no filling process for it. However, to ensure the MVA-oppgjør reflects accurate information, you need to correctly complete the MVA-melding (VAT declaration) beforehand.

VAT refund form in Norway - MVA-refusjon

Foreign businesses not established in Norway but incurring Norwegian VAT (e.g., on travel or service purchases) can apply for a refund using the RF-1032 form.

Who is required to submit Norwegian VAT refund?

Non-Norwegian companies which are not registered in Norway, but are entitled to refunds of VAT provided

- the VAT relates to the applicant’s business activities carried out abroad,

- the business would have been liable to registration in accordance with the Norwegian Act relating to Value Added Tax if it had been carried out in Norway,

- the VAT would in that case have been deductible.

When should I submit Norwegian VAT refund form?

Annually, for 2025 expenses by September 30 for the previous calendar year.

The application must cover a minimum of three months and a maximum of one calendar year. If it is the rest of a calendar year, the duration may be shorter than three months.

Where should I file VAT refund form in Norway?

Via Skatteetaten, typically in paper form or through specific online platforms depending on country of origin.

What should I attach to Norwegian VAT refund form?

You must attach:

- original invoices and import documents

- a clear description of the business activities carried out abroad

- a certificate from a public authority confirming that the applicant is engaged in such business

- a certified export document if goods to which the application relates have been exported from the country

- an original authorization

You can book a free consultation with our VAT experts in time that is suitable for you!

Norwegian VAT registration form

Who must register for Norwegian VAT?

Norwegian and foreign businesses exceeding the VAT threshold. When you reach the monetary limit:

- NOK 50,000 (not including VAT) for enterprises and most organisations.

- NOK 140,000 (not including VAT) for charitable and non-profit organisations.

- Important note

VOEC – VAT on e-commerce

For foreign companies selling low-value goods (below 3000 NOK per item) directly to Norwegian consumers, there is a voluntary VAT system called VOEC.

Companies registered in VOEC must charge and remit Norwegian VAT from the first crown of this sales. Although VOEC simplifies purchases for consumers, it does not replace the standard VAT registration thresholds if the company’s other sales in Norway exceed these limits. Some goods, such as food, alcohol, and tobacco products, are excluded from VOEC.

In short, the standard VAT thresholds still apply. VOEC is a separate, optional system for specific low-value e-commerce sales by foreign entities.

How to register for VAT in Norway?

The VAT registration takes place via Norwegian Tax Administration’s website.

Remember that your enterprise must be registered in the Central Coordinating Register of Legal Entities.

What transactions must be declared in Norway?

Transactions that require registration for VAT purposes in Norway:

- Import of goods to Norway

- Export of goods from Norway

- Storing goods in Norway and then reselling them

- Purchase of goods, followed by their resale in Norway (local sales)

- Provision of services not exempt and not exempted from VAT in Norway

What information do I need to include in VAT registration?

- business name

- business address

- organisational number

- invoices

- annual taxable supplies – value of the business’s taxable supplies in a given year (sales of goods and services)

- amount of VAT that business is required to pay on its taxable supplies (calculated percentage of the total value of the taxable supplies)

- amount of VAT that the business is able to claim back on its purchases (VAT paid on goods and services)

- possibly supporting documents

Invoices must state:

- Date of the sale

- Seller’s name and organisation number

- The letters ‘MVA’ (VAT) after the organisation number if you are registered in the VAT Register

- Buyer’s name and address or organisation number

- A clear description of the product or service

- Time and place of delivery of the product or service

- Price with VAT specified in NOK

- Total price

- Remuneration

- Payment deadline

Once registered, you’ll receive a Norwegian VAT number and will be required to start submitting regular VAT returns.

Penalties for VAT forms in Norway

The Norwegian Tax Administration (Skatteetaten) may impose severe penalties for VAT forms that are submitted late or not at all. To make sure your article is current, think about including the following details.

Enforcement fines

In case you do not submit:

- the shareholder register statement → Rate is half a court fee per day (maximum limit is 50 court fees and maximum amount is NOK 65,700)

- the VAT return → Rate is half a court fee per day (maximum limit is 50 court fees and maximum amount is NOK 65,700)

- the a-melding → Rate – 1/10 court fee per day per income (maximum limit is 1,000 court fees per period and maximum amount is NOK 1,314,000 per period)

- the tax return for self-employed persons and limited liability companies → Rate is half a court fee per day (maximum limit is 50 court fees and maximum amount is NOK 65,700)

- the excise tax return → Rate is half a court fee per day (maximum limit is 50 court fees and maximum amount is NOK 65,700)

- third party information (basic data) → Rate is half a court fee per day (maximum limit is 50 court fees and maximum amount is NOK 65,700)

Bookkeeping order – Rate is one court fee per day (maximum amount is NOK 1,000,000)

The late filing penalty week by week:

- the late filing penalty increases with NOK 1 314 per week the first 8 weeks

- the late filing penalty increases with NOK 2 628 per week the next 10 weeks

- the late filing penalty increases with NOK 3 942 per week the last 8 weeks

A started week is considered a whole week.

The late filing penalty will increase for a maximum of 26 weeks.

The late filing penalty is based upon the court fee, which is NOK 1 314 for the time being.

- Daily penalties – daily enforcement fines may be imposed for noncompliance with mandatory reports, including VAT returns. These penalties keep coming up until the required data is submitted.

- Fine amount – the daily fine amount is contingent upon the particular report and the length of the delay.

- Appeals – the fine must be paid during the appeal process even though you have the option to challenge the enforcement fine decision.

Interest on overdue payments

Late payment interest – interest is computed on VAT payments that are past due. The total amount owed rises as a result of this daily interest accrual.

Non-compliance penalties

The rates are based on the court fee for 2025.

- Failing to disclose information to a third party: 10 court costs (NOK 13,140)

- Failure to prepare staff lists: 10 court fees (NOK 13,140)

- If you fail to cooperate in connection with an audit, the non-compliance penalty may be set to up to NOK 65,700.

- The penalty will be doubled if there are multiple violations within a 12-month period.

Additional penalties – the Tax Administration may apply non-compliance penalties for failures such refusing to cooperate during audits or provide necessary information, in addition to enforcement fines.

Norwegian additional tax

If you don’t include accurate and comprehensive information on your tax return, you can have to pay more tax.

How much more tax will I be required to pay? – The additional tax rate is 20 per cent of the tax advantage.

The Norwegian tax administration has the authority to levy an extra tax on top of the standard rate in extreme circumstances. Since the additional tax is charged at a rate of 20%, in extreme circumstances, the total amount of additional tax that must be paid is 40%. The Norwegian tax administration has the authority to levy an extra 40% tax on top of the standard rate in extremely severe circumstances. As a result, 60% may be the maximum overall rate of the additional tax.

Sources: Skatteetaten

You can book a free consultation with our VAT experts in time that is suitable for you!

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.