Invoicing in Netherlands - Dutch requirements

Understanding the invoicing in the Netherlands in today’s dynamic business environment is paramount. To issue invoices properly, it is not only about a matter of good practice – it’s a legal necessity, that impacts your business’s VAT compliance, administrative efficiency and the ability of your customers to claim tax deductions. In this guide, provides a specific overview of the Dutch requirements for invoicing, covering VAT obligations and the evolving landscape of electronic invoices, VAT obligations and the new wave of electronic invoices.

- Published on :

- Reading time : 10 min

Requirements for invoices in the Netherlands

To invoice in the Netherlands correctly, businesses must ensure their documents meet specific legal criteria set forth by the Dutch Tax and Customs Administration (Belastingdienst). It is crucial to maintain accurate records and ensure VAT deductibility.

Are you interested in VAT in the Netherlands? Read more or schedule a free consultation

Mandatory information on a Dutch invoice

What are the rules for invoicing in Netherlands?

Every invoice that is issued by a business operating in the Netherlands must include:

- The full legal name and address of the issuing business, its VAT identification number (BTW-nummer)

- If applicable, its Dutch Business Register (KVK-nummer)

- The full legal name and address of the customer

- In certain cases, particularly for B2B transactions or intra-community supplies, the customer’s VAT identification number must also be included

- A unique, sequential invoice number and the date of its issuance

- A detailed and clear description of the goods or services, including their quantity and type or nature and scope

- The actual date on which the goods were supplied or the services were performed, if this is different from the invoice date

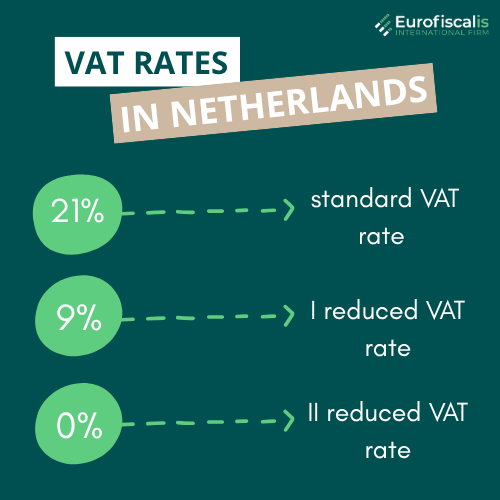

- The applicable VAT rate (e.g., 21%, 9%, or 0%)

- The amount charged for the goods or services, excluding VAT (the net taxable value).

- If different VAT rates apply to various items, these amounts should be itemized separately

- The exact VAT amount in euros must be shown for each rate.

- Any discounts or reductions not included in the price should also be indicated

- The total amount payable on the invoice, including VAT.

Check VAT rates in whole EU!

Invoicing in Netherlands - specific scenarios and requirements

There are specific scenarios where there might be a need to add additional information on invoices.

Simplified Dutch invoices (Under €100)

What is the minimum requirement for an invoice?

When the invoice’s total amount does not exceed €100, the requirements are less strict.

Simplified invoices must contain:

- The name and address of the supplier

- The total VAT amount

- The invoice date

- A clear description of the goods or services supplied

- If it’s a rectified invoice, a reference to the initial invoice

Remember!

Simplified invoices cannot be used for intra-community supplies or distance sales.

You can book a free consultation with our VAT experts in time that is suitable for you!

Special VAT regulations in the Netherlands

When there is a special VAT regulations, such as the reverse-charge mechanism or zero-rated supplies for example exports, the phrase must be explicitly stated on the invoice.

For example: “VAT reverse-charged” ⇒ btw verlegd

Invoicing in Netherlands - Industry-specific invoices

Particular sectors may have unique invoicing rules.

- Simplified requirements invoices for fuel receipts – where payment method can prove client identity for VAT deduction

- No requirement for full invoices for public transport and drink in catering establishments

Dutch invoices issuance and rectification

Dutch invoices must be issued promptly, typically no later than the 15th day of the month following the month in which the supply occurred. For example, if you sold something in May, you have time to sent the invoice until 15th of June.

