VAT in Ireland: everything you need to know

Thinking of doing business in Ireland? VAT in Ireland was introduced on November 1st, 1972, replacing turnover tax. It is a consumption tax which applies to goods and services and is based on EU directives. If you want to operate as a business in Ireland, understanding Irish VAT is a crucial first step.

- Published on :

- Reading time : 10 min

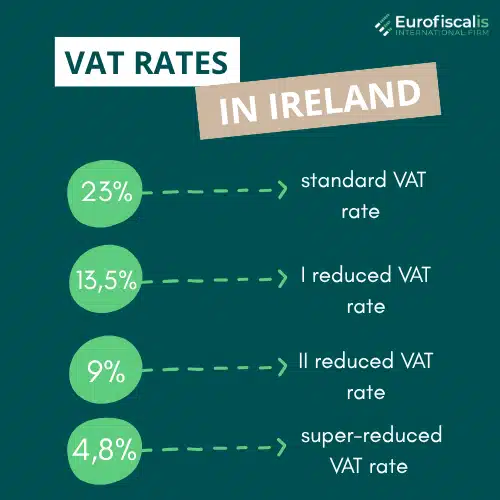

VAT rates in Ireland

In Ireland, there are several VAT rates, which align with EU directives. As a VAT registered supplier, you must apply the correct VAT rate and pay collected tax to the Irish authorities.

Standard rate (23%)

The standard VAT rate in Ireland – 23%. It applies to the majority of goods and services.

I reduced rates (13.5%)

This first reduced rate – 13.5% applies to specific goods and services, such as:

- Electricity

- Restaurant and catering services

- Repairs

- Cleaning services

- Construction work

- Cultural and sporting events

II reduced rates (9%)

A second reduced rate – 9% applies to goods and services, such as:

- Newspapers

- Electronically supplied publications (for example, e-books)

- Sporting Facilities

It was also previously extended for the hospitality sector and certain energy supplies.

Super-reduced rate (4.8%)

A super-reduced rate – 4.8% applies to livestock, intended for use as foodstuffs and agricultural purposes.

The 0% VAT rate in France applies to international and intra-EU transport, excluding road and inland waterway transport.

Zero-rated (0%)

There are certain goods and services that you can apply for 0%. VAT is charged at 0%. Even though there is nothing added to the price, businesses can reclaim the input VAT on related expenses.

- Exports

- Intra-Community supplies

- Certain foodstuffs

- Books

- Children’s clothing and footwear

- Oral medicines

- E-books/audiobooks

Exemptions in Ireland

When it comes to exemptions – that means that no VAT is charged. Businesses do not reclaim input VAT on related expenses.

- Financial services

- Medical services

- Healthcare services

- Education

- Certain cultural activities

- Postal services

- Betting

- Gambling

- Property transactions

- Social services

Check VAT rates in whole EU!

VAT registration in Ireland

Who needs to register for VAT in Ireland?

Irish VAT registration is mandatory for businesses that exceed turnover thresholds within 12-month period:

- Services: €37,500

- Goods: €75,000

- Non-established Entities: A nil threshold applies, meaning they must register from their first taxable supply in Ireland.

- Distance Selling (EU-wide): A €10,000 threshold applies to pan-EU digital services and goods, requiring businesses to register for a One Stop Shop (OSS) return. Businesses can also choose to register for VAT voluntarily, even if they are below the mandatory thresholds.

You can book a free consultation with our VAT experts in time that is suitable for you!

How to register for VAT in Ireland?

If you have an established business ⇒ you need to register online via the Revenue Online Service (ROS) using TR1 or TR2 forms.

If you have a non-established business ⇒ you need to use a specific paper forms like TR1(FT) or TR2(FT). The registration becomes effective from a specified date.

What are TR1 and TR2 forms?

These are tax registration forms used in Ireland for registering a business for tax purposes, including income tax and VAT.

TR1 ⇒ used for individuals, partnerships, trusts, unincorporated bodies

TR2 ⇒ used by limited companies

Irish group registration

If the entities are related, they can opt for – VAT group registration. That means they are treated as a single taxable person for VAT purposes.

