VAT in Sweden: A comprehensive guide for businesses

Doing business in Sweden? Understanding Value Added Tax (VAT) is critical. This guide simplifies VAT in Sweden, covering everything from registration requirements (including the SEK 120,000 threshold and special rules for foreign companies) and VAT rates to compliance, reporting, and the VAT One-Stop Shop (OSS) scheme for distance sellers. Stay ahead of the curve with updates on the e-invoicing regulations.

- Published on :

- Reading time : 16 min

Understanding VAT in Sweden

Introduction to VAT in Sweden

If you do business in Sweden, whether as a local company or a foreign entrepreneur, understanding Value Added Tax (VAT) is essential. VAT in Sweden is a consumption tax applied to most goods and services at different rates. To avoid penalties, businesses must comply with Swedish VAT registration, invoicing, reporting, and payment obligations.

Check out our article, where we briefly described the basic VAT obligations of taxpayers in Sweden, which we expand upon in this guide:

What is Swedish VAT?

VAT (moms in Swedish) is a consumption tax levied on most goods and services at every stage of production and distribution. It is ultimately borne by the final consumer, while businesses act as intermediaries collecting and remitting VAT to the Swedish Tax Agency (Skatteverket).

VAT in Sweden adheres to the principles of the EU VAT Directive, ensuring a degree of harmonization with other member states. However, Sweden maintains its own specific VAT rates, registration thresholds, and reporting obligations.

How VAT works in Sweden?

The Swedish VAT system operates on a multi-stage basis. VAT is added to the price of goods and services at each point in the supply chain, from the initial raw materials to the final retail sale. Businesses charge VAT on their sales (output VAT) and reclaim VAT on their eligible purchases and expenses (input VAT). The difference between the output VAT collected and the input VAT reclaimed is the amount the business owes to Skatteverket or is entitled to receive as a refund.

For example, imagine a Swedish furniture manufacturer sells a sofa to a retailer for 5,000 SEK + 25% VAT. The retailer pays 6,250 SEK (5,000 SEK + 1,250 SEK VAT). The manufacturer then remits the 1,250 SEK VAT to Skatteverket, after deducting any input VAT they paid on their own business expenses.

This keeps the overall amount of tax revenue in line with the actual value added at each stage.

Sweden's VAT authority - Skatteverket

Skatteverket is the primary authority responsible for regulating and administering VAT in Sweden. Its responsibilities include:

- VAT registration and deregistration

- Processing and auditing VAT returns and payments

- Enforcing VAT compliance through audits and investigations

- Managing VAT refunds for foreign businesses

- Issuing guidance and interpretations of VAT legislation

- Imposing VAT penalties for non-compliance

Any business that engages in taxable activities in Sweden must register with Skatteverket. You can learn more about them on their official website.

VAT registration in Sweden

Who needs to register for Swedish VAT?

VAT registration is mandatory if you:

- run a Swedish business exceeding the VAT threshold

- are a foreign company supplying taxable goods/services in Sweden

- sell goods from Sweden to consumers in other EU countries (distance sales)

VAT Threshold:

- Sweden’s VAT registration threshold increased from SEK 80,000 to SEK 120,000 as of 2025. Companies with a taxable turnover of more than SEK 120,000 per year are required to register for VAT.

- Foreign businesses operating in Sweden must register for VAT before making their first taxable sale, as no VAT threshold applies to them. This includes businesses selling goods online to Swedish consumers or providing services within the country.

How to register for VAT in Sweden?

For swedish businesses:

Businesses can register for VAT through Skatteverket’s online portal. You will typically need to provide the following documents:

⇒ Business registration certificate

⇒ Articles of association

⇒ Bank details

For foreign businesses:

Foreign businesses must register for VAT before making any taxable supplies in Sweden. Whether a fiscal representative is required will be determined by the businesses location:

⇒ EU companies – no fiscal representative needed

⇒ Non-EU companies – may require a local fiscal agent

Registration processing time: 2–6 weeks

Special VAT registration rules in Sweden for foreign companies

Foreign companies face specific VAT obligations when operating in Sweden. You likely will need to register for VAT in Sweden if you:

- Sell goods to Swedish consumers via e-commerce or distance selling channels.

- Store inventory within Sweden (e.g., using Amazon FBA).

- Provide electronically supplied services (ESS) to Swedish consumers.

- Conduct certain types of construction or installation work.

Companies located outside the EU may be required to appoint a tax representative to handle their VAT obligations in Sweden. This representative acts as a liaison with Skatteverket and ensures compliance with all relevant VAT rules.