If the invoice contains errors or does not meet the requirements, it must be rectified.

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT in the Netherlands

Understanding who pays VAT in the Netherlands involves recognizing the roles of both the supplier and the customer, as well as specific mechanisms like the reverse charge.

Understanding VAT responsibility in the Netherlands

Standard VAT rules:

- The supplier charges VAT on the invoice → collects it from the customer → subsequently remits it to the Belastingdienst

- If there is a VAT-registered business, the customer → pays VAT to the supplier → has the right to deduct this amount as input tax in their own VAT return → must provide the complete invoice → VAT-registered businesses the VAT largely nets out

- Exception!

An important exception is the reverse-charge mechanism (btw verlegd).

These scenarios are for certain cross-border B2B transactions within the EU or certain domestic supplies (for example in construction or when specific goods/services are supplied to Dutch entrepreneurs).

In these situations the liability for VAT shifts from the supplier to the customer. Therefore, the supplier issues an invoice without charging VAT, clearly stating “VAT reverse-charged,” and the customer is responsible for calculating, reporting, and paying the VAT to their own tax authority.

Dutch VAT identification and authentication

In the Netherlands, all VAT-registered businesses have a unique VAT identification number. Businesses must display VAT ID on their invoices.

For any interactions with the Dutch Tax and Customs Administration, VAT-registered taxpayers must authenticate their identity using the eHerkenning system, or may use DigiD.

Electronic invoicing (e-Invoicing) in the Netherlands

As the whole EU, the Netherlands as well is actively changing into electronic invoices. Specially with the interactions with government entities.

E-Invoicing for Public entities (B2G) in the Netherlands

For businesses supplying goods or services to the Dutch central government, e-invoicing is mandatory since 2017. This obligation aligns with the EU e-invoicing directive (Directive 2014/55/EU).

You can book a free consultation with our VAT experts in time that is suitable for you!

Accepted formats

Public entities accept electronic invoices in such as:

- Peppol BIS 3.0 (the preferred format with country-specific rules known as NL CIUS)

- UBL-OHNL

- SI-UBL 2.0

These formats ensure automated processing.

Mandatory infrastructure

Electronic invoices for the central government are submitted via the secure Peppol network, which is connected to Digipoort (government’s platform for receiving digital messages).

Suppliers with larger volumes of invoices, can also establish a direct connection to Digipoort.

E-Invoicing for Business-to-Business (B2B) in the Netherlands

E-invoicing for B2B transactions is not mandatory yet. However, businesses are increasingly adopting it due to its benefits.

In B2B transactions, the buyer’s explicit consent to receive electronic invoices is generally required. There are no mandatory formats or specific obligations by law for these types of transactions.

Archiving electronic invoices in the Netherlands

Businesses are legally required to retain their invoices for specific periods:

- Movable property → invoices relating to movable property must be archived for 7 years

- Immovable Property → invoices concerning immovable property (real estate) must be kept for 10 years

E-invoices must be stored in a way that ensures their authenticity and integrity throughout needed period.

If you want to archive invoices abord, you must meet the conditions, such as accessibility and readability for audit purposes or having a Qualified Electronic Signature.

Changes in VAT regulations in 2025

- Recognition of public transport transaction certificates as a basis for VAT deduction, even without an OV-chipkaart, provided detailed information about the journey and the VAT amount is given.

- Liability for incorrectly calculated VAT by non-entrepreneurs.

- Stricter obligation for invoice recipients to verify invoices for the correctness of the VAT charged.

- Extension of the 5-year period for reducing overpaid VAT for distance sales and digital services.

- Changes in invoicing for small businesses (SME exemption): From January 1, 2025, simplifications in invoice requirements for small businesses using the SME exemption have been introduced, which may include a new identification number “EX”.

Ensuring compliance and avoiding pitfalls in the Netherlands

Make sure you adhere to Dutch invoicing regulations. Any non-compliance might lead to consequences, such as penalties from the Belastingdienst and the denial of VAT deduction rights for your customers.

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.