Invoicing in Italy Step-by-Step: Requirements and Rules

Invoicing in Italy – what do you need to know? Starting from mandatory e-invoicing rules to invoice formats, tax codes, and storage requirements. We’ll walk you through the process step by step, help you stay compliant, and answer common questions like: What is the 7% tax rule in Italy? and Which platform should You use to issue e-invoices?

- Published on :

- Reading time : 11 min

How does invoicing work in Italy?

In Italy there is one of the most advanced and demanding invoicing system in the whole Europe. Whether you’re selling to local customers, doing business with Italian companies, or expanding your e-commerce across borders, understanding how invoicing works in Italy is a must.

If you want to keep up with local regulations and avoid any of invoicing mistakes, this article is specially for you.

How do I invoice in Italy? – the basics explained

You have to know that if you’re doing business in Italy, invoicing isn’t something optional but rather a legal obligation.

Since 2019, Italy has introduced mandatory electronic invoicing (e-fattura) for almost all domestic transactions. This includes sales to:

- other businesses (B2B),

- private individuals (B2C),

- public bodies (B2G).

Italian tax invoice – what to remember

To invoice in Italy, you must:

- Issue invoices in electronic format (XML FatturaPA)

- Send them through the national SdI platform

- Archive them digitally for 10 years

There is no need to maintain manual invoices, PDFs or paper versions. There are no longer valid for any of the tax purposes.

E-invoicing in Italy - what you need to know

What is the format of e-invoicing in Italy?

Invoicing in Italy has to follow a very strict technical format defined by the Italian tax authority ⇒ XML FatturaPA

With more than 100 data fields, this standardised structure is intended for validation and computer processing.

Key XML elements include:

- Seller and buyer identifiers (VAT or tax codes)

- Line items and unit prices

- VAT breakdowns and applicable codes

- Payment methods and due dates

- Specific codes for reverse charge or VAT exemptions

You can book a free consultation with our VAT experts in time that is suitable for you!

What is the e-invoicing platform in Italy?

All Italian invoices must be submitted through the Sistema di Interscambio (SdI), the official invoicing platform operated by the Agenzia delle Entrate.

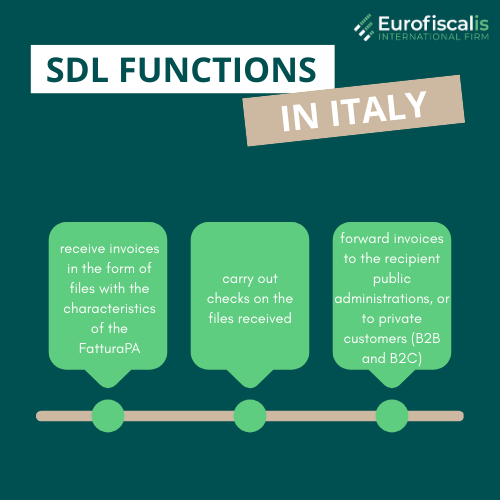

The SdI functions as a central hub that:

- receive invoices in the form of files with the characteristics of the FatturaPA;

- carry out checks on the files received;

- forward invoices to the recipient public administrations, or to private transferees/customers (B2B and B2C).

Your business must obtain an SDI code or certified PEC email address to receive invoices. Most companies use invoicing software that integrates directly with the SdI for faster, which makes compliant processing.

The SDI code is primarily used for automated invoice processing through software, while a certified PEC email address can be used for direct communication and receiving notifications within the SDI system.

Digital archiving Italian e-invoices

Italian law requires electronic invoices to be:

- Stored for 10 years – so it is the same as with paper ones

- Your company has to ensure authenticity and integrity

- You must have a digital timestamp and signature

You can use a certified archiving service, your invoicing software’s archive feature, or the government portal. Be sure to complete the conservazione sostitutiva process to ensure legal validity, such as the roles of the responsible party, the archiving system, and the need for secure storage and retrieval.

Source: Sistema di Interscambio

You can book a free consultation with our VAT experts in time that is suitable for you!

Invoicing requirements in Italy based by transaction types

B2B and B2C invoicing in Italy

Italy was the first EU country to mandate e-invoicing for all business sectors, including B2C transactions. As stated above, you must issue an electronic invoice and send it via SdI, even if your client is a private individual.

For B2C, the buyer’s fiscal code replaces the VAT number, and if it’s unavailable, the placeholder “0000000” is used.

B2G invoicing - public authorities

According to public procurement regulations, your invoice must include a few more facts. Your invoice for B2G transactions needs to contain:

- A Codice Univoco Ufficio (CUU) – a unique identifier for the public body

- CIG (Tender Identification Code) and CUP (Project Code) if applicable

- A digital signature and timestamp

Invoices without these details will be rejected and not paid.

You can book a free consultation with our VAT experts in time that is suitable for you!

Cross-border clients invoicing

When you are a foreign company and you are invoicing clients from Italy – you must understand how Italian invoices are treated under Italian law.

Since July 2022, even cross-border transactions must be reported through SdI using a simplified format (cross-border e-invoicing).

Depending on whether you’re VAT-registered in Italy, you might need to:

- Register for VAT and follow full e-invoicing rules

- Report transactions via “Esterometro” or submit simplified XML to SdI

- Include reverse charge references or exemption codes

What is Esterometro?

