VAT in Austria: A comprehensive guide for businesses

This comprehensive guide to VAT rates in Austria will help you dispel any doubts regarding standard rates (20%), reduced rates (13% and 10%), and specific exemptions. We’ll break down the core concepts, from how the system works and why it’s important, to the practical steps involved in VAT registration, filing returns, understanding exemptions, and ensuring ongoing compliance.

- Published on :

- Reading time : 17 min

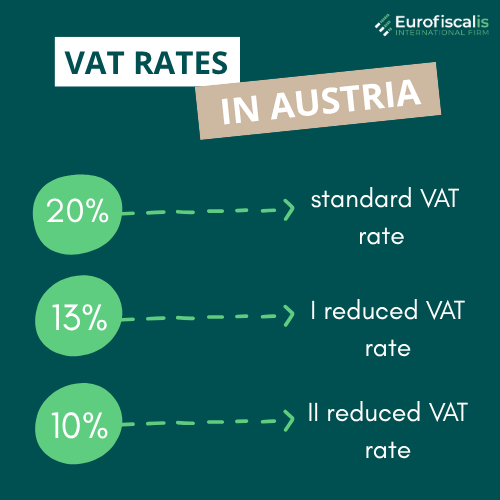

Austrian VAT rates

In Austria there is a multi-tiered VAT rate system, categorized by different types of goods and services.

Standard VAT rate (20%)

Austrian standard VAT rate is 20%. It is the most common rate and applies to the majority of goods and services traded within the country.

I reduced VAT rate (13%)

The reduced tax rate in Austria applies to:

- Domestic flights

- Admission to sporting events, cultural events, and amusement parks

- Firewood supplies

- Delivery of living animals, living plants

- Wine production on the farm

- Certain cut flowers and ornamental plants

II reduced VAT rate (10%)

The second reduced tax rate in Austria applies, to:

- Food products

- Takeout food

- Water supplies

- Restaurant and catering services (with specific rules for beverages)

- Passenger transport (bus, rail, taxi)

- Newspapers, magazines; books; e-books

- Activities of social services

- Collection of household waste

The 0% VAT rate in Austria applies to international and intra-EU transport, excluding road and inland waterway transport.

Zero-rated and exempt supplies in Austria

Zero-rated supplies (0%)

VAT zero-rated in Austria are technically taxable supplies, but the VAT rate applied is 0%.

The critical aspect here is that businesses making zero-rated supplies are still entitled to deduct the input VAT they incurred on purchases related to these supplies. This means they don’t charge VAT, but they can still recover VAT expenses. Common examples include:

- Exports of goods to countries outside the European Union (to third countries)

- Intra-Community supplies of goods to VAT-registered businesses in other EU member states (provided specific conditions, such as the recipient’s valid VAT ID and proof of dispatch, are met).

VAT exemptions in Austria

VAT exemptions in Austria means that no VAT is charged, and critically, the business is generally not entitled to deduct input VAT related to these exempt supplies, also known as “non-genuine” exemptions.

VAT exemptions list in Austria:

- Small business (Kleinunternehmerregelung) – As of 2025, businesses with a net annual turnover not exceeding €55,000 (currently €35,000) can opt to be exempt from VAT. Highlight that while they don’t charge VAT on sales, they also cannot deduct input VAT on their purchases.

- Financial and insurance services – Banking, financial institutions (e.g., lending, payment processing) and insurance companies are exempt from VAT.

- The sale of land and long-term leasing or letting of immovable property for residential purposes are generally exempt.

- Medical and educational services – Such as services provided by doctors, hospitals, nursing homes, educational institutions, therapists in Austria

- Certain social and cultural activities – Services that are rendered by public bodies, youth welfare organizations and non-profit organisations, such as non-profit museums and theatres

Check VAT rates in whole EU!

Understanding Value Added Tax in Austria - Umsatzsteuer

What is VAT (Umsatzsteuer) in Austria?

The Value Added Tax in Austria is referred to as “Umsatzsteuer” (Ust) or commonly known as “Mehrwertsteuer” (MwSt). It is an indirect consumption tax that is imposed at each stage of the supply chain, from production to final consumption.

How Austrian VAT works?