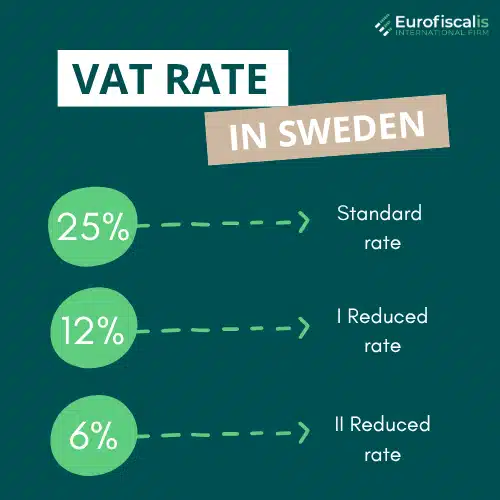

VAT rates in Sweden

Sweden applies three VAT rates plus exemptions:

| Rate | Category |

|---|---|

| 25% | Most goods and services |

| 12% | Food, hotel stays, restaurants, non-alcoholic beverages |

| 6% | Books, newspapers, passenger transport, cultural events |

VAT-exempt goods and services in Sweden

Certain services are exempt from VAT, meaning no VAT is charged, but input VAT cannot be reclaimed. Examples include:

- Medical services

- Financial and insurance services

- Education and training

For a comprehensive list of VAT-exempt activities, refer to Skatteverket’s official guidance Skatteverket’s list of VAT exemptions

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT compliance and reporting in Sweden

Understanding the nuances of VAT compliance in Sweden is essential for running a successful and legal business.

VAT invoicing rules

Swedish VAT regulations prescribe specific requirements for VAT invoices. To meet compliance standards, your invoices must include:

- The seller’s name, address, and VAT identification number

- The buyer’s name, address, and VAT identification number (if applicable)

- A unique invoice number

- The date of issue

- A clear description of the goods or services provided

- The quantity and unit price of each item

- The VAT rate applied

- The total VAT amount due

2025 Update in Sweden – e-invoicing

Sweden will introduce new digital invoicing rules to align with EU e-invoicing requirements. When it will be possible (regulations will be published) we will inform you about it in our blog. Follow us!

VAT filing and deadlines in Sweden

The frequency of VAT filing in Sweden depends on your company’s annual turnover:

| Turnover | Filing frequency | Due date |

|---|---|---|

| >40 million SEK | Monthly | 26th of following month |

| 1–40 million SEK | Quarterly | 26th of following month |

| <1 million SEK | Annually | 12 May of following year |

The frequency of your VAT reporting will be communicated by the Skatteverket.

A fine of SEK 500 to SEK 1,000 per declaration may be imposed for failing to file a VAT return. In Sweden, late VAT payments incur a penalty of 1.25% interest plus an additional 15% per month overdue.

Non-resident businesses registered for VAT in Sweden must comply with local bookkeeping and VAT rate regulations.

This comprises:

- Correctly billing customers for products or services in compliance with the Swedish Time of Supply VAT Act

- Issuing electronic invoices with customer approval

- Accounts and records must be maintained for a minimum of seven years

- The Swedish VAT Act’s obligations for invoice disclosure

VAT payment methods to Skatteverkt

VAT payments must be made via bank transfer to Skatteverket before the deadline.

- Foreign companies must make VAT payments in Swedish kronor (SEK) and include a reference number for correct processing.

VAT record-keeping requirements

Businesses are required to retain all VAT-related records for a minimum of 7 years. These records can be stored in electronic or paper format. This includes invoices, VAT returns, payment records, and any other documentation relevant to your VAT transactions.

VAT for foreign businesses selling in Sweden

Distance selling to Sweden and the VAT One-Stop Shop (OSS)

EU-based distance sellers can use the VAT One-Stop Shop (OSS) scheme to simplify VAT reporting. The OSS scheme allows you to report and pay VAT on all your EU distance sales through a single VAT return in your home country, rather than registering for VAT in each individual member state. However, non-EU sellers are typically required to register directly for VAT in Sweden.

Cross-border business activities in Sweden

Foreign businesses involved in cross-border transactions with Sweden must comply with all applicable EU VAT regulations. This includes import/export declarations, reverse charge mechanisms, and other specific rules governing the movement of goods and services across borders.

A written commitment to submit income statements to the Skatteverket must be given by foreign financial firms planning to engage in cross-border commercial operations in Sweden to the Financial Supervisory Authority (Finansinspektionen).

