Invoicing in Sweden 2025 - Requirements and rules

The invoicing in Sweden requires a thorough understanding of its regulations, the increasing adoption of electric invoices and a strong focus on VAT (Moms in Swedish). This article aims to demystify Swedish invoicing practices, covering everything from mandatory invoice elements and the pervasive B2G e-invoicing system to upcoming regulatory shifts, empowering you to manage your invoicing efficiently and compliantly.

- Published on :

- Reading time : 10 min

Swedish invoice requirements

Invoicing in Sweden - mandatory information for invoices

The most important thing of compliant invoicing in Sweden lies in ensuring every invoice, or “faktura” – including all information. This is needed for VAT (Moms) purposes as any mistakes may lead your business complications with the Swedish Tax Agency (Skatteverket) or potential penalties.

Essential elements of a Invoice in Sweden - Momsfaktura

A Swedish VAT invoice, known as a “Momsfaktura” must include the following essential elements:

- Date of invoice “Fakturadatum” – the date the invoice is officially issued

- Sequential and unique number “Fakturanummer”

- Supplier’s VAT registration number “Momsregistreringsnummer” – it is typically SE followed by 10 digits and 01

- Supplier’s information – such as legal name, address of business

- Customer’s information – such as legal name, address of business

- Customer’s VAT registration number – if needed (it is necessary for intra-community supplies within the EU or when the reverse charge mechanism applies)

- Supplier’s corporate identity number (organisationsnummer).

- Information if the supplier is approved for F-tax (F-skatt)

- Description of goods or services “Varornas mängd och art eller tjänsternas omfattning och art” – such as quantity, nature

- Date of supply or completion of services

- Taxable amount VAT rate or exemption “Beskattningsunderlag”

- VAT rate “Mervärdesskattesats”

- VAT amount to pay “Momsbelopp att betala”

- Information on exemption or reverse charge

- Payment terms including due date (expected, but not mandatory for VAT purposes by Skatteverket’s list)

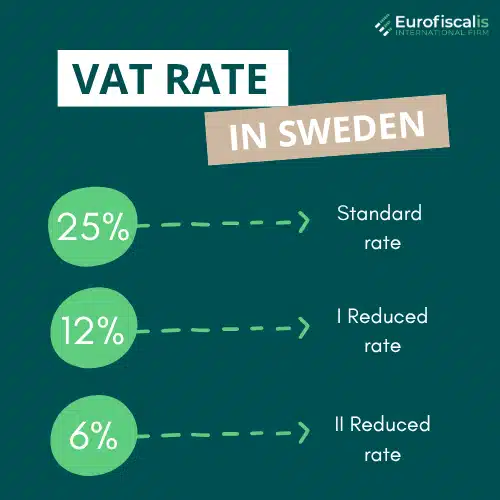

Language, currency and VAT rates on invoices in Sweden

Swedish is the official and preferred language for domestic transactions and dealings with public authorities. However, English is also widely accepted in B2B transactions, particularly with international partners.

When it comes to currency, the VAT amount must be shown in Swedish Kronor (SEK). If an invoice is issued in a foreign currency, the total VAT amount due must still be converted and stated in SEK, along with the exchange rate used for this conversion, to ensure compliance with Skatteverket requirements.

If you want to find out more about VAT in Sweden check out our article below:

Simplified Swedish invoices - When are they permitted?

Swedish law permits the issuance of simplified invoices, typically for transactions up to SEK 4 000 including VAT. These invoices are common in retail or for services where providing full details is impractical.

Invoicing in Sweden credit notes - Kreditfakturor

A credit note (kreditfaktura) is issued to correct or cancel a previously issued invoice (if you returned goods, price adjustments, or errors on the oryginal invoice). Your credit notes must:

- explicitly reference the original invoice number they pertain to

- contain much of the same information as a standard invoice, including supplier and customer details, VAT information, and a clear indication of the amount being credited

This ensures a transparent audit trail for both parties and for accurate VAT adjustments.

