VAT in the United Kingdom: A comprehensive guide for businesses

Tax representation in the United Kingdom is essential for fully understanding VAT in the UK. Learn more about the requirements for businesses with a taxable turnover exceeding £85,000. The UK applies VAT rates of 20%, 5%, and 0%, with returns submitted via Making Tax Digital (MTD). Special schemes, such as the Flat Rate Scheme, help simplify reporting. Compliance with VAT rules, especially in international trade, is crucial to avoid penalties.

- Published on :

- Reading time : 20 min

VAT in the United Kingdom - what is VAT and how does it work?

Definition and purpose of VAT in the UK

Value Added Tax (VAT) is a consumption tax levied on most goods and services sold in the UK. It’s designed to be paid by the end consumer, but businesses are responsible for collecting and remitting the VAT to HM Revenue and Customs (HMRC). VAT (20%, 5%, and 0%) is added to the price of goods and services at various rates depending on the nature of the transaction.

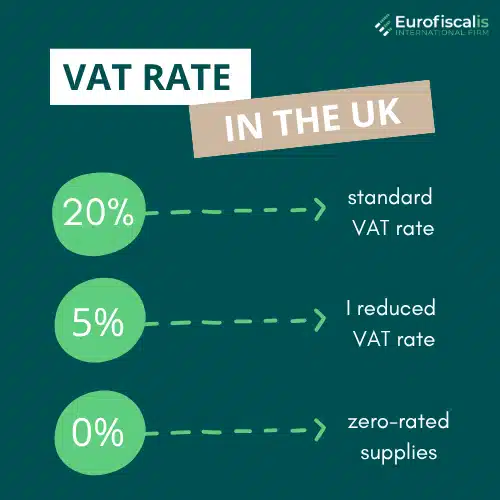

VAT rates in the United Kingdom

According to HMRC, the UK has three VAT rates:

- Standard rate 20% – applied most goods and services, including clothing, electronics, fuel

- Reduced rate 5% – applied to specific products like:

- child car seats

- some social housing

- some social services

- supplies of electricity, natural gas, and district heating networks, but only for domestic use

- some energy-efficient items used for domestic purposes

- LPG gas and heating oil used in households

- some types of renovations in private apartments

- some types of medical equipment intended for disabled persons

- Zero-rated supplies 0% – includes:

- domestic and international passenger transport

- newspapers and magazines

- basic minimally processed food products

- water supply

- some medical articles

- some children’s products

- live animals

- animal feed

- Exempt supplies – for example:

- entrance fees for certain cultural events (museum visits, art exhibitions, zoos, and performances),

- care or treatment provided by a qualifying institution (hospital, hospice, or nursing home),

- health services provided by registered doctors, dentists, optometrists, pharmacists, and other healthcare professionals,

- education, vocational training, and other related services provided by an authorized body (school, college, or university).

VAT registration in the United Kingdom

Who needs to register for VAT in the UK?

In certain cases, enterprises are required to register for VAT with HMRC:

- If taxable turnover exceeds £85,000 in a 12-month period.

- If you are based outside the UK but sell goods or services in the UK.

- If you import goods worth over £85,000 from the EU (subject to post-Brexit changes).

- If you supply digital services to UK consumers.

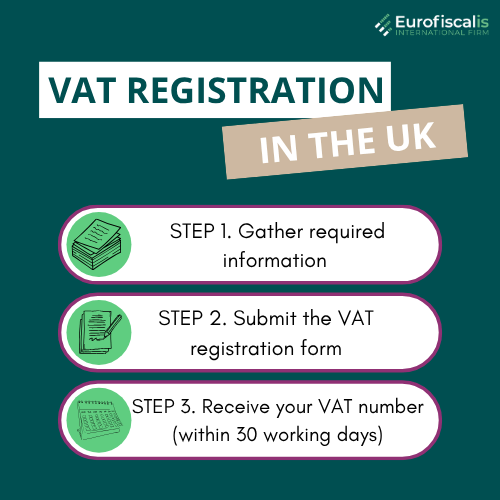

How to register for VAT in the United Kingdom?

Businesses must follow a structured process for registering for VAT in the UK, which includes gathering business details, submitting an application, and receiving a VAT number from HMRC:

Step 1. Gather required information such as business details, expected turnover, and bank account information.

Step 2. Submit the VAT registration form online using HMRC’s portal.