When a corporation notifies the Financial Supervisory Authority that it plans to conduct business in Sweden, it must provide this written assurance.

Which income statement formats are required in Sweden of a foreign financial institution?

The deadline for submitting income statements is January 31 of the year after the relevant income year.

For both deceased people’s estates and private individuals residing in Sweden, the following income statements must be submitted:

- form KU20 – interest income

- form KU25 – interest expense

- form KU21 – bonds

- form KU30 – standard rate of capital income on investment savings account

- form KU31 – dividends, etc. on part-ownership rights

- form KU32 – divestment of part-ownership rights / bonds

- form KU34 – divestment/issuance/completion of options

- form KU35 – completion of futures

- form KU40 – divestment (sales) of shares in investment funds

- form KU41 – standard rate of capital income on shares in investment funds

- form KU50 – pension savings

- form KU52 – foreign insurance or foreign PEPP

- form KU80 – payment from abroad

- form KU81 – payment abroad

The following income statements must be submitted for legal entities with fiscal domicile in Sweden:

- form KU50 – pension savings

- form KU52 – foreign insurance or foreign PEPP

- form KU80 – payment from abroad

- form KU81 – payment abroad

Income statements KU80 and KU81 must be submitted for legal entities, natural persons and estates of deceased persons for the following direct or indirect payments above SEK 150,000:

- international transfers from Sweden by parties with unlimited tax liability here

- international transfers to Sweden to parties with unlimited tax liability here

- domestic transfers within Sweden between parties with unlimited tax liability here, and parties with limited tax liability here

Please be aware that just the most popular forms of income statements are included in the above list, which is not exhaustive.

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT refund for foreign businesses in Sweden

Non-EU companies that have incurred VAT expenses in Sweden may be eligible to claim a refund. The VAT refund process involves submitting an application to Skatteverket, along with supporting documentation demonstrating the VAT expenses incurred.

The refund process follows the 13th Directive for non-EU businesses, while EU businesses follow the 8th Directive refund procedure.

Criteria for VAT refunds in Sweden

- If a foreign company is not registered for VAT in Sweden, it is eligible to request for a VAT refund.

- In Sweden, it lacks a permanent location or set establishment.

- Business-related expenses, such as travel, conferences, petrol, lodging, trade shows, or subcontracted services, have resulted in VAT charges.

- In Sweden, the VAT had nothing to do with activities that would necessitate VAT registration, including local sales of products.

- Certain expenses, such VAT on non-business-related goods or client entertainment charges, might not be recoverable.

How to apply for a VAT refund in Sweden?

Applications for VAT refunds from foreign companies must be sent to the Swedish Tax Agency (Skatteverket) via:

EU companies: Submit an application via the tax site in their home nation, which then sends it to Sweden.

Companies outside of the EU: Use Form SKV 5800 to apply directly to Skatteverket.

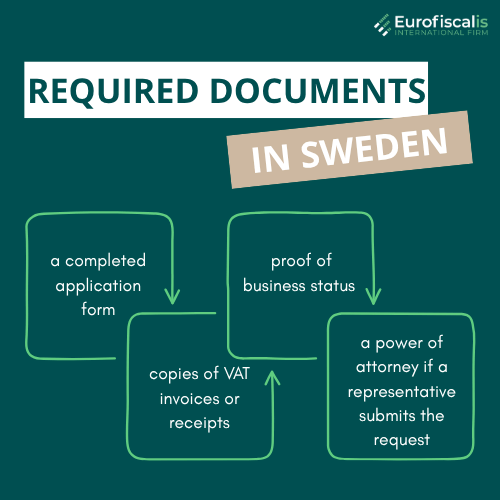

Required documents:

- A completed application form.

- Copies of VAT invoices or receipts.

- Proof of business status (e.g., Certificate of Tax Registration from home country).

- A power of attorney if a representative submits the request.

Submission deadlines in Sweden:

⇒ Apply by September 30 of the year after the refund period if you are an EU business, and by June 30 of the following year if you are a non-EU business.

Time spent on processing and refunds:

⇒ Skatteverket typically takes up to 4 months to process applications in their entirety. If more information is needed, the processing period may be up to 8 months.

Minimum sums for refunds in Sweden

- Applications must cost at least SEK 500 for a full year.

- Applications must be at least SEK 4,000 for shorter time frames (quarterly, for example).

- Bank transfers in SEK (Swedish kronor) are used to make refunds. Applications that are inaccurate or lacking information may be delayed or rejected.

