Invoicing in Slovakia - learn how to do it right

Invoicing in Slovakia is currently under a significant transformation. This country, like the rest of the EU, is moving from traditional paper invoicing towards electronic system. Nowadays, businesses that are operating in Slovakia need to understand both – the current VAT invoicing requirements and the new shift into eInvoicing. This is crucial to ensure their compliance and avoid penalties. This guide covers essential rules for issuing invoices, both today and in the future.

- Published on :

- Reading time : 10 min

Future mandatory eInvoicing (Business-to-Business - B2B)

The most significant change in Slovakia is the introduction of mandatory eInvoicing for domestic Business-to-Business (B2B) transactions.

When is the implementation date of mandatory Slovakian eInvoicing?

It is scheduled to take effect on January 1, 2027. From this day and onward, invoices for B2B transactions will only be valid if they:

- Contain required information (based on the VAT Act)

- Are issued, sent, and received in electronic format

- Are suitable for automated digital processing

Model and reporting in Slovakia

The FA – Finance Administration in Slovakia is developing a “5-corner, decentralised e-invoicing model.” This model, from January 2027, will enable the exchange e-invoices between businesses and to the Slovakian tax authorities. It will concurrently involve real-time e-reporting of B2B transactions.

Slovakia adopts Peppol network

Slovakia is adapting the Peppol network for its decentralized e-invoicing system. This system will establish the FA as the national Peppol Authority based on the Peppol network (legislation I expected to be by summer 2025). The solution uses a five-corner approach to ensure flexibility and compliance while facilitating structured invoice interchange through certified suppliers without buyer pre-approval.

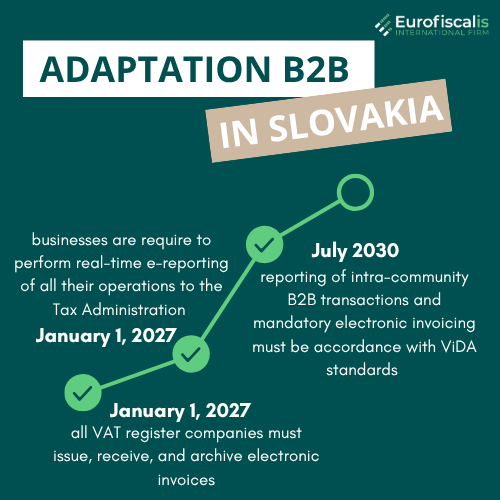

Slovakian timeline of adaptation B2B

- January 1, 2027 ⇒ all VAT register companies must issue, receive, and archive electronic invoices EN 16931

- January 1, 2027 ⇒ businesses are require to perform real-time e-reporting of all their operations to the Tax Administration

- July 2030 ⇒ reporting of intra-community B2B transactions and mandatory electronic invoicing must be accordance with ViDA standard

Electronic invoicing in Slovakia - digital transformation

Slovakia, like other EU countries, is pursuing a strategy for digitalization, aligning with broader European Union initiatives to enhance tax compliance and efficiency.

Current eInvoicing Landscape Business-to-Government - B2G and Government -to-Government - G2G

The journey towards comprehensive eInvoicing in Slovakia began with the public sector.

Since April 2023, Slovakia has progressively implemented mandatory electronic invoicing for certain transactions occurring between businesses and public entities (B2G), as well as between government institutions themselves.

If the B2G transactions exceed €5,000 – it is a mandatory eInvoicing.

Slovakian eInvoicing platform

Electronic invoices are processed through Information System for Electronic Invoicing (IS EFA) which is a government’s interface. The legal basis is Act No. 215/2019 on guaranteed electronic invoicing and the central economic system, which came into force on August 1, 2019. This act is also transposed Directive 2014/55/EU into Slovak law, so it is complying with the European eInvoicing standard.

EInvoices requirements in a VAT Control Statement

- All transactions (there is no threshold) – simplified must be lower than EUR 3000

- B2B (Business-to-Business)

- B2G (Business-to-Government)

- B2C (Business-to-Client)

- Sales

- Purchase

- Intra-EU transactions

- Domestic transactions

What information must be submitted?

- Invoice date

- Invoice number

- Type of transaction

- Tax rate

- Total amount of payment

- VAT amount payable

- Partner’s VAT number

You can book a free consultation with our VAT experts in time that is suitable for you!