You can book a free consultation with our VAT experts in time that is suitable for you!

Electronic invoicing (e-invoicing) in Sweden - the digital shift

As is the case across Europe, Sweden is undergoing a digital transformation in invoicing, particularly with established requirements for electronic invoicing (e-faktura) in the public sector. Understanding the e-invoicing landscape is vital for any business interacting with Swedish entities.

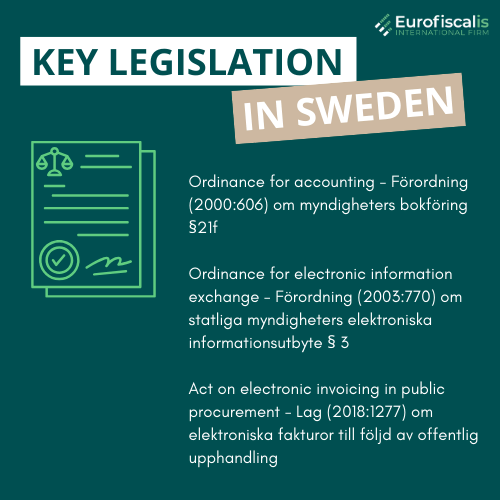

Key legislation governing e-invoicing in Sweden

The following laws mandate electronic invoices:

- Ordinance for accounting – Förordning (2000:606) om myndigheters bokföring §21f

- Ordinance for electronic information exchange – Förordning (2003:770) om statliga myndigheters elektroniska informationsutbyte § 3

- Act on electronic invoicing in public procurement – Lag (2018:1277) om elektroniska fakturor till följd av offentlig upphandling

Mandatory B2G (Business-to-Government) e-invoicing

Since April 1, 2019, it became legally mandatory for B2G transactions such as government agencies, municipalities, regions to send e-invoices. This mandate is legally in Lag (2018:1277) om elektroniska fakturor till följd av offentlig upphandling.

In Sweden paper or PDF invoices are not generally accepted. For B2G transactions it is required to use its primary standard – PEPPOL BIS Billing 3.0. The DIGG (Agency for Digital Government) acts as the Swedish PEPPOL Authority, overseeing implementation and promoting the use of common SFTI (Single Face To Industry) standards, which often align with PEPPOL.

If your business supplies the Swedish public sector, you must issue electronic invoices via the PEPPOL network. This necessitates the use of an approved service provider or software with PEPPOL Access Point capabilities.

B2B (Business-to-Business) e-invoicing - voluntary but growing

Currently, Sweden does not have a legal mandate for businesses to exchange electronic invoices in B2B transactions. However, many companies in Sweden are encouraging and beginning to require their trading partners to switch to e-invoicing. This helps reduce cost, faster payments, minimizes errors and improves data accuracy. As in B2G transactions, e-invoices can be issued though PEPPOL.

You can book a free consultation with our VAT experts in time that is suitable for you!

What constitutes a valid electronic invoice in Sweden?

The electronic invoice is legally valid in Sweden, when it meets the following criteria:

- the authenticity of its origin – proof of who sent it

- integrity of its content – the assurance it has not been altered

- legibility through out of the period – by the system and people

In addition to these requirements, it must also meet technological and procedural needs. This includes using data formats like PEPPOL UBL, utilizing electronic signatures, and securing your business’s EDI (Electronic Data Interchange) processes. Adhering to these requirements will ensure compliance during audits.

Like paper invoices, electronic invoices must have the same requirements and be stored for legally and securely for needed period.

Invoicing in Sweden - special Swedish scenarios

Besides normal invoicing there are certain transaction in Sweden that have different and specific invoicing rules. It is important to understand these arrangements to maintain compliance.

Self-Billing – Självfakturering

Självfakturering, or the self-billing is an example of transaction where the customer issues the invoice on behalf of the supplier. In Sweden, this is acceptable under some conditions, such as requiring a prior written agreement between the both sides of the transaction.

