Invoicing in Luxembourg 2025 - Complete guide

Mastering invoicing in Luxembourg is not merely an administrative task but also a cornerstone of legal and financial probity. From understanding the fundamental mandatory elements of a paper invoice to embracing the nationwide shift towards electronic invoicing for public sector transactions via platforms like Peppol, businesses must remain diligent.

- Published on :

- Reading time : 10 min

Understanding the invoicing in Luxembourg

What constitutes a legal invoice in Luxembourg?

An invoice in Luxembourg is a simple, payment request. It is a formal document that legally confirm a transaction between a buyer and a supplier. Its role is to evidence the sale of goods or the provision of services including all of the specifics of the exchange.

For all VAT registered businesses it is crucial to correctly format invoice for the supplier to account VAT collected and for the buyer to reclaim deductible VAT. Beyond tax implications, a legal invoice serves as vital proof in accounting records, supports financial audits, and can be a key piece of evidence in the event of commercial disputes. Adherence to Luxembourg’s Commercial Code and VAT law concerning invoicing is therefore not optional, but it is a fundamental condition of fully compliant business conduct.

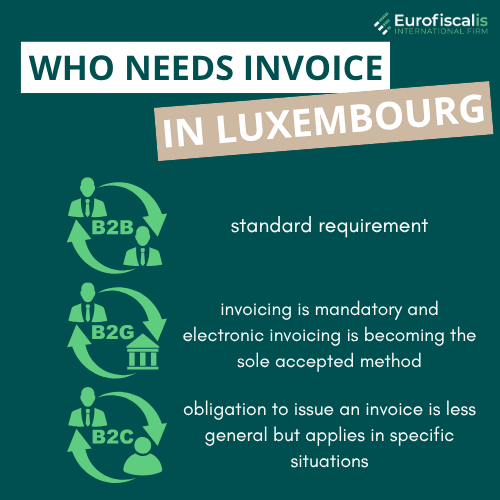

Who needs to issue invoices in Luxembourg?

The obligation to issue an invoice in Luxembourg primarily rests with taxable persons (typically VAT registered businesses) for supplies of goods or services rendered to another taxable person or to a non-taxable legal entity.

Understanding distinctions is a must to ensure compliance across all of the different transaction types:

- For B2B (business to business) transactions – standard requirement

- For B2G (business to government) transactions – invoicing is mandatory and electronic invoicing is becoming the sole accepted method

- For B2C (business to consumer) scenarios – the obligation to issue an invoice is less general but applies in specific situations, such as:

- distance sales

- when requested by the customer

- for certain types of goods or services (for example construction work related to immovable property, new means of transport)

Invoicing in Luxembourg - deadline

The deadline for issuing invoices is typically by the 15th day of the month following the one in which the chargeable event occurred. Ensuring that the VAT is accounted for the correct reporting period of time.

VAT registration in France

To be considered legally compliant, an invoice must be issued and contain very specific details, including:

General requirements of the invoice in Luxembourg

- A unique and sequential invoice number

- The date of issue

- The date of supply of goods or services (whether it is different from the date of issue), needed to determine the correct tax period

- Supplier’s information (full legal name, business address, Luxembourg VAT identification number)

- Buyer’s information (for B2B intra-community supplies, the customer’s valid VAT identification number from another EU member state is essential)

- Description of the goods supplied or services rendered (including quantity and nature)

VAT specific invoice details requirements

- The taxable amount per VAT rate or exemption

- VAT rate or rates applied

- The VAT amount payable (must be specified in EUR)

- The total amount excluding VAT

- The total amount including VAT

- If VAT is not charged due to an exemption or if the reverse charge mechanism applies – you must add a clear reference, such as “Reverse Charge”

Additional invoice information requirements

- Margin schemes ⇒ if you are using a special VAT scheme for second-hand goods, works of art – the invoice must indicate this for example “Régime de la marge – Biens d’occasion”

- Travel agents scheme ⇒ if your invoice is under this scheme it requires a specific reference for example “Régime de la marge – Agences de voyages”

- Self-billing ⇒ if the buyer issues the invoice, it must state “Autofacturation” which is self-billing

- Invoices issued by a third party ⇒ if the third party issues the invoice in the name and on behalf of the supplier – this must be clear

These specific additional details are critical to applying VAT rules correctly.

Source: Invoice in Luxembourg

You can book a free consultation with our VAT experts in time that is suitable for you!

Electronic invoicing (eInvoicing) in Luxembourg – digital shift

As with the rest of Europe, including the Luxembourg is switching to mandatory digital invoicing. Luxembourg is actively promoting digitalisation, with eInvoicing becoming increasingly central, especially in public procurement.

What is eInvoicing according to Luxembourg regulations?

In the context of Luxembourg regulations and EU Directive 2014/55/EU, an electronic invoice (eInvoice) is more than just a digital image of a paper invoice, like a PDF sent via email. True eInvoicing involves the exchange of an invoice in a structured electronic data format.

This means the invoice data is organized in a way that allows for automated and electronic processing by the recipient’s accounting system. Key to compliant eInvoicing is ensuring the authenticity of origin (proof of who sent it), the integrity of content (assurance the data hasn’t been altered), and its continued legibility throughout the storage period.

The mandatory B2G eInvoicing rollout in Luxembourg

Luxembourg has been moving towards digital transformation in B2G (business to government) transactions by legally mandating e-invoicing.

Suppliers to Luxembourg’s public sector organizations (state bodies, communes, public establishments) are legally obligated to submit their invoices electronically.

