Tax return for foreign workers in Norway

As a foreign worker in Norway, it is crucial to have a clear understanding of the country’s tax system to ensure compliance and avoid potential pitfalls. This article will provide you with a comprehensive guide to tax residency, income taxation, filing tax returns, and other essential aspects of the Norwegian tax system.

- Published on :

- Reading time : 17 min

- Updated on : 30/06/2025

Norwegian tax residency and obligations

Tax residency plays a vital role in determining your tax obligations in Norway. A tax resident is someone who has lived in the country for at least 183 days within a 12-month period or 270 days within a 36-month period. Tax residents are subject to taxation on their worldwide income, whereas non-residents are only taxed on income earned within Norway. To determine your tax residency status, consult the criteria mentioned below and seek guidance from the Norwegian Tax Administration if needed.

Who is a tax resident in Norway?

Your status as a Norwegian tax resident is primarily determined by the duration of your stay in the country. You become a Norwegian tax resident if you:

- Spend more than 183 days within any 12-month period

- Spend more than 270 days within any 36-month period

If you are classified as a Norwegian tax resident, you are subject to taxation on your worldwide income, regardless of where it was earned.

If you are a non-resident for tax purposes, you are typically only taxed on income derived directly from Norwegian sources.

Do foreigners ay taxes in Norway?

Yes, , foreigners do pay taxes in Norway. Any person that earns (does not matter if you are a short-term contractor, a long-term employee, or a self-employed professional) in Norway is subject to its tax laws.

Norwegian tax system - rates and schemes for foreign workers

Norway operates a progressive tax system, meaning higher earners pay a larger percentage of their income in taxes. However, the system also offers a simplified scheme for certain foreign workers, affecting the tax rate for foreign workers in Norway.

When combined, these elements result in a progressive overall tax burden. The total effective tax rate, as it was written above is typically from around 22% for lover incomes and up till 38,2% for higher ones.

The progressive tax system

For most foreign workers who establish tax residency or work for a substantial period, the general progressive tax system applies.

- Ordinary income tax

The ordinary income tax rate is approximately 22%. This rate applies to your ordinary income after standard deductions.

- Bracket tax (Trinnskatt)

This is a progressive tax levied on gross income above certain thresholds. The rates increase with higher income brackets.

- National insurance contributions (Folketrygdavgift)

These contributions, which normally amount to 7.9% of your gross salary (for earned income), support Norway’s extensive social security system, which provides healthcare, unemployment insurance, and pensions.

You can book a free consultation with our VAT experts in time that is suitable for you!

Simplified tax scheme (PAYE - Pay As You Earn)

This scheme is for certain foreign workers, specially for those on short term assignments and not considered as tax residents in Norway. This scheme is known as the Pay As You Earn – PAYE (kildeskatt på lønn)

- Target audience – foreign workers, not tax residents in Norway, stay for a limited period.

- Fixed tax rate – A flat tax rate of 25% is subtracted straight from your gross pay under PAYE. The National Insurance Contributions are included at this rate. The rate is lowered to 17.3% (or 17.2% for individuals employed on the Norwegian continental shelf) if you are exempt from paying Norwegian National Insurance Contributions (for example, because you hold an A1 certificate from your native country).

- Important – The PAYE scheme is straightforward. The tax deducted is considered a final settlement, meaning:

- No tax return is required to be filed in Norway for this income.

- Crucially, no deductions can be claimed against income taxed

- The scheme has an annual income limit (for example NOK 697,150 for the 2025 income year). You have the option to leave the PAYE scheme and move to the general progressive tax system, which would then permit deductions, if your income surpasses this or if you so desire.

Tax return for foreign workers in Norway - navigating

For foreign workers under the general tax system, filing an annual tax return is a mandatory step to ensure your tax liability is correctly assessed and to potentially claim a tax refund for foreign workers in Norway.

Check out our article on VAT forms and tax return in Norway:

The tax deduction card (Skattekort)

Obtaining a tax deduction card is the first practical step in your tax journey in Norway. It contains your estimated annual income and the corresponding tax percentage your employer should withhold. This card must be accurate. If your income or deductions change significantly during the year, you should apply for a revised tax deduction card to prevent under- or over-payment of tax.

The annual tax return (Skattekort / Skattemelding)

For most individuals under the general tax system, filing an annual tax return, officially called a “Skattemelding,” is mandatory.

- Who needs to submit? – If you are a tax resident in Norway, or a non-resident earning income not covered by the PAYE scheme, you will need to file a tax return.

- Deadline – The standard deadline for submitting your tax return is April 30th of the year following the income year.

- Process – Your tax return will normally be pre-filled by the Norwegian Tax Administration (Skatteetaten) using data they have obtained from banks, employers, and other organisations. This pre-filled form will be made available to you online via their portal (the website of Altinn or Skatteetaten). It is imperative that you carefully go over this pre-filled information. Verify the information, including any income that isn’t on the list, and—most importantly—include any deductions to which you may be entitled. If the pre-filled form is not checked and modified, it may lead to inaccurate tax assessments or lost refund chances.

