VAT in EU: intra-Community transactions

VAT in EU intra-Community transactions – comprising the supply and acquisition of goods and services between EU Member States – hold particular significance. Proper comprehension and management of these transactions are crucial for ensuring compliance and optimizing tax obligations. In this article, we delve into the intricacies of intra-Community transactions, providing you with a comprehensive guide to effectively navigate the EU’s VAT landscape.

- Published on :

- Reading time : 10 min

Understand VAT in the EU Internal Market

VAT in EU - what is it and how does it work?

The VAT in EU is built on a shared structure created to facilitate trade while ensuring tax neutrality. The EU sets standard VAT rules, though their application varies across Member States. On the basis of the destination principle, VAT is generally paid in the country where the goods or services are used. This system helps prevent both double taxation or non-taxation in transactions across borders. As goods and services move freely across the internal market, the EU VAT system provides a harmonized method for determining when and where VAT is due. The European Union is subject to some common directives, but what distinguishes them are the VAT rates in EU.

EU VAT rates 2025

VAT in EU – definition and importance

Each member state is free to choose its own VAT rate. Nonetheless, these rates are legally regulated in Europe under the VAT law, particularly with regard to minimum thresholds.

- The standard or normal VAT rate ⇒ for the majority of products and services, a standard tariff is applied in each EU nation. Not less than 15% will do.

- The reduced VAT rate ⇒ EU nations (since April 2022) have been able to implement two reduced rates of no less than 5% for a variety of products and services, one super-reduced rate of less than 5%, and one exemption in order to uphold the equal treatment principle.

- The super reduced VAT rate ⇒ This VAT rate is only used on very few products and services.

- The parking VAT rate ⇒ Certain goods and services that are not listed in Annex III of the VAT Directive are subject to “parking” rates in some Member States. These “parking,” or interim, rates may be used in these nations as long as they don’t go below 12%.

EU VAT rates changes in 2025

The year 2025 introduces several changes to VAT rates across the European Union.

Increase in Finland’s VAT Rate in 2025

Since September 1, 2024, Finland’s tax authorities have raised the standard VAT rate from 24% to 25.5%. This measure aims to meet EU requirements on public deficits, which must remain below 3% of GDP.

Slovakia’s VAT Rate Hike in 2025

Slovakia is implementing a major change in 2025 with its standard VAT rate increasing from 20% to 23%, effective January 1. This decision follows a rise in Slovakia’s public debt and recommendations from the European Union to implement measures for fiscal stabilization.

Adjustment of Estonia’s VAT Rate in 2025

Following a 2-point increase in 2024, Estonia plans another hike in its standard VAT rate in 2025. Initially scheduled for January 1, the adjustment, which will raise the rate from 22% to 24%, is now set to take effect in July 2025.

Read more information on VAT rates in the EU in our article:

Definition and scope of intra-Community transactions in EU

What are intra-Community transactions and what is the meaning?

Intra-Community refers to exchanges or transactions taking place among EU member states.

Intra-Community transactions indicate to cross border trade of goods or services between two VAT-registered businesses located in different EU Member States.

These activities include:

- Intra-Community Supply (ICS) – a sale of goods from one Member State to another.

-

- Intra-Community Acquisition (ICA) – a purchase of goods by a VAT-registered business from another EU country.

To qualify as an intra-Community transaction, based on Directive 2006/112/EC both supplier and customer must be VAT-registered, and the goods must be transported from one Member State to another.

Transactions subject to EU VAT regulations

The VAT in EU applies to four types of transactions, which are detailed as:

- The supply of goods for consideration within the EU;

- The supply of services for consideration;

- Intra-Community acquisitions of goods;

- Goods imported from non-EU countries.

Source: Intra-Community

There are particular regulations governing the treatment of VAT in each of these transactions, particularly with regard to determining the place of taxation.

How do you declare intra-Community transactions?

Goods and services acquired or supplied inside the community in EU must be declared on the business’s VAT return. These kinds of transactions will likely be reported in separate boxes on the VAT return, depending on the country. Moreover it is a mandatory informational reporting requirement to note that it is must be reported in the European Sales Listing – or ESL. More specific information than the ESL is included in the Intrastat, a statistical return submitted to customs and statistical authorities. An Intrastat return is need documentation if there are intra-Community supplies and acquisitions of goods (exceeding the relevant for each country thresholds).