VAT in Ireland - compliance and obligations

Irish invoicing requirements

Irish VAT invoices must include specific details:

- Date of issue

- Unique invoice number

- VAT numbers of both the supplier and the customer

- For reverse charge transactions or intra-Community supplies, the VAT ID of the customer and a note about the application of specific options

- Description of the goods or services

- Quantity and nature of goods and services

- Net value of the supply

- Applicable VAT rate

- Amount of VAT

- Gross total payable

If you issue in a foreign currency, you must indicate the EUR amount.

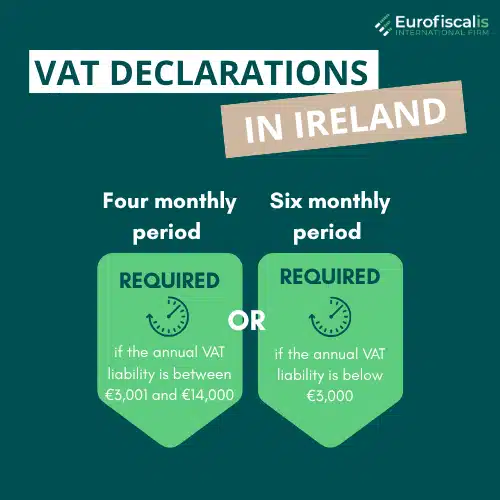

Filing VAT returns (VAT3) in Ireland

In Ireland most businesses file VAT returns bi-monthly. However, if the company is a constant repayment position, they might be required to submit VAT returns on a monthly basis.

- Four monthly period ⇒ if the annual VAT liability is between €3,001 and €14,000

- Six monthly period ⇒ if the annual VAT liability is below €3,000

Deadline for filing and paying is the 19th day of the month following the end of the VAT period.

If your business is filing electronically, the deadline for filing is extended to the 23rd day of the month.

The electronic filing is required through ROS.

Each business has to submit an Annual Return of Trading Details.

Irish VAT repayments

Businesses have the option to claim VAT refunds for input VAT paid on their expenses. However, this option is subject to limitations. Input VAT can only be reclaimed within 4 years.

You can book a free consultation with our VAT experts in time that is suitable for you!

Retaining Irish invoices

Businesses must retain Irish invoices that are:

- Issued promptly, accurately and comprehensively

- Retained for a minimum 6 years – covering all sales and purchases

- Electronic invoices must be accompanied by a proper digital signature or other valid authentication methods (where required).

Specific VAT scenarios – understanding Irish VAT better

VAT on digital services

B2C Sales to Irish Customers | B2B Sales | One Stop Shop (OSS) |

|---|---|---|

Non-resident businesses that sell digital services to Irish consumers are subject to Irish VAT – 23% rate. They must register for VAT upon their first taxable sale unless operating under the OSS scheme. | The reverse charge mechanism often applies – it shifts the VAT liability to the business customer. | The OSS allows businesses that supply B2C digital services and goods to declare and pay VAT in a single Member State. It simplifies VAT obligations. |

Irish VAT on imports and exports

Imports | Exports | Intra-Community Acquisitions and Supplies |

|---|---|---|

VAT is payable at the point of importation, typically at the same VAT rate as domestic suppliers. Postponed accounting arrangements allow VAT registered traders account for import VAT on their VAT returns. | Goods dispatched outside the EU VAT area are zero-rated (0%). However, businesses must have and keep all the evidence of export to qualify for this specific rate. | Specific rules apply to the movement of goods and services between EU Member States. |

Reverse charge mechanism in Ireland

The reverse charge mechanism often applies, shifting the VAT liability to the business customer, in certain B2B transactions, particularly for services received from abroad and some specific domestic supplies.

Input VAT Deduction

Your business can reclaim VAT paid on expenses that are related to its own taxable supplies. However, certain restrictions apply, such as VAT on passenger motor vehicles and petrol, which are typically not reclaimable.

Penalties and risks of non-compliance in Ireland

Non-compliance with Irish VAT regulations can result in penalties, including fines for late registration, late filing, or incorrect returns.

Penalties and risks of non-compliance in Ireland, such as:

- For incorrect VAT records ⇒ between €3,000 and €5,000, based on behaviour

- For acquiring goods from abroad ⇒ €4,000

In Ireland there is a long list of penalties of specific offences. The majority of payments for penalties are €4,000. However, it is best to check the official Revenue website frequently for the most up-to-date information on penalties.

Source: Revenue

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.