VAT returns in Poland: requirements and deadlines

VAT returns in Poland are a significant part of operating businesses in Poland. Engaging in taxable transactions within its borders necessitates a clear understanding of the country’s VAT system. This comprehensive guide delves into the intricacies of VAT returns in Poland, including any requirements, deadlines and procedures for claiming VAT refunds.

- Published on :

- Reading time : 16 min

Understanding Polish VAT

Polish VAT operates similarly to other VAT systems within the European Union, adhering to common principles while incorporating specific national regulations.

What is VAT in Poland?

Value Added Tax (VAT), known as Podatek od Towarów i Usług (PTU) in Poland, is an indirect tax applied to the supply of goods and services at each stage of the production and distribution chain. Businesses collect VAT on their sales (output VAT) and pay VAT on their purchases (input VAT).

The difference between output VAT and input VAT is what is ultimately remitted to the tax authorities or refunded to the business.

Polish VAT rates

- Standard VAT rate stands at 23%

- 8% – applies to specific foodstuffs, certain medical supplies, social housing, and some services related to culture and sport.

- 5% – primarily used for basic foodstuffs, books, and specific agricultural products.

- 0% – reserved for intra-Community supplies of goods and services, and international transport, among others.

Understanding which rate applies to your specific goods or services is fundamental to accurate invoicing and VAT declarations.

Deadlines for Polish VAT returns and payments

Standard filing deadlines

Monthly returns (JPK_V7M) | Quarterly returns (JPK_V7K) |

|---|---|

Due by the 25th day of the month following the settlement period. For example, the VAT return for January is due by February 25th. | Due by the 25th day of the month following the end of the quarter. For example, the VAT return for Q1 (January-March) is due by April 25th. |

It is important to note that the payment of the VAT liability is due at the same time as the submission of the JPK_V7. If the 25th falls on a Saturday, Sunday, or public holiday, the deadline is automatically shifted to the next working day.

Other reporting obligations and deadlines in Poland

EC Listing (VAT UE) | Intrastat Declarations | Reverse Charge Listings (VAT 27) |

|---|---|---|

Reports intra-Community supplies of goods and services. | Statistical reports on the movement of goods between EU member states. | Used for certain domestic reverse charge transactions. |

Generally by the 25th day of the month following the period (monthly or quarterly, depending on thresholds and filing frequency of the VAT return).

| By the 10th day of the month following the reporting period.

| Typically aligned with the VAT return deadline. |

Who needs to file VAT returns in Poland?

It all falls upon businesses registered with the Polish tax authorities for VAT purposes.

VAT declarations as Polish resident businesses

All the businesses, regardless of its legal form, that performs taxable activities in Poland and exceeds certain turnover thresholds.

VAT declarations as non-resident VAT traders in Poland

Foreign companies that conduct taxable activities in Poland, even if they do not have a fixed establishment there, such as:

- Selling goods from a Polish warehouse

-

- Providing services where the place of supply is Poland

-

- Operating an e-commerce business selling to Polish consumers above the distance selling thresholds – which are replaced by the OSS scheme

It is important for any non-resident businesses be careful, because they might need to register for VAT and file for VAT returns, even not being physically present in Poland.

How does a VAT declarations work in Poland?

VAT declarations in Poland are standardized and predominantly electronic. Involves total output VAT collected on sales and the total input VAT paid on purchases for a given period.

The Polish VAT reporting system is the electronic document JPK_V7 (Jednolity Plik Kontrolny dla VAT z deklaracją). It combines:

- SAF-T (Standard Audit File for Tax) part – it compasses the VAT registers of sales and purchases.

Including invoice numbers, dates, parties involved, net amounts, VAT amounts, and applied VAT rates.

- VAT return part – the traditional aggregated declaration summarizing the total output VAT, total input VAT, and the resulting VAT liability or refund amount.

Because of this integrated method, a business files both its summarised VAT return and its comprehensive transaction ledger at the same time as it uploads its JPK_V7.

When you want to get a VAT return, you need to start with calculating the VAT due or refundable:

- Output VAT (VAT on Sales) the VAT charged on goods sold or services provided by your business

- Input VAT (VAT on Purchases) the VAT paid by your business on goods and services acquired for its taxable activities

If Output VAT > Input VAT ⇒ the difference is the VAT amount payable to the tax authorities

If Output VAT < Input VAT ⇒ the difference represents a VAT credit, which can either be carried forward to the next period or claimed as a VAT refund

What is KSeF?

KSeF, or the National e-Invoicing System (Krajowy System e-Faktur), is a tool that enables the electronic transmission of invoices. This occurs between businesses and public administration bodies. It involves issuing, sending, receiving, storing, and making invoices available in electronic form. This system was introduced in Poland under the Act of September 11, 2019. Invoices issued via KSeF are called structured invoices. Such an invoice takes an XML format.