- Required documents – passport or national ID, your employment contract, all annual statements from your employer (Årsoppgave), any other income sources or financial institutions.

Payslips throughout the year can also be helpful for cross-referencing.

You can book a free consultation with our VAT experts in time that is suitable for you!

Claiming your tax refund in Norway

One of the most common questions from foreign workers is – How to claim tax refund in Norway for foreigners? The process largely depends on which tax scheme you are under.

How tax refunds work under the general tax system in Norway?

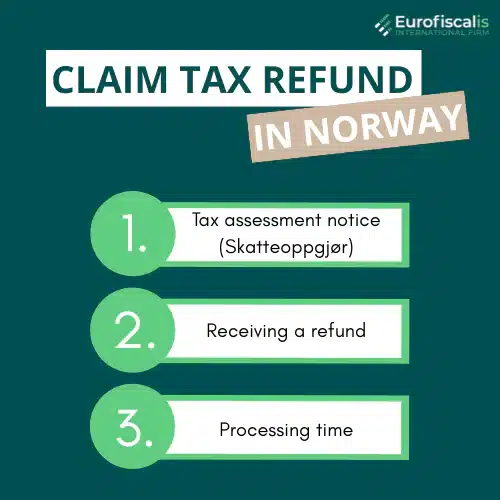

1. Tax assessment notice (Skatteoppgjør) – You will receive a final tax assessment notification once your tax return has been processed by the Norwegian Tax Administration, which may take some time after the deadline, usually between June and October. Your total income, deductions, assessed tax, and—most importantly—whether you paid too much tax (which would result in a refund) or too little tax (which would result in an additional payment) are all clearly stated in this document.

2. Receiving a refund: The Norwegian Tax Administration will automatically transfer the extra cash to the bank account that is registered with them if the notice indicates an overpayment. To prevent delays, make sure your bank information is current in their system.

3. Processing time: While the tax return deadline is April 30th, the processing of returns and the issuance of tax assessment notices can vary. Refunds typically appear in your account within 1 to 3 months after your tax assessment notice is issued.

Tax return for foreign workers in Norway under the PAYE scheme

As previously highlighted, the PAYE scheme is designed for simplicity, with tax settled at source. This generally means:

- No tax return, no refund process – Since no tax return is typically filed under the PAYE scheme, there is no explicit process for claiming a refund for taxes paid under this scheme in the same way as the general system. The 25% (or 17.3%/17.2%) deducted is considered the final tax.

- Exceptional cases for refunds: There are very limited circumstances where a refund might occur under the PAYE scheme:

- If your employer mistakenly deducted more than the stipulated 25% PAYE tax.

- The excess contribution may be reimbursed if you paid National Insurance Contributions at first but later obtained an A1 certificate verifying your exemption from social security contributions in Norway.

- Pathway to refund eligibility (Switching schemes): If you wish to claim deductions that would reduce your tax liability and potentially result in a refund, you must opt out of the PAYE scheme and switch to the general progressive tax system. In the event that your withheld tax exceeds your actual tax burden, you may be eligible for a refund after filing a complete tax return and claiming all allowable deductions. There is a deadline for making this decision.

You can book a free consultation with our VAT experts in time that is suitable for you!

Maximizing your Norwegian refund through deductions

The question of How much tax refund will I get in Norway? doesn’t have a fixed answer, as it depends entirely on your individual circumstances, income, and most importantly, the eligible deductions you can claim.

Standard deduction (Limited applicability)

This deduction primarily remains applicable to specific groups, such as foreign workers on the Norwegian continental shelf and foreign sailors who are not considered tax residents.

Commuter status (Pendler)

If you maintain a permanent home in another country or another part of Norway while working in Norway, you might qualify as a “pendler” (commuter). This status allows you to deduct significant expenses related to your temporary stay in Norway, including:

- Accommodation costs – Rent for a separate dwelling near your workplace.

- Food expenses – A fixed daily allowance for food

- Travel expenses – Costs for travel between your permanent home and your workplace in Norway.

Interest on debt and mortgages

You can generally deduct interest paid on loans, including mortgages, in Norway. For foreign residents with mortgages abroad, deduction of interest on debt can be claimed if more than 90% of your global income is from Norway (for EU/EEA residents) or if otherwise agreed by tax treaty.

Seaman's deduction (Sjømannsfradrag)

This is a specific deduction for seafarers who spend a minimum of 130 days at sea. It allows a deduction of 30% of their income earned onboard, up to a maximum amount.

Important considerations for foreign workers in Norway

Tax treaties and avoiding double taxation

In Norway there is a numerous if double taxation treaties with other countries. These are to prevent you from being taxed on the same income in both countries, for example Norway and your home country. You must understand the provision of the tax treaty between Norway and your country. It is your responsibility to inform the Norwegian TAX Administration if a tax treaty applies to your situation.

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.