D number in Norway

D numbers are temporary Norwegian identification numbers for individuals who do not have a Norwegian passport, lack Norwegian citizenship or are not registered as residents in Norway. The D number is used for essential services in Norway, such as opening a bank account, accessing some medical services and crucially for obtaining your tax deduction card.

- Published on :

- Reading time : 9 min

- Updated : 27/05/2025

What is a D number in Norway?

Defining the D number (D-nummer) - a temporary Norwegian identification

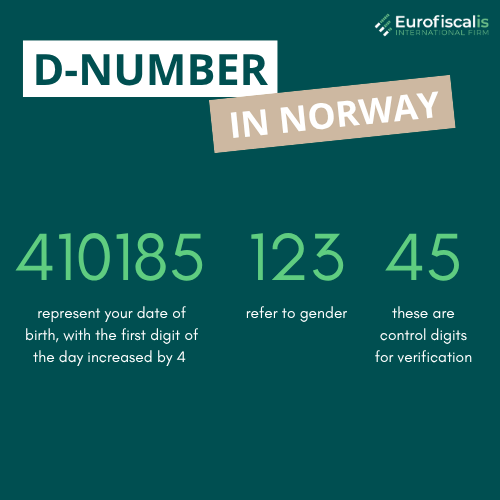

A D number in Norway is an identification number with 11 digits. The digits are structured as follows:

- First 6 digits ⇒ represent your date of birth, with the first digit of the day increased by 4 for example 01.MM.YYYY becomes 41.MM.YYYY in the D number

- Next 3 digits ⇒ these 3 numbers refer to gender (even numbers for women and odd for men)

- Final 2 digits ⇒ these are control digits for verification

It is assigned by Norwegian authorities to individuals who are not registered in the Norwegian National Registry (Folkeregisteret).

These individuals are not registered as residents but require an identifier in Norway due to specific documentation needs.

Remember that this is a temporary identification number – it is not the same as you get distinct from national identity number for permanent residents.

What is the function of D number (D-nummer)?

D number function is to be able to interact with Norwegian private and public sector entities – when a permanent national identity number is not applicable.

Who is responsible for assigning D number?

The primary body responsible for assigning D numbers is the Norwegian Tax Administration – Skatteetaten, even when requested by other agencies.

How is a D number in Norway different from a National Identity Number - fødselsnummer?

Differences between D number in Norway and a Norwegian National Identity Number (often called fødselsnummer):

D Number | National Identity Number (Fødselsnummer) | |

Residency Status

| A temporary identifier for individuals who are not permanent residents but need to engage with Norwegian systems (e.g., for short-term work, specific business roles). | Assigned to individuals who are registered as permanent residents in Norway. |

Permanence | Temporary. If an individual later becomes a registered resident (e.g., by staying over six months and meeting criteria), they receive a National Identity Number, and the D number is linked/inactivated. | A lifelong identifier. |

Who needs to apply for a D number in Norway?

When to apply for a D number via Skatteetaten?

- When you are working in Norway (for less than 6 months) → if you are planning to work in Norway, you will need to have a D number to obtain a tax deduction and be able to report your income to the Skatteetaten

- When you have to pay taxes → it works as your tax identification number, when you don’t have a fødselsnummer

- When you want to have a bank account → if you want to open a bank account , the majority of Norwegian’s banks require a D number or fødselsnummer

- When you are interacting with public authorities → if some cases the public authorities might need a D number

When to apply for a D number via Brønnøysundregistrene?

- When you are involved in business activities → if you are involved in Norwegian-registered foreign company or any Norwegian business (you are appointed as board member, a general manager, an auditor or an accountant) and you don’t have a national ID number, the Brønnøysund Register Centre – Brønnøysundregistrene will need a D number

Specific cases involving UDI (Norwegian Directorate of Immigration)

When you are seeking asylum or permits → UDI might request a D number (because UDI does not directly issue D numbers) from Skatteetaten as part of any immigration or integration processes in Norwegian systems.

If you fall under UDI’s purview for these matters, the D number allocation is typically handled as part of your overall application or case management with UDI, meaning you usually don’t need to apply separately to Skatteetaten for this purpose.

You can book a free consultation with our VAT experts in time that is suitable for you!

How to get a D number in Norway?

Applying for a D number through Skatteetaten

If your need for a D number in Norway primarily relates to tax, short-term work, or banking, the Norwegian Tax Administration (Skatteetaten) is your main point of contact.