KSeF – structured invoice

A structured invoice is an electronic document in which data is organized in a specific format, enabling automatic processing of information. It’s an invoice that uses specific standards and markup languages, such as XML or JSON, to precisely define data fields and their types. This format makes it easy to import invoices into accounting systems and perform data analysis.

When did KSeF become mandatory?

The National e-Invoicing System was introduced in Poland on January 1, 2022. From that moment, businesses could voluntarily issue and receive invoices electronically. However, starting July 1, 2024, it became mandatory, in accordance with the act signed by the President on June 16, 2023. The obligation to use the system applies to both entities conducting business activities and public administration bodies. The introduction of the e-invoicing system is part of efforts to simplify and automate administrative processes in Poland.

Who is obligated to use the National e-Invoicing System?

The obligation to use the National e-Invoicing System applies to all entities registered as VAT taxpayers in Poland. This includes entrepreneurs conducting business activities under the provisions of the Civil Code and entities operating under other acts.

The rules for using the National e-Invoicing System

- Issuing invoices: Businesses are obliged to issue invoices in electronic form. These invoices must meet specific technical requirements, such as using a secure electronic signature or a time-stamped electronic seal.

- Sending invoices: Electronic invoices are sent via a platform provided by the Ministry of Finance or through IT system operators. Invoices are sent according to the “one-way communication” principle.

- Receiving invoices: Invoice recipients are required to accept and save electronic invoices in their system. These invoices must comply with formal and legal requirements and must be accessible for a specified period.

- Storing invoices: Both issuers and recipients of electronic invoices are required to store these documents for 10 years. Invoices should be stored in their original electronic form and must be accessible to inspection authorities.

National e-Invoicing system and benefits for taxpayers

Shortened VAT refund period

The electronic settlement process is more efficient, which shortens the waiting time for funds to be returned. Taxpayers should receive a refund within 40 days instead of the previous 60 days.

Simplified confirmation of tax base reduction

The introduction of the National e-Invoicing System eliminates the need for traditional documentation confirming the conditions for reducing the tax base. This allows for adjustments to be made in the current settlement period, which speeds up and simplifies the process of confirming a reduction in the tax amount.

Accelerated document flow

Using electronic invoices significantly accelerates document circulation. All operations take place online, saving time and simplifying document management. An additional advantage is that duplicates of invoices will not need to be issued if a contractor loses an invoice, as all invoices will be available in KSeF.

Elimination of the risk of document destruction or loss

With e-invoices, all documents are stored electronically, which eliminates the risk of losing important information and makes them easier to retrieve if necessary.

Requirements for VAT returns in Poland

VAT returns in Poland - VAT registration (VAT-R form)

- Your business must be registered for VAT, to file VAT returns in Poland.

- You must submit the VAT-R form to the Head of the Tax Office competent for the taxpayer’s registered office or place of business.

Upon submission, the tax authorities undertake a verification process (involving assessing the applicant’s bona fides and business activity). For foreign entities, this scrutiny can be more extensive.

VAT registration includes:

- Polish VAT number: You must obtain a Polish VAT number – NIP

- How to register:

- Online: via governmental platforms

- By post: sending the completed form to the tax office

- In-person: submitting the form directly at the tax office

- Required documents:

- Proof of legal title to premises (e.g., lease agreement, ownership deed)

- Articles of association or other legal entities’ founding papers

- For non-resident entities, often a copy of the company’s extract from its home country’s commercial register

- The entity would normally complete an NIP-2 form concurrently to obtain a Polish Tax Identification Number (NIP) if they do not already have one

You can book a free consultation with our VAT experts in time that is suitable for you!

Polish electronic submission (JPK_V7)

The Polish tax system has embraced digitalization, making electronic submission of VAT returns mandatory.

The JPK_V7 must be submitted electronically via the Polish Ministry of Finance’s platform. Businesses must use an electronic signature (qualified electronic signature or trusted profile ePUAP) for authentication.

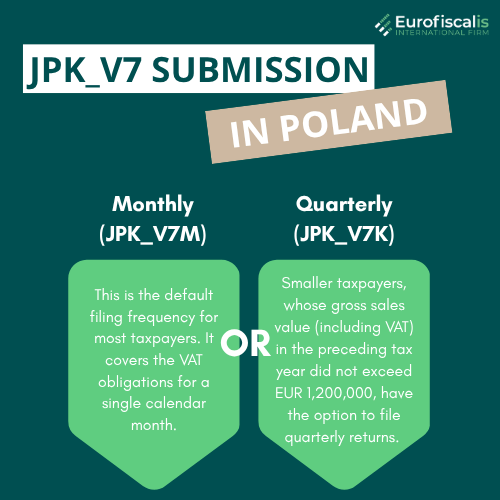

Monthly (JPK_V7M) | Quarterly (JPK_V7K) |

|---|---|

This is the default filing frequency for most taxpayers. It covers the VAT obligations for a single calendar month. | Smaller taxpayers, whose gross sales value (including VAT) in the preceding tax year did not exceed EUR 1,200,000, have the option to file quarterly returns. |

However, even quarterly filers must submit the SAF-T part of the JPK_V7 monthly. This means the detailed transaction data is submitted monthly, but the aggregated declaration (VAT return part) is submitted quarterly.

