Here is all you need to know about yearly VAT return in Norway

This comprehensive guide is designed to walk Norwegian small businesses through every aspect of the annual VAT return scheme, from understanding its core benefits and eligibility criteria set by Skatteetaten, to the practical steps of application via Altinn and the eventual filing process. If you’re looking to reduce your VAT administration and report VAT just once a year, this page will provide the clarity you need.

- Published on :

- Reading time : 7 min

- Updated on : 31/05/2025

What is a yearly VAT return in Norway?

The annual VAT reporting scheme allows businesses with low turnover to submit a single VAT report for the entire year, rather than reporting every two months like most other businesses. This is especially beneficial for small businesses or companies with seasonal operations that prefer fewer administrative tasks.

Annual VAT reporting vs. standard reporting

| Annual VAT Reporting | Standard VAT Reporting |

Reporting detail | You compile all your VAT information for the entire income year into a single return. | Businesses submit VAT returns (MVA-melding) every two months |

If you want to read more about VAT in Norway, check out our article:

Yearly VAT return in Norway - advantages

- Reductions in administration workload –prepare for one return instead of six

- Frees up time and resources

- Larger VAT payments – better, long-term financial planning

Eligibility for yearly VAT return in Norway

3. Criteria – Submission of tax returns

For at least one year, businesses must submit tax returns for VAT – correctly and punctually every other month.

It’s not a strict qualifying criterion for all applicants (especially new ones) that they must have submitted returns correctly for a prior year.

Can you do an annual VAT return in Norway?

The Norwegian Tax Administration – Skatteetaten has specific criteria that enterprises must meet to qualify for yearly VAT return scheme.

1. Criteria – Turnover thresholds for small enterprises in Norway

The primary critical factor is your business’s taxable turnover.

According to Skatteetaten, small businesses with a taxable turnover of less than NOK 1 million over a 12-month period can apply for annual reporting.

It is really important to correctly calculate taxable turnover (which is excluding VAT exempt sales) to determine if you meet the criteria.

2. Criteria – Business types and general conditions

Businesses must be registered in the VAT Register and have a history of compliant VAT reporting if they’ve been operating for some time.

New businesses can also potentially apply if they anticipate their turnover will remain below the threshold for the yearly VAT return.

You can book a free consultation with our VAT experts in time that is suitable for you!

Maintaining eligibility for Norwegian yearly VAT return

Once you are approved for a yearly VAT return, you are responsible for monitoring your turnover.

If your taxable turnover exceeds the NOK 1 million threshold during an income year, you will typically no longer qualify for the yearly VAT return scheme for the following year.

- Important

It’s your duty to inform Skatteetaten of this change. If you fail to do so and continue to file a yearly VAT return it might lead you for a potential complications with tax authorities.

How to apply for annual VAT reporting in Norway?

It requires a formal application to Skatteetaten. This is usually processed through the Altinn platform.

The application process via Altinn in Norway

- Log in to the Altinn portal

- The application is submitted using a specific form or a dedicated digital service within Altinn.

- Ensure you have the necessary Altinn roles (e.g., “Accountant salary” or similar with rights to submit tax forms) for your organization to complete and submit the application for yearly VAT return

- The process involves logging into Altinn, locating the correct application service for changing VAT reporting frequency, and completing the required fields accurately.

Comprehensive summary of your financial transactions for the entire year. This includes the total sum of your taxable sales (basis for output VAT), any VAT-exempt sales, sales with reverse charge, and the total amount of deductible input VAT paid on your business purchases and expenses.

Required information and documentation for application in Norway

This includes:

- Your organization number (organisasjonsnummer),

- Business name,

- Contact information,

- A declaration confirming your eligibility,

- Declaration or confirmation that your taxable turnover is below the current threshold (e.g., NOK 1 million),

- Skatteetaten may also require information about your expected turnover if you are a new business applying for the yearly VAT return.

You can book a free consultation with our VAT experts in time that is suitable for you!

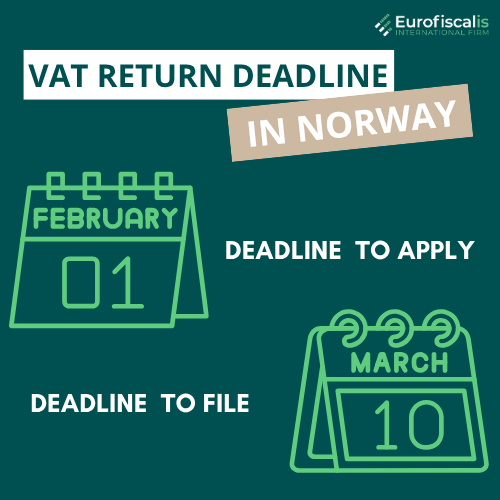

Norwegian application deadlines and Skatteetaten's approval timeline

The application must be submitted in advanced of the income year for which you wish to start annual VAT reporting.

For example, if you want to file a yearly VAT return for the 2025 income year – you had to submit your application by the deadline in 2024.

- Deadline to apply for the scheme (e.g., usually by February 1st of the year before the annual reporting year).

- Deadline to file the annual return (e.g., March 10th of the year after the reporting year)

Best practices for your Norwegian yearly VAT return

- Maintaining accurate records throughout the year is crucial – you must maintain updated records, including all sales and purchase invoices, he legally required retention period (typically much longer than 12 months; refer to Norwegian bookkeeping regulations)

- Managing cash flow for the annual VAT payment – best practice is to regularly set aside a portion of your revenue (based on your output VAT minus estimated input VAT)

- Regularly check Skatteetaten’s website for any updates to rules or thresholds

FAQ - quick answers to common questions

Can I apply for a yearly VAT return if my business is newly registered for VAT in Norway?

Yes, newly registered business in Norway you can apply for yearly VAT return. You must remember about needed requirements such as, annual taxable turnover (below the NOK 1 million).

What are the consequences if I miss the deadline for submitting my Norwegian annual VAT return or making the payment?

When you miss the deadline (10th of March) it can lead to penalties from Skatteetaten. This can include coercive fines (tvangsmulkt) for late filing and interest charges on overdue VAT payments.

Do I still need to issue VAT-compliant invoices if I'm on a yearly VAT return schedule in Norway?

Yes. The yearly VAT return changes your reporting frequency, however you must issue invoices correctly, VAT-compliant invoices for all taxable sales, detailing the VAT amount, remains unchanged. These invoices are the foundation of your VAT accounting and are essential for accurately completing your yearly VAT return.

If I am due a VAT refund, will I receive it only once a year with Norwegian yearly VAT return?

Typically, yes. If you are in a VAT refund position and use yearly VAT return. Any net VAT refund due will be processed after submitting your yearly VAT return.

Where can I find the most current official information and forms for the yearly VAT return in Norway?

In Norway, you can find it on the Norwegian Tax Administration – Skatteetaten website and the Altinn portal.

Source: Skatteetaten – VAT return

You can book a free consultation with our VAT experts in time that is suitable for you!

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.