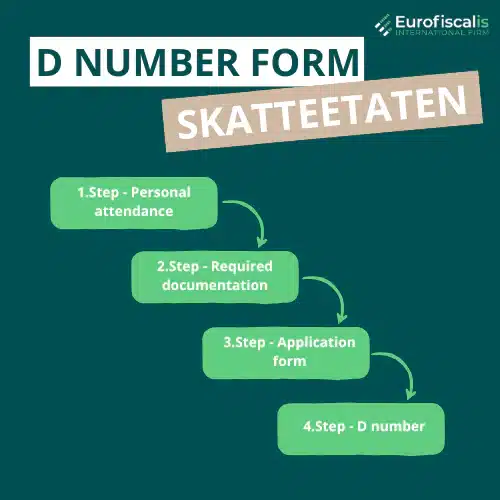

Steps to get a D number from a Skatteetaten

1. Step – Personal attendance

- Book an appointment in advance if possible (this is often recommended)

- Attend an ID check in person at a designated tax office

2. Step – Required documentation

- Present a valid identification, such as:

- A valid passport

- EEA citizen – you will need to bring a valid national ID card

- Sometimes you also might need to have an employment contract or the form RF-1209 “Application for tax deduction card for foreign citizens”

3. Step – Application form

- Complete the necessary application forms provided by Skatteetaten.

After that the Skatteetaten approves all documents it will assign a D-number. You can find detailed instructions, current requirements, and downloadable forms directly on the Skatteetaten D number section of their official website.

Obtaining a D Number through Brønnøysundregistrene (The Brønnøysund Register Centre)

If you need to apply for the D number in Norway (when you are involved in business activities) the Brønnøysund Register Centre is your main point of contact.

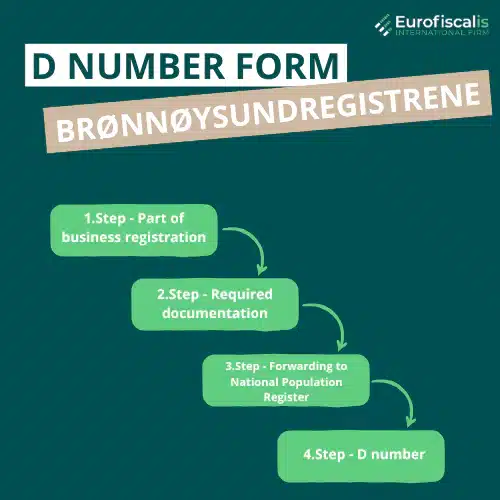

Steps to get a D number from a Brønnøysundregistrene

1. Step – Part of business registration

- Submit as the part of Coordinated register notification form (Samordnet registermelding)

2. Step – Required documentation

- Provide a certified copy of valid identification

- A valid passport

- EEA citizen – you will need to bring a valid national ID card

- Sometimes you also might need to have an employment contract or the form RF-1209 “Application for tax deduction card for foreign citizens”

3. Step – Forwarding to National Population Register

- Brønnøysundregistrene will then forward the necessary information to the National Population Register (managed by Skatteetaten)

- The D number will be assigned

If you need more detail on documentations or procedure it is the best to check the information on their official website the Brønnøysundregistrene – D number.

Validity and inactivation of your Norwegian D number (D-nummer)

What happens if my Norwegian D number becomes inactive?

A D number in Norway is not indefinitely active if unused. As claimed by the Skatteetaten D number becomes inactive if it has not been used for 5 years.

If your D number is inactive:

- you need to use again (with public authorities, such as tax reporting)

- you need to undergo a new identity check with Skatteetaten to reactivate it or be assigned a new one

- you need to keep track of its status

Correctly using your D number in Norway

Once you have your D number in Norway, you can use it:

- When your employer wants you to provide tax purposes

- When you want to open a bank account or you are dealing with financial institutions

- When you are include it in official business registration documents if applicable

- When you are requested to by any Norwegian public authority

Remember: Treat D number as a sensitive personal information. Provide it only to legitimate entities and only if there is a valid reason.

D number in Norway - questions

H3: What if my situation changes? (for example becoming a resident in Norway)

Your status of D number will change:

- When you transition from a temporary stay to become (by living in Norway for more than 6 months) a resident in Norway

After registration as a resident:

- You will be assigned a permanent National Identity Number (fødselsnummer)

- Your D number in Norway will be connected to your new fødselsnummer

- D number will be inactive/supersede

How long does it take to get a D number in Norway?

Application via Skatteetaten

- after checking and approving your identity the timeframe is about 2 weeks

Application via Brønnøysundregistrene

- the timeframe depends on whole process time for registration

Is a D number the same as a tax identification number in Norway?

Yes, for individuals who do not have a Norwegian National Identity Number (fødselsnummer), the D number in Norway serves as their official tax identification number (TIN) for dealings with the Norwegian Tax Administration (Skatteetaten).

Can I use my D number to travel?

No, a D number in Norway is not a travel document and you can not use it in place of an ID card or passport for travel. It is an identification number for use within Norway for official and administrative purposes, as clarified at the beginning of the article.

Where can I find my D number if I've lost it or forgotten it?

If you can not find your D number in Norway:

- Check official correspondence you may have received from Norwegian authorities (e.g., from Skatteetaten), employment contracts, or bank statements, as it may be printed there.

- If you still cannot find it, contact the authority that likely issued or requested it for you (primarily Skatteetaten).

Source: D number in Norway

If you want to know more about VAT registration in Norway, read the article below:

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.