- Specific requirements for "Sensitive" goods:

It is implemented in Poland, to combat VAT fraud – specially for goods like: steel products, fuels and certain electronic devices. Transactions involving these “sensitive” goods may trigger additional reporting requirements within the JPK_V7 or mandate the use of the split payment mechanism.

Record-keeping in Poland

There must be a well-organised and accurate records-keeping for demonstrating compliance, substantiating input VAT deductions, and justifying VAT refund claims.

All records must be kept for a period of 5 years from the end of the calendar year in which the tax payment deadline fell.

You can book a free consultation with our VAT experts in time that is suitable for you!

Penalties for non-compliance in Poland

- Late submission – for example a failure to submit the JPK_V7 by the deadline can result in fines. The penalty amount is depending on the severity and duration of the delay.

- Underpayment or overstated refunds – for example the taxpayer will be liable for the discrepancy plus interest for late payment if an audit finds that the VAT refund was overstated or the amount of VAT owed was underreported. Percentage penalties may also be applied to the amount that was underpaid.

- Deregistration – for example the failure to submit VAT returns in Poland for three consecutive months or quarters, or continued non-compliance, the tax authorities have the power to deregister a company from VAT, making it illegal to issue VAT invoices.

VAT refunds in Poland - procedures and rates

Can you claim VAT back in Poland?

Yes, if, in a given settlement period, your input VAT (VAT paid on purchases) exceeds your output VAT (VAT collected on sales), you will have a VAT surplus or credit. Polish VAT law allows taxpayers to either:

1. Carry forward the surplus: The excess input VAT can be carried forward and offset against future VAT liabilities.

2. Request a refund: The taxpayer can request a direct payment of the surplus to a designated bank account.

How do you claim back VAT in Poland?

The process for claiming VAT back in Poland is initiated directly within the JPK_V7 tax return itself. In the declaration part of the JPK_V7, there are specific fields where the taxpayer indicates their intention to carry forward the surplus or request a refund.

For foreign companies registered for VAT in Poland, requesting a direct refund typically requires a Polish bank account. While opening such an account remotely can be challenging, it is often a practical necessity for receiving timely refunds. The refund is processed to this specified account.

To support the refund claim, especially for larger amounts or in cases of audit, businesses must be prepared to provide supporting documentation, including:

- Valid VAT invoices for purchases.

- Customs documents for imported goods.

- Proof of payment for relevant transactions.

For foreign businesses not registered for VAT in Poland but incurring Polish VAT (e.g., on business expenses like hotel stays or trade fair participation), the refund process is governed by the EU’s 8th Directive (for EU businesses) or 13th Directive (for non-EU businesses). These procedures involve filing a separate refund application through their home country’s tax authority or directly to the Polish tax authorities, respectively. These do not require a Polish bank account.

You can book a free consultation with our VAT experts in time that is suitable for you!

Polish VAT refund rates (Foreign Businesses)

For Businesses (under EU Directives):

For foreign businesses claiming VAT under the 8th or 13th VAT Directive procedures, the refund will be the full amount of eligible input VAT paid. There are no “rates” applied to the refund itself, but rather the refund is based on the VAT rate charged on the original purchase.

Minimum refund limits apply:

- For refund periods less than a fiscal year but not less than 3 months: EUR 400 (or equivalent in PLN).

- For a full fiscal year or the final period of a fiscal year: EUR 50 (or equivalent in PLN).

VAT refund in Poland - deadlines for businesses

Once a refund is requested in the JPK_V7, the Polish tax authorities have specific deadlines to process and pay the refund:

1. Standard refund period: 60 days

- This is the general period from the date of submission of the JPK_V7 tax return.

2. Shortened refund period: 25 days

- A faster refund period of 25 days is available for taxpayers who meet specific criteria, such as:

- Using the split payment mechanism for all received invoices.

- Meeting requirements related to online cash registers and non-cash payments (e.g., at least 80% of sales registered via cash register are paid non-cash, and total sales via cash register exceed PLN 40,000 in the preceding 6 months).

- Maintaining a Polish bank account specified in their VAT-R registration.

- Having a clean tax history without any irregularities.

3. Extended refund period: 180 days

- The refund period can be extended to 180 days in certain circumstances:

- The tax authorities decide to conduct additional verification or a detailed tax audit of the VAT return.

- The refund is only due to input VAT on purchases; the taxpayer did not engage in any taxable sales activity during the specified time.

- The amount of the return is significant or presents particular issues.

- The purpose of this extension is to guarantee the legitimacy of the refund claim and is at the discretion of the tax authorities.

It is important to note that these deadlines provide the tax authority the most time possible to complete the return; they do not ensure that you will receive your money on the 25th, 60th, or 180th day.

Source: VAT refunds in Poland

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.