It is a buyer responsibility to ensure corrects compliance when issuing the invoice. However, the supplier remains responsible for the accuracy of the VAT declared.

Reverse Charge Mechanism - Omvänd Skattskyldighet

Omvänd skattskyldighet, or the reverse charge mechanism, is an example of transaction where the responsibility for accounting for VAT shifts from the supplier to the buyer. In Sweden, it applies to some domestic services, trading specific goods (like mobile phones and integrating circuits above a certain threshold), trading emissions rights, and in B2B cross-border services supplied within the EU.

For reverse charge transactions, the supplier issues an invoice without VAT, including information, such as “omvänd skattskyldighet” and the relevant legal provision. The buyer must account for both input and output VAT on their own VAT return.

Invoicing in Sweden for international transactions

When invoicing customers outside of Sweden:

- Invoicing EU Customers ⇒ Intra-Community Supplies

B2B sales of goods to VAT-registered businesses in other EU Member States are generally zero-rated for Swedish VAT if all of the conditions meet the needs, such as documentation of transport or a valid customer VAT ID. Place of supply rules usually lead to a reverse charge for the customer.

The invoice must include:

- The customer’s valid EU VAT number

- Written information about intra-Community supply

- Reported on a EC Sales List

- Invoicing Non-EU Customers ⇒ Exports

Exports of goods to countries outside the EU are generally zero-rated for Swedish VAT.

The invoice must include:

- A reflection of this 0% VAT

- Support by evidence of export, for example documentation

- A declaration such as “export” or “zero-rated supply”

You can book a free consultation with our VAT experts in time that is suitable for you!

Invoice management, storage, and compliance in Sweden

Record keeping and storage requirements

The Bookkeeping Act (Bokföringslagen) – Swedish law mandates all accounting information, including sales and purchases invoices.

They must be archived for a minimum 7 years after the end of the calendar year to which they relate. They must be stored in paper or electronic form.

How much are the financial penalties imposed by the administration on companies without a registered office in France?

Consequences of non-compliance in Sweden

Compliance is really important in Sweden. Any non-compliance can lead to harsh consequences. Skatteverket may impose financial penalties (skattetillägg) for incorrect or incomplete invoices. Consequently, business might jeopardize their ability to reclaim input VAT or their customer’s ability to deduct VAT.

The future of invoicing in Sweden - Upcoming changes and trends 2025

The invoicing landscape in Sweden, like elsewhere in Europe, is dynamic. Businesses should stay informed about potential legislative updates and evolving technological trends to ensure ongoing compliance and leverage new efficiencies.

Proposed 2025 VAT invoice rule updates

From January, 2025 Sweden refined VAT invoicing rules. It is bring Swedish regulations more closely with the EU VAT Directive, which is harmonizing across all of the Member States.

Businesses should monitor official announcements from Skatteverket and the Swedish government for final legislative confirmation and detailed guidance on these upcoming changes, such as:

- sales through payment machines – purchases made using automated devices such as kiosks or vending machines

- transactions in public transportation – streamlined billing for tickets and payments in public transportation networks

- toll payments – use of tolls on roads and bridges

- in order to streamline VAT documentation, new regulations will apply when electrical power and network services are bundled on a single invoice

The path towards wider B2B e-invoicing mandates?

Even though B2G electronic invoicing is firmly established, the question of a broader B2B e-invoicing mandate in Sweden remains a topic of interest. The European Commission’s “VAT in the Digital Age” (ViDA) initiative proposes a move towards harmonized Digital Reporting Requirements (DRR) and e-invoicing for intra-EU transactions.

Embracing Swedish digital transformation in invoicing

The digital shift towards invoicing. Adopting new e-invoicing solutions will help to integrate with accounting and ERP systems. Electronic invoices will increase automation, reduce manual errors and improve improved cash flow management through quicker payments. It is really important that businesses embrace new technologies to gain an edge and streamline their financial processes.

Source: eInvoicing in Sweden

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.