Intrastat declarations in Sweden

Businesses moving goods across Swedish borders may be required to file Intrastat declarations. Intrastat returns are due by the 10th of each month. Late submissions may result in penalties.

For arrivals, the annual barrier for submitting Intrastat in 2025:

- Return is SEK 15,000,000,

- Dispatches, it is SEK 4,500,000.

Reverse charge in Sweden

Reverse charge shifts the responsibility for VAT payment from the supplier to the buyer, ensuring that VAT is accounted for correctly in cross-border and certain domestic transactions.

Reverse Charge - When does it apply?

- Cross-border business-to-business (B2B) sales are when a company in the EU offers services to another company in the EU.

- When importing from non-EU nations, the importer is responsible for paying the VAT at customs clearance.

In Sweden domestic reverse charge is applicable to:

– services for installation and construction.

– sales of specific technological gadgets, such as tablets and cell phones.

– trafficking in garbage and scrap metal.

– large transactions in some businesses that exceed SEK 100,000.

How can you report a VAT reverse charge?

- The phrase “Reverse charge applies” should be included on the supplier’s invoice rather than VAT.

- Buyer’s VAT return- Under the reverse charge procedure, both output VAT (collected) and input VAT (reclaimed) must be included.

- The reverse charge amounts must be reported in Box 30 (output VAT) and Box 48 (input VAT deduction) of the Swedish VAT return (Momsredovisning).

Swedish reverse charge - Mistakes to avoid

- Incorrectly charging VAT on transactions where reverse charge is applicable.

- Not providing a legitimate VAT number on invoices.

- The reverse charge VAT was reported incorrectly in the incorrect areas of the VAT return.

Businesses can seek expert VAT advising services or refer to Skatteverket’s official VAT guidelines for further information.

VAT penalties and non-compliance risks in Sweden

Consequences of late or incorrect VAT filing

Non-compliance with Swedish VAT regulations can lead to the following penalties:

- Late filing penalties – up to 500 SEK per delayed return

- Interest on late payments – calculated at 15% per annum

- Severe cases – tax fraud investigations

VAT fraud and tax evasion in Sweden

Sweden enforces strict measures to prevent VAT fraud, including:

- Cross-border data sharing within the EU

- Random audits and compliance checks

- Harsh penalties for fraudulent activity

The Swedish statute of limitations

The amount of time that the government has to look into a tax liability is known as the statute of limitations. Typically, a taxpayer might return within this time to apply for a tax credit.

In Sweden, the statute of limitations is six years. This implies that up to six years prior to the current year, both the taxpayer and the tax authorities may request a review of former reporting periods.

In a similar vein, taxpayers in Sweden have six years to apply for a tax credit.

VAT updates and future changes in 2025 in Sweden

As of January 1, 2025, Sweden’s VAT invoicing laws will undergo significant changes, particularly affecting simplified invoices. These modifications address particular situations in Sweden while also being in line with more general EU VAT regulations.

2025 VAT invoice regulation updates

Repeal of SKVFS 2005:14

SKVFS 2005:14 will be repealed under SKVFS 2024:26, effective from December 2024, as per Skatteverket’s announcement on November 21, 2024.

New rules for simplified invoices

Starting in 2025, Sweden will introduce mandatory e-invoicing to align with EU digital reporting standards and improve VAT transparency.

Who will be impacted?

- Swedish companies that sell both locally and internationally.

- Foreign companies that must pay VAT in Sweden.

- Online retailers with operations in Sweden.

- In Sweden, invoices are issued by both large and small businesses.

- Vendors to government agencies (B2G billing is already required).

When?

→ January 1, 2025 – Businesses must adopt structured e-invoicing in compliance with EU standards.

→ Mid-2025 onwards – Further real-time digital reporting obligations may be introduced.

Skatteverket’s updated regulations will cover:

- sales via payment machines,

- public transport transactions,

- toll payments,

- combined electrical power and network services on one invoice.

Technical specifications:

– Invoices must be in authorized structures or XML format (PEPPOL BIS Billing 3.0).

– Companies need to connect their accounting and ERP systems to tax authorities.

– Mandatory VAT data (seller/buyer details, tax breakdown, unique invoice number) must be included in invoices.

EU Context

The changes comply with the EU VAT Directive, allowing simplified invoices for smaller transactions with key details included. Sweden aligns with EU standards to facilitate Single Market trade.

Additional resources for Sweden

Contacting Skatteverket for VAT assistance ⇒ for VAT inquiries, contact Skatteverket’s business tax department via email or phone.

Source: VAT in Sweden

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.