VAT registration in Poland - Comprehensive guide

VAT registration in Poland is essential for foreign companies trading in the country. Whether you’re storing goods, selling locally, or engaging in cross-border transactions, understanding Polish VAT rules is crucial. In this guide, we explain the VAT registration process, obligations, and how Eurofiscalis can assist you in ensuring full compliance.

- Published on :

- Reading time : 12 min

VAT registration in Poland - why is it important?

If your business sells goods or services in Poland, you may be required to register for VAT. Whether you store goods, sell locally, or conduct intra-EU transactions, VAT registration in Poland ensures legal compliance and allows you to reclaim input VAT.

Expanding into new markets for your goods or services is a true art – it requires not only an excellent understanding of the local business specifics but also tax regulations and the ability to adapt to them. Often, even something as mundane as the local language can cause significant problems for those who are otherwise adept at navigating taxes.

Poland – a strategic location for European businesses

VAT registration in Poland - Why choose Poland for business expansion?

Poland’s central location and growing economy make it a prime choice for foreign businesses. However, to legally trade in Poland, foreign companies must comply with VAT registration requirements. Thanks to this, a foreign company gains almost the same rights as local Polish companies.

A VAT number in Poland opens up a wide range of benefits, such as simplifying customs procedures and the ability to store goods in Poland.

⇒ One of the most important advantages is the reputational aspect – a foreign company with a VAT number in Poland, by maintaining compliance with regulations, gains the perception of being a serious and reliable player in the eyes of local contractors.

Without a doubt, VAT registration in Poland for companies that want to develop their business in this country is a strong foundation for building a market position.

You can book a free consultation with our VAT experts in time that is suitable for you!

Basics of VAT in Poland

The role of VAT in Poland and the EU

VAT in Poland, like in the entire European Union, is an integral part of the tax system. Without it, there is no business, and it has a significant impact on most cross-border transactions. We wrote more about what VAT is in Poland, what VAT rates in Poland are, and what transactions are subject to taxation in Poland in this article.

Polish VAT legislation

VAT in Poland, also known as the goods and services tax, was regulated by the Act of March 11, 2004, commonly referred to as the “VAT Act of Poland” (Journal of Laws of 2023, item 1570).

- It defines what constitutes the subject of taxation in Poland, who is subject to VAT in Poland, and what the tax base is in Poland.

- It also indicates the current VAT rates in Poland and the methods of settling VAT. It talks about VAT exemptions in Poland and who can benefit from them.

One of the more important aspects for foreign entrepreneurs is the fact that it thoroughly discusses all the elements that must be included on a Polish VAT invoice.

VAT rates in Poland

Navigating Polish VAT rates

One of the questions that entrepreneurs interested in business development in Poland most frequently ask us every day is what VAT rates are in Poland. They are particularly interested in whether their products are subject to reduced VAT rates in Poland.

Unfortunately, this is never an easy and straightforward matter, because reduced VAT rates are assigned to products in the context of their customs codes. Therefore, there is no simple answer to this, because in order to provide a correct response on this matter, it simply needs to be thoroughly checked. Of course, we are taking on this task and checking everything for them, fully aware that this VAT rate can really make a difference in their business.

Standard and reduced VAT rates in Poland

In Poland, we currently have three VAT rates:

- The standard VAT rate in Poland is 23%, which applies to most products not listed in the annexes to the act, where reduced VAT rates are mentioned.

- The first reduced VAT rate is 8%, which covers many food products, goods used in agriculture, horticulture, forestry, as well as those related to healthcare. This rate also applies to many services, such as transportation, construction, and recreational services.

- The last, second reduced rate is 5%, which also applies to many food, agricultural, and horticultural products.

This is why there is no straightforward answer to which VAT rate applies to your product. Because different groups of products are subject to both the basic VAT rate of 23% and both reduced rates. Then customs codes come into play, which help us determine the correct VAT rate.

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT registration in Poland for foreign companies

Understanding Polish VAT registration

Foreign companies expanding into the Polish market need to understand VAT registration in Poland, its requirements, and compliance obligations. Once you obtain a VAT number in Poland, you are required to submit periodic VAT declarations, which in Poland function as the Standard Audit File for Tax (SAF-T). However, this is not the end of your obligations; we will cover that later in the article. So how do you register for VAT in Poland?

- In the case of cross-border activities, VAT and EU VAT numbers in Poland are assigned simultaneously. However, this must be indicated in the appropriate place on the registration form.

How to register for VAT in Poland?

1. Prepare documents – company registration, VAT application (VAT-R), proof of activity.

2. Submit application – via post or in person (foreign businesses cannot apply online).

3. Wait for approval – 5-30 days waiting for the VAT number

4. Receive VAT number & start compliance – submit VAT returns via JPK_V7M.

New JPK_KR reporting requirements from 2025

Phased implementation of JPK_KR reporting:

- January 2025 – Large companies with annual sales exceeding €50 million are required to comply.

- January 2026 – Other businesses subject to corporate income tax, as well as personal income taxpayers maintaining accounting records, will be included.

- January 2027 – All remaining corporate and personal income taxpayers will be obligated to adhere to the reporting requirements.

A cornerstone of the Polish and EU tax systems

The JPK_KR structure mandates the submission of detailed accounting records, including:

- Identification data of the taxpayer’s contractors, primarily their tax identification numbers.

- Invoice identification numbers from the National e-Invoice System (KSeF), applicable to invoices serving as accounting evidence.

- Tags identifying account accounts, as specified in seven annexes to the regulation, covering various entities such as banks, insurance companies, and other units.

- Data confirming the acquisition, production, or removal from the register of fixed assets or intangible assets, including relevant invoice details and contractor tax identification numbers.