Remember to:

- Register for VAT and obtain a VIES number

- Understand your transaction types – Intra-Community Supply; Intra-Community Acquisition; B2B or B2C

- Issue correct invoices – 0% or reverse charge

- File VAT returns

- Report to the EC Sales List

- File Intrastat Declarations (if applicable)

- Maintain documentation – keep evidence

Place of taxation for Intra-Community supplies and acquisitions in EU

Establishing the location for VAT liability is essential for intra-Community transactions:

- Goods – When they are sent out or transported from one EU Member State to another, the place of supply is the country of departure. Nevertheless, the VAT is reported in the destination country by the purchaser through the reverse charge method.

- Services –In B2B dealings, the location of supply is typically where the client is based. In B2C situations, the regulations differ based on the kind of service.

Intra-Community supply of goods

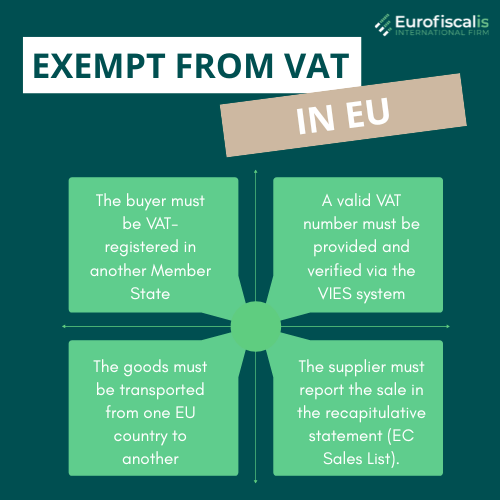

Under EU VAT rules, intra-Community supplies are typically exempt from VAT in the country of origin, provided certain conditions are met:

- The buyer must be VAT-registered in another Member State;

- A valid VAT number must be provided and verified via the VIES system;

- The goods must be transported from one EU country to another;

- The supplier must report the sale in the recapitulative statement (EC Sales List).

When does the tax liability arise for intra-Community supplies of goods?

The tax liability (also referred to as the “tax point”) for intra-Community supplies of goods arises at the moment the invoice is issued. The place of taxation is determined by where the intra-Community acquisition of goods is made (i.e. the Member State where the goods are finally located after transportation from another Member State).

An intra-Community supply invoice must be issued no later than the 15th day of the month following the actual delivery of the goods. It is easy to conclude that the delivery of the goods to the recipient triggers the tax obligation, which must be documented by issuing an invoice within the prescribed deadline.

If, for certain reasons, you fail to issue the invoice within the deadline set by the regulations, the tax obligation arises regardless of the invoice issuance date, i.e., on the 15th day of the month following the delivery of the goods.

However, what is important, issuing an intra-Community supply invoice after the deadline does not preclude the application of the 0% VAT rate, provided, of course, that the conditions of the quick fixes have been met.

What is an example of an intra-community VAT in EU?

Taxation in the Member State of identification:

Example:

Where a company acquiring goods from Poland provides its supplier with the VAT number under which it is identified in Belgium, VAT must be paid on the acquisition in Belgium.

Taxation in the Member State of arrival of the goods:

Example:

When a company using its Swedish VAT number acquires goods from Greece, and those goods are delivered to its facility in Finland, VAT must be paid on the acquisition in Finland, with any tax due in Sweden reduced accordingly.

You can book a free consultation with our VAT experts in time that is suitable for you!

Who accounts for VAT in an Intra-Community supply of goods?

The VAT for an Intra-Community Supply of Goods is accounted for by the buyer. You need to understand that once you’ve issued an invoice with a 0% VAT rate for a ICS – assuming, of course, that all the aforementioned conditions are met – your role in the transaction concludes with the delivery of the goods.

Your accounting records will reflect the sale at a 0% rate as ICS. The responsibility for settling the VAT in the tax declaration falls to the buyer of the goods. In their reporting, the VAT will be both charged (as an acquisition) and deducted (as input tax) on their return.

When these conditions are fulfilled, the supplier is allowed to apply the 0% VAT rate in the Member State of dispatch.

Intra-Community acquisition of goods

From the viewpoint of the buyer, obtaining goods from a different EU Member State initiates an intra-Community acquisition. In this case:

- The purchaser needs to declare VAT in their home countrythrough the reverse charge system;

- This VAT may be claimed as input tax if the items are utilized for taxable commercial activities;

- Accurate documentation and reporting in the VAT return and EC Sales List are necessary.