Step 3. Receive Your VAT Number – HMRC will issue your VAT number after processing your application (typically within 30 working days).You will also be notified about your VAT accounting period.

VAT registration for EU and non-UK businesses

Non-UK enterprises must register for VAT in the UK if they sell products or services to UK customers. Importantly, firms who operate on online marketplaces such as Amazon and eBay are subject to unique VAT regulations. These include new VAT restrictions for items supplied via online platforms.

Changing VAT registration details

If any of your business details change – such as your company address or ownership structure – you must inform HMRC to update your VAT registration details. Changes must be reported within 30 days.

Cancelling or transferring VAT registration

If your taxable turnover falls below the deregistration threshold (£83,000), or if you stop trading, you may need to cancel your VAT registration. Furthermore, when selling a business, VAT registration can be transferred to the new owner.

You can book a free consultation with our tax representative in time that is suitable for you!

VAT thresholds in the United Kingdom

Foreign companies (non-residents of the United Kingdom)

In the case of foreign companies (non-residents of the United Kingdom) from January 2021, the VAT registration threshold in the UK is £0. If you register as a VAT taxpayer, you will be subject to certain obligations.

Starting from your effective registration date, you must:

- charge the appropriate amount of VAT,

- pay the due VAT to HMRC,

- submit quarterly VAT returns,

- keep VAT records and a VAT account.

VAT threshold registration in the United Kingdom for non-foreign companies

| Circumstance | Threshold | What to do: |

|---|---|---|

| Total taxable turnover | More than £90,000 | Register for VAT |

| Bringing goods into Northern Ireland from the EU ("acquisitions") | More than £90,000 | Register for VAT |

| Selling goods from Northern Ireland to consumers in the EU ("distance selling") | Total sales across the EU over £8,818 | Register for VAT in EU countries |

| VAT-registered - taxable turnover | Less than £88,000 | Cancel VAT registration (optional) |

VAT accounting scheme thresholds

| Scheme | Threshold to join scheme | Threshold to leave scheme |

|---|---|---|

| Flat Rate Scheme | £150,000 or less | More than £230,000 |

| Cash Accounting Scheme | £1.35 million or less | More than £1.6 million |

| Annual Accounting Scheme | £1.35 million or less | More than £1.6 million |

If you sell items from Northern Ireland to VAT-registered enterprises in the EU, you must follow additional VAT reporting requirements.

English VAT schemes

Simplified VAT schemes in the United Kingdom

HMRC offers several VAT schemes designed to simplify the VAT accounting process:

- Flat rate scheme: A simplified scheme where businesses pay a fixed percentage of their turnover, rather than calculating VAT on individual transactions.

- Cash accounting scheme: Allows businesses to pay VAT on sales when they receive payment, rather than when the sale is made.

- Annual accounting scheme: Allows businesses to submit one VAT return per year, rather than quarterly.

- Margin scheme: For second-hand goods, antiques, and works of art, this scheme calculates VAT on the margin (the difference between the sale price and purchase price).

These schemes can simplify VAT reporting and improve cash flow for certain types of businesses.

You can book a free consultation with our VAT experts in time that is suitable for you!

Charging and collecting VAT in the United Kingdom

VAT in the United Kingdom - what is charged on?

VAT is usually levied on the sale of goods and services, unless they are exempt or zero-rated. Businesses must ensure that they use the right VAT rates, as using the incorrect rate can lead to errors on VAT returns and penalties from HMRC.

How much English VAT you must charge?

The amount of VAT you must charge depends on the nature of your goods or services. The standard rate applies to most sales, while reduced or zero rates apply to specific products. Businesses must factor in the appropriate VAT rate when pricing products and services, and ensure they issue VAT-compliant invoices to customers.

English VAT returns and compliance

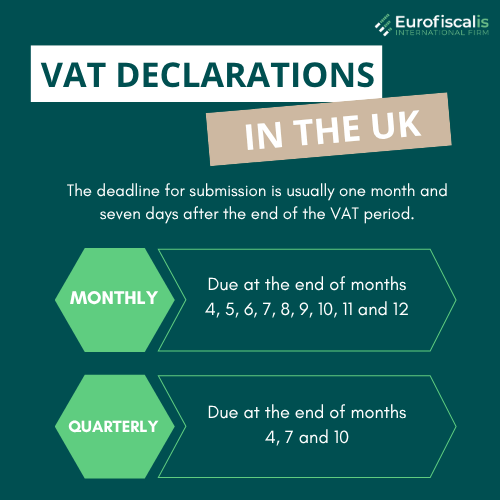

How to submit a VAT return in United Kingdom?