- Details on the differences between balance sheet results and tax results, categorized into permanent and temporary differences, with specific classifications such as tax expenses not recorded in the balance sheet and non-taxable income.

- Information on taxable income for taxpayers subject to lump-sum taxation on company income.

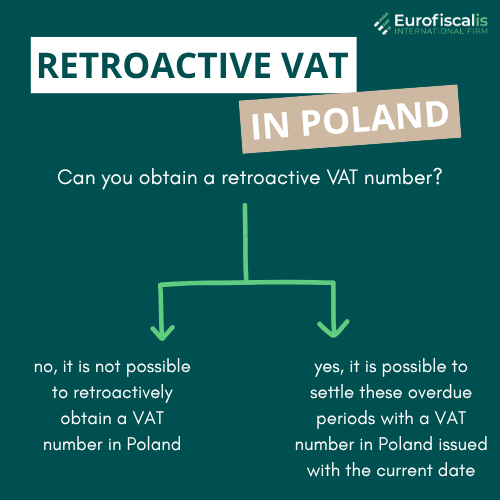

Can you register for VAT in Poland retroactively?

Can you obtain a retroactive VAT number in Poland?

Many foreign clients we assist have approached us with the question of whether retroactive registration is possible in Poland. The reason for this question is most often the oversight of the tax moment and the unfamiliarity with Polish tax regulations.

The answer is again ambiguous because registration with a retroactive date in Poland is impossible. However, it is possible to apply for a VAT number in Poland with the current date and indicate in the application the need to settle past periods.

A key distinction between Poland and other European countries (such as the Czech Republic, France, or Belgium) is that, despite a past tax obligation, the VAT number can only be issued with a current or future date on the VAT certificate.

At Eurofiscalis, we successfully handle a large number of such cases. In some cases, as a result of settling previous periods, we conducted tax audits on behalf of our clients, and all of them ended successfully for them.

The answer to the question in this section is twofold:

→ no, it is not possible to retroactively obtain a VAT number in Poland

→ yes, it is possible to settle these overdue periods with a VAT number in Poland issued with the current date.

Who needs to register for VAT in Poland?

When is VAT registration mandatory in Poland?

Settling VAT in Poland, as well as identifying with a Polish VAT number, are obligations for those companies that want to conduct taxable transactions in this country.

VAT registration in Poland is mandatory for companies engaging in taxable activities. This includes:

- Import and export of goods in Poland

- Local sales in Poland

- Storing goods in Poland

- Intra-Community supply of goods from Poland to another EU country

- Intra-Community acquisitions of goods from other EU countries to Poland

- Exceeding INTRASTAT limits

- Mail order sales to Poland – if you do not use OSS, registration is mandatory after exceeding the limit of €10,000.

Read our article on:

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT registration in Poland – Key information for non-residents

Polish VAT rules for foreign businesses

As we know, ignorance of the law is harmful. And if you have a company that is not based in Poland but would like to start a business in this country, it is important that you have at least a basic understanding of VAT rules in Poland, VAT payments, and filing declarations.

1. Remember that if you heard something about VAT exemptions up to 200,000 PLN, and you want to carry out transactions specified in the previous paragraph, you must register for VAT in Poland – regardless of the amount of your turnover. The exemption in this case does not apply to you – as a non-resident – in any way.

2. In Poland, there is a reverse charge system for several services and goods. It is worth checking whether your business qualifies for the possibility of applying reverse charge in Poland. Then the buyer of the service or goods will be obliged to settle the tax.

3. Local companies can register for a VAT number electronically. However, unfortunately, this option is not currently available for non-residents, meaning companies based outside of Poland. The application for a VAT number for non-residents in Poland must be submitted in paper form.

4. If your company is based outside the European Union, you are required to cooperate with a tax representative who will be jointly responsible for your obligations in Poland before the tax office. It is worth remembering that a tax representative must have an impeccable reputation and meet certain conditions to be able to perform such a role.

5. Regardless of whether you have a registered office in the European Union or outside of it, you can recover VAT in Poland resulting from specific local purchases or imports into Poland that were directly related to your business activities.

6. In Poland, VAT declarations (JPK VAT) must be submitted electronically. JPK VAT is the equivalent of the EU SAF-T, which is being implemented in an increasing number of European countries.

7. Payment of VAT is only possible to an individually assigned micro-account in Poland.

8. When planning a business in Poland, one should take into account the planned introduction of KSeF – the National e-Invoicing System. It is worth taking a closer look at the requirements regarding invoices that the government will impose on all taxpayers conducting taxable transactions.

9. In Poland, the so-called Split Payment mechanism (MPP) is in effect. It involves the payment for goods or services being divided into net and VAT through a special transfer message. The obligation arises when the invoice amounts to more than 15,000 zlotys and contains at least one item listed in Annex 15 to VAT agreement.

Implications for VAT reporting in Poland

In addition to VAT compliance, foreign businesses operating in Poland should be aware of Poland’s shift toward digital tax reporting. From 2025, companies subject to Polish corporate income tax will be required to submit JPK_KR, a digital tax file covering their accounting records.

While this may not impact every foreign company, those with a permanent establishment or fixed operations in Poland should ensure they are prepared for this reporting obligation. Poland is continuously moving towards digital tax compliance. The JPK_V7M/K file has already replaced traditional VAT returns.

Businesses operating in Poland should prepare for these changes by updating their accounting systems and processes to ensure compliance with the new reporting requirements. Engaging with tax professionals or consulting services like Eurofiscalis can provide valuable assistance in navigating these regulatory updates effectively.

Source: VAT registration in Poland

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.