Read our article on related topic:

Discover how to declare and pay VAT for sales across EU Member States using a single online portal, simplifying compliance without multiple VAT registrations:

Intra-Community supply of services

For cross-border services within the EU, the place of taxation depends on whether the transaction is B2B or B2C:

- B2B: The place of supply is where the customer is located. The customer accounts for VAT under the reverse charge mechanism.

- B2C: The supplier usually charges VAT in their own country, although there are exceptions for services such as telecommunications and digital services.

Moreover, provisions related to use and enjoyment can affect the location of taxation based on where the service is truly consumed.

Movements of goods - non-transactional ICS and ICA

The movement of own goods occurs, when you want to ship goods to customers directly from a foreign warehouse – thereby reducing delivery time and costs (e.g., when selling through Amazon FBA). However, you must be aware that the movement of goods is treated as an Intra-Community Supply for VAT purposes and must be reported in the VAT declaration. Below are some key rules to consider when moving your own goods to a foreign warehouse.

- To move goods between for example your country’s warehouse and a foreign one, you must have an EU VAT number – both in your country and in the country where you plan to store the goods.

- The document confirming this transaction will be an internal invoice or a warehouse issue document. We recommend issuing an internal invoice, as it can be presented to auditing authorities if needed. This internal invoice should list your country’s headquarters’ address in both the “Seller” and “Buyer” fields. Additionally, in the “Seller” field, include your country’s VAT number with the necessary prefix, and in the “Buyer” field, include your foreign VAT number with the appropriate country prefix. The invoice should also include the warehouse address. Other than that, the rules are no different from a standard ICS invoice.

- If you carry out multiple non-transactional deliveries of goods, you can issue a single collective internal invoice at the end of the month, summing up the net amounts of all goods.

- Remember that even moving your own goods does not exempt you from the obligation to have proof of export and delivery of the goods.

- The internal invoice can be issued in your local currency, but there should be a conversion on it with an indication of the exchange rate in force in the country of delivery.

You can book a free consultation with our VAT experts in time that is suitable for you!

Quick fixes - what is the VAT rate for intra-Community supply of goods?

Quick Fixes is a set of measures adopted by the European Union to simplify intra-community transactions and combat VAT fraud. The provisions of Council Directive (EU) 2018/1910 of December 4, 2018, amended the VAT Directive 2006/112/EC, introducing the so-called Quick Fixes VAT package. These regulations, which came into effect on January 1, 2020, aim to standardize and simplify certain VAT rules for companies selling goods between several EU member states.

They proposed three main axes aimed at optimizing and clarifying intra-community VAT transactions.

1. The buyer must provide a valid VAT number in the country of delivery.

2. The supplier must be able to prove the export of goods from the country’s territory by retaining two transport documents, which aims to enhance transaction security and prevent fraud.

3. The supplier is obliged to diligently complete the VAT summary declaration (ex-DEB), thereby ensuring optimal traceability of operations.

It is necessary to meet these three criteria in order to issue an invoice exempt from VAT.

.

The new regulations particularly concern three areas:

- Chain transactions within the EU – The new regulations introduce the definition of an “intermediary entity” (an entity other than the first and last in the chain, which is also responsible for the transportation of goods). The new rules simplify the identification of intra-Community transactions in the case of an “intermediary entity,” however, they do not specify the criteria on which to assess whether such an entity actually exists in a given chain.

- Principles of the functioning of call-off stock warehouses within the EU – The new regulations aim to standardize the rules regarding deliveries to consignment warehouses (“call off stock”) in individual European Union countries. The “call off stock” procedure allows a taxpayer to avoid VAT registration when moving their own goods between two EU countries, provided that these goods are to be subject to subsequent delivery in the destination member state. Also shortening of the period after which the transfer of goods not picked up from the “call off stock” warehouse is subject to taxation on the same terms as the transfer of one’s own goods. Currently, this period is 12 months from the introduction to the warehouse.

- Requirements for applying the 0% rate for intra-Community supply of goods (ICS) – A strict requirement has been introduced for the buyer to provide a valid VAT identification number for the purpose of applying the 0% VAT rate in intra-Community acquisitions (previously this was purely formal) and for the supplier to submit a correct VAT-UE summary information. Additionally, Regulation 2018/1912 introduces a catalog of documents, the collection of which will result in the taxpayer being presumed to meet the condition of having evidence of the transportation of goods to the territory of another member state, which is one of the conditions for applying the 0% rate for intra-Community transactions (ICT).