In Austria, the VAT system operates on the principle of input and output tax.

Output VAT – is when a business charges VAT on its sales of goods or services

Input VAT – is when a business reclaims VAT paid on its purchases of goods or services

The net amount of VAT collected (output VAT minus input VAT) is then remitted by businesses to the Austrian Federal Ministry of Finance (BMF).

Why is VAT important for your business in Austria?

⇒ Legal obligations – It cannot be negotiable. Austrian tax laws are stringent and adherence to VAT regulations is a statutory obligation. If your business does not follow the rules, it will lead you to legal consequences.

⇒ You have to remember that VAT directly impacts your pricing and profitability. When you apply VAT incorrectly it will lead you to mispricing services or products. Furthermore, it will erode profit margins or make your offerings uncompetitive.

⇒ Avoiding penalties – Fines for non-compliance Austria will happen if you for example fill late payments or make any errors in reporting. The management of Austrian VAT must be proactive and accurate.

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT registration in Austria

When is Austrian VAT registration required?

Austrian domestic turnover threshold

If you business’s net annual turnover from taxable supplies in Austria exceeds the €55,000 (effective 2025), you are generally required to register for VAT.

Exceeding the EU distance selling threshold (€10,000)

Since July 2021, it has been possible to settle distance sales to European Union countries through the One Stop Shop (OSS) procedure. Entrepreneurs can still choose how they want to settle their sales.

If the sale is conducted only in Austria, the domestic €55,000 threshold applies.

However if the sale is around all EU countries the seller has the option to register for VAT in that country after exceeding the sales limit of 10,000 EUR (this is a total limit for all EU countries). Then they can apply Austrian VAT rates, Austrian tax rules, and settle directly in Austria.

Storing goods in Austria

If your business stores goods in Austria – using a local warehouse or an Amazon FBA facility, as it constitutes a taxable presence or supply chain activity.

Read more about Amazon locations in our article:

Importing/exporting goods into or from Austria

Importing or exporting goods from outside the EU into Austria or from Austria to non-EU countries requires VAT registration.

Making intra-Community acquisitions/supplies

If your business acquires goods from a VAT registered supplier in another EU country (intra-Community acquisitions) or supplies goods to a VAT registered business in another EU country (intra-Community supplies), these can trigger an Austrian VAT registration obligations, especially when your business is not already VAT registered.

Providing construction services in Austria

If a non-resident business provides construction services in Austria, particularly to a private individual (where reverse charge mechanism does not apply) → VAT registration is required.

No threshold for non-resident, non-EU businesses

If a non-resident business from outside the EU makes any taxable supplies in Austria (where the reverse charge mechanism is not applicable), there is no turnover threshold; VAT registration is required from the first supply.

You can book a free consultation with our VAT experts in time that is suitable for you!

Austrian VAT return filing

VAT declarations and VAT payment in Austria

In Austria, the frequency of filing declarations depends on the volume of transactions conducted within the country. Declarations can be submitted quarterly or monthly.

The decision in this matter is made by the Austrian tax office. It informs about this directly during VAT registration. If it happens that the amounts of the sales transactions change during the year, the administration may change the reporting frequency.

Mandatory annual VAT declaration in Austria

It is the obligation of every taxpayer who has a VAT number in Austria to also submit an annual summary declaration. If any VAT underpayments occurred during the tax year, there is an option to settle them when submitting the annual VAT return.

Deadlines for submitting VAT returns in Austria

Monthly and quarterly VAT returns in Austria are submitted by the following deadlines:

1. Monthly – one month + 15 days after the end of the billing period (e.g., the declaration for July must be submitted no later than September 15)

2. Quarterly – one month + 15 days after the end of the settlement period (e.g., the declaration for the 1st quarter must be submitted by July, and it must be submitted no later than May 15).

3. Annual VAT summary declarations in Austria are submitted by the following deadlines:

⇒ If the declarations are submitted in paper form, the deadline is April 30 of the year following the reporting year (e.g., for the year 2024, the deadline is April 30, 2025).

⇒ If the declarations are submitted electronically via the FinanzOnline system, the deadline is June 30 of the year following the accounting year (e.g., for the year 2024, the deadline is June 30, 2025).