The obligation of electronic transmission of the data of “cross-border” transactions, i.e. the supplies of goods and services carried out and received to and from subjects not established in the territory of the State.

Mandatory invoice fields in Italy

If you want to issue a legally valid invoice in Italy, your document must include:

- Issue date,

- An invoice identifier that is sequential and unique,

- Name of the business, residence or address of the seller, information about the fiscal representative, and, if relevant, the address of the non-resident’s permanent establishment,

- VAT number of the seller,

- The buyer’s business name, home address or place of business, fiscal representative information, and, if applicable, the non-resident’s permanent establishment address,

- The buyer’s VAT number, the fiscal code for individual customers, or the EU VAT number supplied by the EU member state if the buyer is based in another EU country,

- Thorough explanation of the kind and quantity of commodities or the nature and extent of services,

- Date of payment or transaction (if different from the date on the invoice),

- The net sum, the applied VAT rate, and the VAT amount,

- Unit cost of goods or services, excluding taxes, rebates, or discounts (unless included in the unit cost),

- A reference to the applicable Italian/EU legal provision if VAT is not charged.

What can you add to Italian invoice as additional best practice?

- Use progressive invoice numbers (without gaps or duplicates)

- State currency and exchange rates if billing in non-EUR

- Include the phrase “autofattura” for self-invoicing where required

- Clearly mark any reverse charge or VAT-exempt invoices with relevant EU Directive or local article

Understand the Italian 7% tax rule and other VAT specifics

What is the 7% tax rule in Italy?

This refers to withholding duty (ritenuta d’acconto). It’s generally applied to professional services handed by individualities or certain hookups. The customer withholds 7 of the tab value and pays it to the duty authority on behalf of the supplier.

If you’re a foreign business without a permanent establishment, this usually does not apply, but always verify based on the contract and service type.

VAT rates in Italy

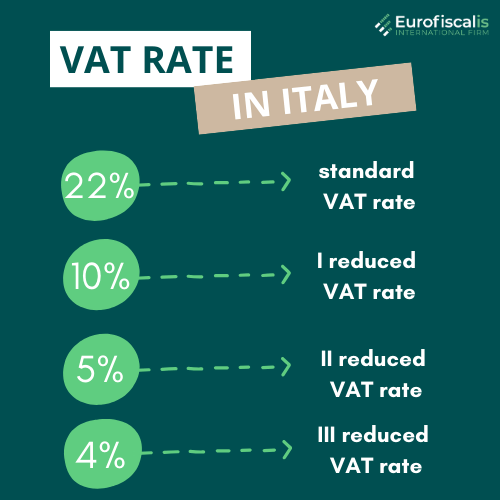

Italy applies the following VAT rates:

- 22% – standard rate

- 10% – first reduced rate for certain foods, accommodation

- 5% – second reduced rate for social/health services

- 4% – third reduced rate for basic necessities

If you want to read more about Italian VAT rates:

Use the correct VAT code (N-nn) on your invoice to indicate the legal basis for exemption or reduced rates.

Codes indicate the reason for a specific VAT treatment (e.g. taxed, non-taxed, exempt) and that there are specific numeric codes (such as N1, N2, etc.) for different scenarios.

Stamp duty and other charges

Italian invoices that are not subject to VAT might require a €2 digital stamp duty (imposta di bollo). This applies to invoices over €77.47, and must be declared quarterly via the Fatture e Corrispettivi portal.

Invoices subject to VAT do not need the stamp duty.

Calculation and deadlines

The Revenue Agency calculates the stamp duty due quarterly, based on data in lists A and B. The amount is available in the “Invoices and considerations” portal by the 15th of the second month following the end of the quarter (except for the second quarter, which is postponed to September 20).

Payment methods

Payment can be made through the “Invoices and Fees” portal by indicating the taxpayer’s IBAN, or via F24 form (submitted electronically). Specific tax codes (2521-2526) are provided for each quarter, penalties, and interest.

Late payments

The web procedure calculates penalties and interest for late payments. The taxpayer can consult past payments and receipts on the portal.

Omitted/deficient/late payments

The Revenue Agency sends an electronic communication to the taxpayer’s certified e-mail address (INI-PEC), detailing the amount due (stamp duty, penalty, and interest).

Clarifications and assistance

Taxpayers can request clarifications within 30 days of receiving the communication through the CIVIS web service or by scheduling an appointment at a territorial office. The CIVIS service allows for online assistance and provides the outcome of the processing.

What’ s new in e-invoicing in Italy? - recent changes 2024-2025

Last year and this year Italy continues to refine its e-invoicing

- Elimination of Esterometro in favor of real-time reporting through SdI

- New technical specifications for XML FatturaPA

- Upcoming EU ViDA changes that will further harmonize digital reporting

Invoicing in Italy - what is the future of of EU e-invoicing?

Italy was the first EU country to roll out mandatory e-invoicing nationwide. It’s now a blueprint for other member states preparing for ViDA (VAT in the Digital Age). Its aim is to standardize digital reporting across the EU.

Invoicing in Italy is now more in line with EU-wide trade and reporting because of its early adoption of EN16931 standards and interaction with Peppol. Peppol is the EU’s B2G communication platform. It is used for the electronic exchange of documents such as invoices, orders.

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.