Examples of documents under Intra-Community Supply

- Transport documents received from the carrier/forwarder, which unequivocally indicate the export of goods and delivery to a location in another EU member state.

- List/specification of individual cargo items.

- Electronic correspondence with the buyer containing their order.

- Documents related to insurance or freight costs.

- Proof of payment for the goods.

- Document serving as proof of receipt of the goods by the buyer in another EU member state.

Issuing an invoice does not constitute proof of export and delivery of the goods, and therefore does not justify the application of a 0% VAT rate.

VAT in EU - identification numbers and the VIES system

What is a VAT identification number in EU?

Also known as VAT registration number. This is the special number used to identify a business or non-business that is registered for VAT as a taxable person.

Who needs a VAT number in EU?

Valid VAT numbers are crucial for adopting the correct VAT handling for intra Community exchanges. Businesses can certify these numbers via the VIES (VAT Information Exchange System). If a purchaser does not supply a valid VAT number, the customer may be required to charge local VAT.

Format of VAT numbers

A block of digits or characters (up till 12) must come after the country’s code at the start of each VAT identification number.

For example:

Poland PL 1234567890 10 characters

Italy IT 12345678901 11 characters

Sweden SE 123456789012 12 characters

Every EU country issues its own national VAT number.

Businesses must specifically register for VAT in following situations:

- when it delivers goods or services subject to VAT tax;

- when it purchases goods within the EU;

- when it receives services for which it must pay VAT (per Article 196 VAT Directive);

- when it provides services for which the client must pay VAT (per Article 196 VAT Directive).

- If the VAT number is active: You can issue an invoice with a 0% VAT rate for an Intra-Community Supply of Goods.

- If the VAT number is inactive: The supplier must apply the local VAT rate on the invoice. In this case, the 0% VAT rate for intra-Community cannot be used.

Check your VAT number in our exclusive tool here:

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT obligations for EU businesses engaged in intra-community trade

Companies carrying out intra-Community transactions must meet several compliance requirements:

- Registration for VAT in the applicable Member State(s);

- Submission of regular VAT returns and summary statements (EC Sales Lists);

- Generating invoices that comply with VAT regulations, featuring the purchaser’s VAT number and a note about the reverse charge;

Maintaining proper records and transport evidence. Failure to comply can result in audits, penalties, or loss of VAT exemption.

How should an Intra-Community Supply (ICS) invoice look in EU?

You should know that an ICS invoice doesn’t differ much from the standard invoices you might issue daily in your company. An ICS invoice must include all the standard elements of a VAT invoice, along with additional information specific to intra-Community supplies of goods.

- Invoice number: It should be unique and assigned sequentially.

- Date of issue: This is crucial, especially due to tax deadlines.

- Seller and buyer details: Both parties must have an active EU VAT number, which must be included on the invoice. These numbers are an essential condition for applying the 0% VAT rate.

- Description of goods: Detailed information about the goods, such as their type, quantity, unit of measure, unit prices, and specifications, must be included on the invoice.

- Net transaction value: Since ICS applies a 0% VAT rate, the invoice should only show the net sales amount, i.e., the amount the buyer is to pay without VAT added.

- Note on ICS application: It’s mandatory to include a statement indicating that the transaction pertains to an intra-Community supply. This is a formal requirement that confirms the transaction follows intra-Community rules.

- Payment deadline: Specifying when the buyer should settle the payment is important for managing your company’s cash flow. This deadline should be clear and ideally agreed upon with the counterparty in advance.

- Additional information: The invoice may also include extra details, such as delivery terms (Incoterms), order number, transport costs, or insurance fees.

Properly issuing an ICS invoice is critical not only for compliance with tax regulations but also for avoiding issues with settlements and audits by tax authorities.

EU legal framework for Intra-Community VAT transactions

The rules governing VAT in EU are established on the EU VAT Directive (2006/112/EC) and the Implementing Regulation (EU No 282/2011). These documents set forth common regulations among the EU Member States while allowing for some local differences in application and enforcement. Businesses engaging cross-border must be mindful of both the harmonized EU legislation and national administrative procedures.

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.