This initiative is spearheaded by the Ministry for Digitalisation. The implementation has been strategically phased based on company size (Large, Medium, and finally Small/Newly created businesses), ensuring a smoother transition.

Accepted eInvoicing standards and formats in Luxembourg

Luxembourg adheres to the European Standard EN 16931. It defines the standard data model for eInvoicing. Luxembourg accepts formats such as XML UBL (Universal Business Language) and XML CII (Cross Industry Invoice).

For the transmission of these eInvoices to public sector entities, the Peppol (Pan-European Public Procurement Online) network is the designated primary channel.

How to send eInvoices to the Luxembourg public sector?

Businesses can submit mandatory electronic invoices to Luxembourg’ s public sector in several ways:

- Using the Peppol network – it is the most integrated method that requires to connect via a Peppol Access Point that has automated submissions

- Manual submission via MyGuichet.lu – the state portal offers a facility to manually create or upload compliant eInvoices, suitable for lower volumes

- API integration – it is a direct system to system integration which is using Application Programming Interface (API), an option for hight volume exchanges

Benefits of electronic invoicing for businesses in Luxembourg

There are wide benefits when it comes to B2B invoicing, such as:

- Faster processing and payment cycles

- Reduced administrative costs

- Improved accuracy and compliance with automated data

- Traceability and transparency

- Environmental benefits from reduced paper usage

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT considerations for invoicing in Luxembourg

Linking invoices to VAT returns

Invoice details are crucial for declaring output VAT (from sales invoices) and claiming deductible VAT (on purchase invoices). Accuracy is paramount.

Invoicing for Intra-Community supplies and exports

When invoicing for goods supplied to a VAT-registered business in another EU Member States (an intra-community supply), Luxembourg businesses generally apply a 0% VAT rate.

However, the invoice must clearly state this specific exemption for example “Exonération TVA, art. 43, § 1er, d) de la loi TVA”. The customer’s valid EU VAT identification number (which should be checked via VIES) must also be included.

For exports outside of the EU, a 0% VAT rate can also apply, provided the invoice reflects this and is supported by special export documents.

You can book a free consultation with our VAT experts in time that is suitable for you!

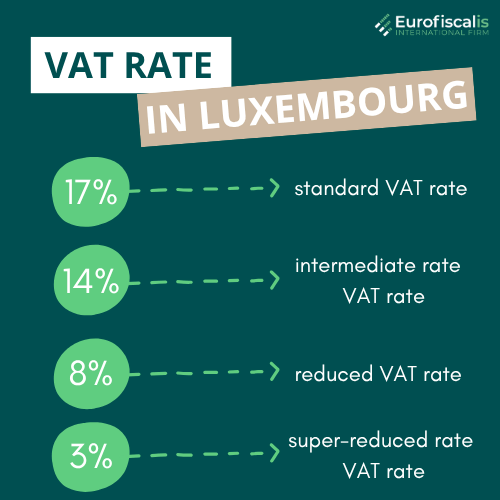

Luxembourg VAT rates

VAT rates

Luxembourg applies several VAT rates:

- a standard rate of 17%

- an intermediate rate of 14%

- a reduced rate of 8%

- a super-reduced rate of 3%

Any incorrect application can lead to penalties and tax discrepancies. Therefore, suppliers must correctly identify and apply the applicable VAT rates.

Practical aspects - language, currency, and storage

When invoicing in Luxembourg, consider these practical aspects:

Invoice language requirements in Luxembourg

Luxembourg has three official administrative languages: French, German, and Luxembourgish.

Invoices can be issued in these languages or, as in common in international business, in English.

The guiding principle is clarity for all parties, including tax authorities (Administration de l’enregistrement, des domaines et de la TVA – AED), who may request a translation if needed.

Currency rules for invoices in Luxembourg

Although invoices can be issued in any currency, the total amount of VAT payable must always be stated in Euros (EUR)

If an invoice is in a foreign currency, the VAT amount must be converted to EUR using an officially recognized exchange rate.

Invoice storage Rules in Luxembourg

Businesses must keep copies of all issued and received invoices for 10 years following the end of the calendar year to which they relate.

Avoiding non-compliance with Luxembourg invoicing rules

To stay compliant and avoid penalties, be mindful of common errors:

- Missing mandatory invoice information

- Incorrect VAT calculations

- Missing references for exemptions or reverse charge

- Falling to meet B2G electronic invoicing deadlines and format requirements

- Not storing invoices for the required 10-year period

- Late issuance of invoices

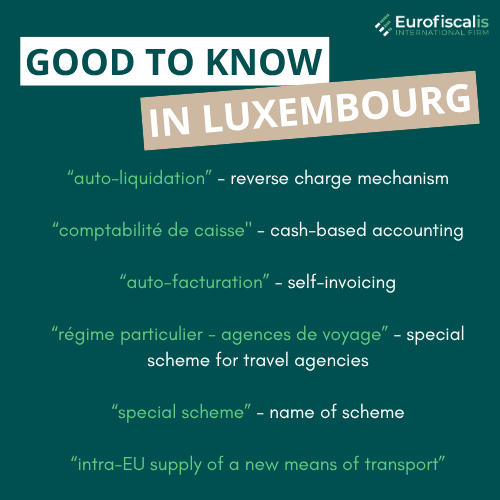

Good to know:

- “auto-liquidation” – reverse charge mechanism

- “comptabilité de caisse” – cash-based accounting

- “auto-facturation” – self-invoicing

- “régime particulier – agences de voyage” – special scheme for travel agencies

- “special scheme” – name of scheme

- “intra-EU supply of a new means of transport”

Our office provides the following services:

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.