Austrian VAT registration process

Prepare your application

Forms of VAT registration in Austria

The primary application form is typically the U15 questionnaire (“Fragebogen zur Erfassung”) – it gathers detailed information about your business.

Gathering required documentation

- certificate of incorporation (or equivalent legal entity registration),

- articles of association,

- proof of identity for directors/shareholders,

- recent financial statements,

- evidence of business activity in Austria (e.g., contracts, proforma invoices),

- and in many cases, certified translations into German.

Where should you submit it?

Applications are submitted directly to the competent Austrian tax office (Finanzamt). For Austrian-resident companies or those with existing Austrian tax numbers, online submission via the FinanzOnline portal is often the standard method.

Timeline for receiving the Austrian VAT number

We recommend starting the VAT registration procedure in Austria before the planned taxable transactions. In this way, you will avoid the risk of interest on overdue VAT and penalties from the Austrian administration.

It depends on whether your application is complete and if the tax authorities is workload.

Fiscal representation for non-EU businesses

Businesses outside of the EU are generally required to appoint a local fiscal representative. This representative acts as a liaison with the Austrian tax authorities, handles VAT declarations, and often bears joint liability for the VAT due.

VAT in Austria - number format

It always begins with “ATU” followed by 8 digits, for example ATU12345678.

The importance of VAT ID verification cannot be overstated, especially for intra-Community (EU cross-border) transactions. You sholud always verify the VAT ID of your business partners using the VIES (VAT Information Exchange System) – to ensure that everything is correct and legal.

Check out our own VIES system!

VAT compliance and reporting in Austria

Invoicing requirements

Standard invoices in Austria

- Seller’s details – full name, address, VAT number (UID-Nummer)

- Recipient’s details – name, address, VAT ID (if a business recipient and applicable for reverse charge or intra-Community supplies)

- Invoice number – must be unique

- Date of document issuance

- Delivery date of the goods or services

- Description of delivered goods, quantity/weight,

- Net amount, VAT amount, gross amount

- Applied VAT rate (20%, 13%, 10%)

- If the 0% VAT rate was applied – a note regarding the provision referencing the legal provision for zero-rating (along with the directive number)

- If reverse charge was applied – a note stating “reverse charge” and referencing the applicable legal provision (along with the directive number)

- Currency in which the invoice was issued

Simplified invoices

If the transactions are not exceeding €400 (gross amount) you can issue a simplified invoices. It comes with the reduced information required (e.g., no need for the customer’s full address or VAT ID).

Record-keeping

Record-keeping is mandatory for 7 years from the end of the calendar year in which the transaction occurred.

VAT refunds filing in Austria

VAT refunds in Austria are possible under the EU Directive 2008/9/EC for all companies that do not have a registered office in Austria, but have made purchases there and have an active VAT number. The legal basis is the regulation according to Section 21 (9) of the UStG BGBl No. 279/1995 as amended.

VAT in Austria - deadlines for submission and payment

Generally, VAT returns (UVA – Umsatzsteuervoranmeldung) must be submitted and VAT paid by the 15th day of the second month following the reporting period (for excample January, the deadline is March 15th). The annual VAT return usually has a later deadline, often June 30th of the following year if filed by a tax advisor.

Below you will find all the information you need to obtain a VAT refund in Austria:

- VAT refund for companies based in the EU

Who can apply for a VAT refund in Austria?

Companies without a fixed establishment in Austria, but having one within the EU

How to apply for a VAT refund in Austria?

Applications must be submitted electronically through the FinanzOnline portal. The U5 form must be submitted.

What documents are needed for a VAT refund in Austria?

Documents: Submission of a certificate of entrepreneur status is not required. The application must contain detailed information in accordance with EU requirements.

Invoices: For invoices over 1000 euros or fuel receipts over 250 euros, a copy may be required.

When to apply and what is the minimum VAT refund amount in Austria?

Deadline: Applications must be submitted electronically by September 30 of the year following the year in which the costs were incurred.

Refund period: It can range from three months to the entire calendar year.

Minimum amount: 400 euros for periods shorter than a year; 50 euros for annual settlements.