After registration in the UK, businesses must submit VAT returns quarterly or monthly, depending on their accounting scheme. The returns are filed online using HMRC’s Making Tax Digital (MTD) system, and the deadline for submission is usually one month and seven days after the end of the VAT period.

What to include in English VAT return?

Your VAT return should include the following:

- Output VAT refers to the VAT you charged on sales.

- Enter the VAT you paid for your purchases.

- Net VAT payable/refundable – the difference between output and input VAT, which can be paid to HMRC or reclaimed.

- Important:

Accurate record-keeping is vital for avoiding errors on your return.

Payment VAT return deadlines in United Kingdom

| Payment | Deadline |

|---|---|

| Monthly | Due at the end of months 4, 5, 6, 7, 8, 9, 10, 11 and 12 |

| Quarterly | Due at the end of months 4, 7 and 10 |

| Final payment (balancing payment) - the difference between your advance payments and the actual VAT bill confirmed on your VAT Return. | Within 2 months of month 12 |

Most companies submit quarterly VAT returns. Monthly returns are typically required for companies with very high turnover (over £2.3 million). This is known as the “Payment on Account” regime, where payments are made in months 1 and 2 based on a scheduled amount, with the balance settled in month 3.

Either 10% of your expected monthly VAT cost or 25% of your quarterly VAT charge is paid with each payment. The amount is based on previous VAT returns (or estimated if you’re new to VAT).

Correcting errors in VAT returns

If an error is found in a VAT return, businesses can correct the mistake in the next VAT return if the discrepancy is less than £10,000. For larger errors, you must contact HMRC directly to rectify the situation.

Late VAT returns and penalties in United Kingdom

Failure to submit VAT returns on time can result in penalties. Businesses will also face interest charges if VAT is paid late. It is crucial to stay on top of submission deadlines to avoid additional costs.

Until you reach the penalty point threshold, you will be penalised one point for each late return.

You will be assessed a £200 penalty upon reaching the threshold. Each further late submission while you are at the threshold will result in a £200 penalty.

VAT refunds and reclaims in the United Kingdom

How to claim a VAT refund in the UK

If your company pays more VAT on purchases than it does on sales (i.e., input VAT exceeds output VAT), you may be entitled to a VAT refund. Refunds are processed through the VAT return submission.

Recording and reclaiming VAT on purchases

To reclaim VAT on purchases, businesses must maintain valid VAT invoices and receipts for all expenses. This includes any goods or services bought from other VAT-registered businesses.

VAT for international trade

VAT on imports and exports in United Kingdom

- UK import VAT ⇒ Businesses that import goods into the UK must pay VAT on the import value. Postponed VAT Accounting (PVA) enables firms to defer import VAT payments until the VAT return is filed, hence increasing cash flow.

- UK export VAT ⇒ Goods sold outside the UK are zero-rated for VAT purposes. To guarantee compliance, enterprises must retain proof of export.

Intrastat statements in United Kingdom

After Brexit, companies that import more than £1.5 million worth of products from the EU into the UK (not including Northern Ireland) are need to file an Intrastat report. Intrastat declarations are no longer necessary for companies exporting goods into the EU. If the threshold is exceeded, any company that imports or exports goods between Northern Ireland and the EU will have to file Intrastat returns.

The thresholds are:

- £500,000 for imports

- £250,000 for exports

Reverse charge in the United kingdom

For some goods and services, the customer becomes responsible for reporting and paying VAT instead of the supplier under the UK’s reverse charge method. Services bought by UK VAT-registered companies abroad are covered by this. In this instance, the UK VAT must be included on the customer’s VAT return rather than the supplier’s.

VAT on selling or moving goods between Northern Ireland and the EU

Following Brexit, Northern Ireland operates under a unique VAT regime due to the Northern Ireland Protocol. Goods sold or moved between Northern Ireland and the EU are subject to special VAT regulations, aligning with certain EU VAT rules.

Common VAT mistakes

- Charging incorrect VAT rates on goods or services.

- Filing VAT returns late and incurring penalties.

- Failing to register for VAT when required.

- Not keeping proper VAT records, which can result in penalties.

Source: VAT in the United Kingdom

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.