Understanding traditional invoicing in Slovakia

Slovak core principles and legal basis

Invoices in Slovakia serve as documentation for substantiating claims for input tax deductions. Slovak VAT payers are obligated to issue invoices for all taxable supplier. It is also confirmed by the EU VAT Directive, which ensures harmonization across member states.

Mandatory invoice requirements in Slovakia

A Slovak invoice must contain:

- The full name and address of both the seller (supplier) and the customer, alongside their respective VAT registration identification numbers, are mandatory.

- Each invoice must bear a unique, sequential number, ensuring traceability and preventing duplication.

- The invoice must clearly state its date of issuance. Additionally, if different from the issuance date, the actual date of the supply of goods or services, or the payment date, must also be indicated.

- Description of the nature of the goods or services provided, including their quantity or extent, is required.

- This also extends to the unit price exclusive of VAT and any applicable discounts or rebates.

- Invoices must detail the taxable amounts that correspond to each applied VAT rate.

- The specific VAT rates used, and the total VAT payable, must be clearly expressed in Euros.

- Supplies under a special VAT scheme should also be noted.

- For transactions where a zero VAT rate applies, such as exports, supplies under a reverse charge mechanism, or intra-community supplies, specific details supporting the zero VAT application must be included.

- The overall total value of the invoice, inclusive of VAT, must be clearly stated.

Helpful phrases:

“the supply is exempt from VAT” or “dodanie je oslobodené od dane”

“self-billing” or “vyhotovenie faktury odberateom”

“reverse charge” or “prenesenie danovej povinnosti”

Invoicing in Slovakia - simplified invoices

They are permitted for sales of EUR 400 or less, and only require the gross amount and the VAT rate.

What is a simplified invoice?

- Documents issued for the supply of goods/services – for not more than EUR 100 in cash

- Receipt from an electric cash register – for not more than EUR 1000 in cash or EUR 1600 electronically

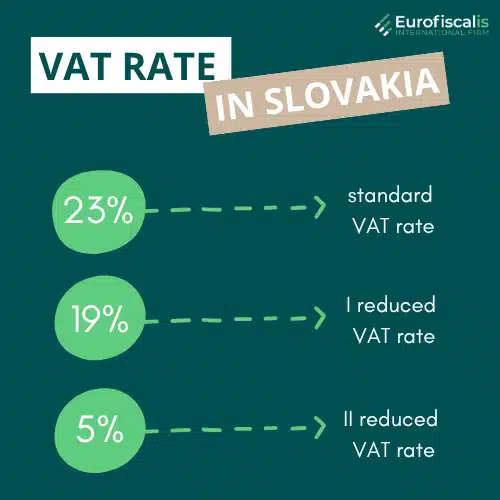

Standard VAT rate – 23%

- Applies to most goods and services, including electronics, clothing, household products, and professional services.

19% VAT Rate applies to:

- food,

- electricity supply,

- restaurant and catering services associated with the serving of beverages, with the exception of the serving excluding alcoholic beverages with over 0.5% alcohol content

5% VAT rate introduced for specific essential goods, including:

- certain food products

- select medical and hygiene products

- the sale of books,

- accommodation services,

- goods and services within the framework of social economy activities,

- selected services such as entrance fees to sports events,

- restaurant and catering services associated with the serving of meals

Issuance deadlines in Slovakia

- For intra-Community transactions (supplies of goods or services to another EU member state) à Slovakian VAT invoices must be issued by the 15th day of the month following the taxable supply.

- For all other types of transactions à an invoice should be issued within 15 days of the taxable supply taking place.

Adhering to these deadlines is mandatory in Slovakia

Storage of Slovakian invoices

Invoices must be stored for 10 years.

If the invoices are related to immovable property, they should be kept available for 20 years.

Slovakian consequences of non-compliance

Failure to meet invoicing requirements will lead to the imposition of fines by the Slovak tax authorities.

Broader EU context and future outlook in Slovakia

Slovakia’s eInvoicing advancements are not isolated but are part of a larger European digital agenda. The EU’s VAT in the Digital Age (ViDA) initiative is set to impose e-invoicing and reporting requirements for intra-community B2B transactions by July 2030. This EU-wide mandate will further integrate Slovakia’s digital invoicing system with those across the European Union. Furthermore, Slovakia anticipates the development of National CIUS-es (Core Invoice Usage Specifications) to ensure seamless interoperability and full compliance with the European eInvoicing standard for domestic transactions.

Source: eInvoicing in Slovakia

You can book a free consultation with our VAT experts in time that is suitable for you!

Our Slovakian office provides the following services:

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.