- VAT Refund for Companies Based Outside the EU

Who can apply for a VAT refund in Austria?

Companies from outside the EU that do not have a registered office or generate turnover in Austria can apply for a refund of Austrian VAT under certain conditions.

How to apply for a VAT refund in Austria?

Applications must be submitted electronically through the FinanzOnline portal. The U5 form must be submitted.

What documents are needed for VAT refund in Austria?

Fully completed forms and original invoices and documents confirming the status of the entrepreneur are required.

When to apply for a VAT refund in Austria?

Applications should be submitted within six months from the end of the calendar year in which the right to a refund arose.

In Austria, VAT cannot be reclaimed on expenses incurred for entertainment goods, the purchase and leasing of cars, motorcycles, and other vehicles. It is also not possible to deduct costs incurred for certain goods and services that are used for business purposes less than 10% of the time.

The reverse charge mechanism (RCM) in Austria

In Austria, the reverse charge VAT system means that it is not the company supplying the goods or services that is obligated to pay VAT, but rather the company receiving these goods or services. In such cases, the recipient company is responsible for paying VAT to the tax office.

This system applies, among other things, to the provision of services by foreign companies that do not conduct business in Austria, and these services are taxed in Austria according to the rules of the place of service provision. Certain conditions apply here, including the issuance of an invoice without the tax amount, on which the recipient of the service is responsible for paying the due VAT.

Reverse charge in Austria applies primarily to cross-border services, including construction, consulting, legal, licensing, telecommunications, and electronic services provided by foreign companies.

Moreover, the reverse charge can be applied in the case of the supply of goods, such as precious metals and raw materials, when transactions take place between VAT entities. Detailed information and a complete list of services subject to the reverse charge system in Austria are available on the website of the Austrian tax office.

Intrastat declarations in Austria

In the event of exceeding the thresholds for the import and export of goods, sellers are required to submit INTRASTAT declarations in Austria.

In 2025, both the export and import thresholds remain unchanged at €1,100,000. It is the taxpayer’s responsibility to monitor their imports and exports, and to register with INTRASTAT and start reporting on their transactions at the appropriate time. In the event of failing to fulfil their obligations, the administration imposes penalties on taxpayers.

It can be filed monthly.

EC Sales List (ESL)

EC Sales List also known as a Summary Statement, is required when your business makes intra-Community supplies of goods and services to VAT registered customers in other EU member states.

It can be filled monthly or quarterly.

Penalties for non-compliance in Austria

Every company that fails to meet its tax obligations in Austria, regardless of whether it has its headquarters in the country or not, risks facing financial penalties. Even a few days of delay in paying VAT or submitting the VAT declaration in Austria is enough. How much are the financial penalties imposed by the tax administration on companies without a registered office in Austria?

⇒ If the company does not submit the declaration by the deadline (by the 15th day of the second month following the settlement period), it is required to pay a penalty of 10% of the due VAT amount.

⇒ If a company delays in paying VAT, it must be prepared to pay a penalty of 2% of the due VAT amount.

How can you avoiding penalties in Austria?

- Accurate record-keeping

- Timely filing and payment

- Seeking professional advice

Key considerations for specific business types

E-commerce businesses

- EU distance selling rules and the One Stop Shop (OSS) Scheme – online sellers that are making cross-borders B2C sales to EU consumers can use €10,000 EU-wide threshold

- VAT on Electronically Supplied Services (ESS) – digital services (streaming, online courses) that are supplied to private consumers are taxed at the VAT rate of customer’s country of residence

Businesses with physical presence (Warehousing, etc.)

- Implications of storing goods in Austria – if you store goods in Austria, you must be VAT registered, because these activities are considered a taxable presence

Businesses providing services

- General place of supply rules (B2B Services) – the place of supply is generally where the customer is established

- General place of supply rules (B2C Services) – for most B2C services, the place of supply is generally where the supplier is established

- Specific exceptions to place of supply rules

- Services related to immovable property – taxed where the property is located

- Passenger transport services – taxed where the transport takes place

- Cultural, artistic, sporting, scientific, educational, and entertainment services – for B2C customers, these services are taxed where the activity takes place

- Electronically supplied services (B2C) – taxed where the customers resides

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.