Invoicing in Great Britain 2025 - Practical guide

Read this guide and you will become a master invoicing in Great Britain. This article covers everything from the basic mandatory components every UK invoice must feature, as stipulated by HMRC, to the specific nuances of VAT invoicing, the evolving world of e-invoicing, and actionable best practices.

- Published on :

- Reading time : 10 min

Why correct invoicing in Great Britain matters?

Understanding the profound impact of correct invoicing in Great Britain is the first step towards streamlining your financial processes. It’s more than just sending a bill – it’s a critical business function with far-reaching implications.

Are you interested in VAT in Great Britain? Read more or schedule a free consultation

Legal compliance and HMRC requirements for UK businesses

Adhering to the invoicing rules Great Britain is non-negotiable for legal compliance. Her Majesty’s Revenue and Customs (HMRC) outlines specific HMRC requirements UK for what constitutes a valid invoice, especially concerning VAT.

Failure to correctly comply with all these regulations for invoicing in Great Britain can lead to financial penalties, complications during tax audits and investigations.

Ensuring prompt payment and healthy cash flow

The quality and timeliness of your invoicing in Great Britain directly influence how quickly you receive payment. Clear, accurate, and professional invoices reduce customer queries and disputes, paving the way for prompt payment in the UK. Efficient invoicing is therefore a cornerstone of healthy cash flow, allowing your business in Great Britain to manage its finances effectively and plan for future growth.

Professional business image and customer trust

Your company’s image is influenced by all of its communications, and invoices are no different. Professional, error-free invoicing in Great Britain enhances your operational efficiency and attention to detail. Customers will feel more comfortable doing business with you as a result of the increased trust and improved UK customer relations, which may result in repeat business and smoother payment processes.

You can book a free consultation with our VAT experts in time that is suitable for you!

What must be on your invoice in Great Britain?

When you are issuing invoices in Great Britain it is crucial to include all mandatory information that is specified by UK law. These requirements are not optional. Gov.uk provides clear guidance on what to include on an invoice in the UK.

Standard invoice requirements for all UK businesses

- Invoice number – must be unique

- Seller’s information – including: VAT registration number (if you are VAT-registered) , company name, address, contact information

- Buyer’s information – including: VAT registration number, company name, address etc.

If they are VAT registered and you are making a taxable supply to them in another EU member state ⇒ post-Brexit rules apply for international transactions, always check current guidance for specific scenarios involving customers outside Great Britain

- Description of goods or services

- The date the goods or services were provided – it is a supply date or tax point

- The date of the invoice – when it was created

- The quantity of goods or the extent of the services

- The VAT rate

- The unit price or rate for each item, excluding VAT

- The total amount payable, excluding VAT (the net amount)

- Reference to any special VAT schemes used (e.g., margin schemes for second-hand goods, or if a reverse charge applies, a note such as “reverse charge: customer to pay the VAT to HMRC)

For B2B supplies within the UK where the reverse charge applies, the customer’s VAT number is also crucial.

Additional requirements for limited companies in Great Britain

When your business operates as a limited company, in addition to standard invoice requirements you must add:

- The full registered company name – as it appears on the certificate of incorporation

- The company registration number and the registered office address – if you’re also displaying a trading address, the registered office must still be clear

Requirements for solo trader operating in Great Britain

If you are a solo trader business that is invoicing in Great Britain, you must include:

- Your own name

- Any business name you are trading under

- An official address where any legal documents can be delivered to you if you are using a business name.

This ensures proper legal service for matters related to your invoicing in Great Britain.

You can book a free consultation with our VAT experts in time that is suitable for you!

Date of issue – invoicing in Great Britain

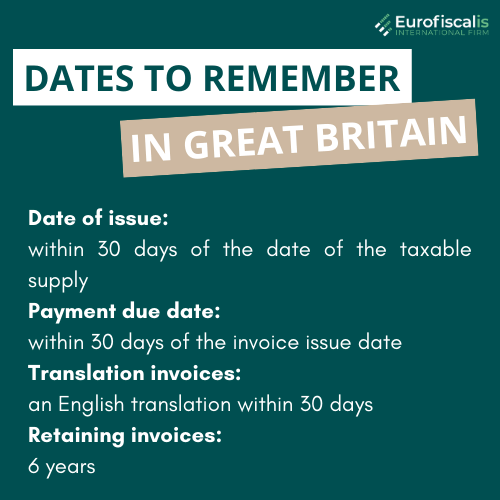

Your business must issue VAT invoices within 30 days of the date of the taxable supply. When the transaction involves an intra-Community supply of goods or services, the invoice must be provided by the 15th day of the month following the month in which the taxable supply was made or service was provided.

Payment due date – invoicing in Great Britain

It is common to pay within 30 days of the invoice issue date. Remember that there is not mandatory to include a payment date on your invoice, however it might be a good practice.

Language and currency – invoicing in Great Britain

You can issue invoices in Great Britain in English, however it is not necessary to do so. If a VAT officer wants you to translate it from another language your business must provide an English translation within 30 days.

Invoices can be in any currency you want.

If you issue in a foreign currency (other than GBP) the total VAT payable must additionally be converted into GBP. You must use the period rate of exchange published on the official page HMRC.

Retaining invoices in Great Britain

You must retain your invoices (both sales and purchases) for 6 years, whether they are paper or electronic.

You can book a free consultation with our VAT experts in time that is suitable for you!

Navigating VAT invoicing in Great Britain - Rules and regulations

For a lot of businesses VAT invoicing in the UK is a very important aspect of business’s financing. If you are VAT-registered or you are trading with VAT-registered customers or businesses – understanding the UK VAT invoice requirements and HMRC VAT rules is essential.

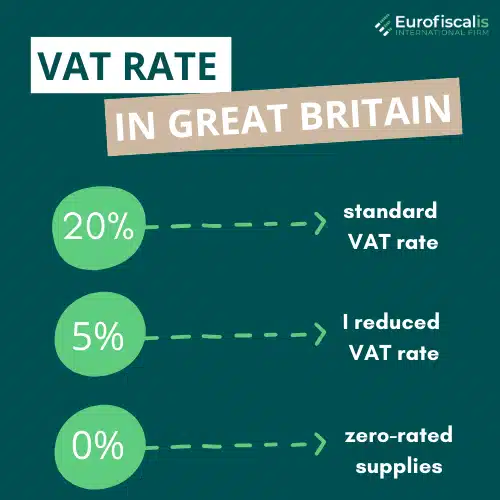

Check out VAT rates for 2025 in Great Britain:

When is a VAT Invoice mandatory in the UK?

VAT invoice in Great Britian is mandatory when you supply goods or services to another VAT-registered business that are taxable. Firstly, you need to understand the threshold for compulsory registration. Even when you are under the threshold – but you are voluntarily registered , you still have to issue VAT invoices for taxable supplies when requested by a VAT-registered customer for their invoicing in Great Britain records.

Simplified VAT invoices - When can you use them in Great Britain?

When your business is conducting invoicing in Great Britain and it contains retail supplies under £250 including VAT – then you might be permitted to issue a simplified VAT invoice in the UK.

It comes with fewer details than a full VAT invoice. However, you still have to include information, such as your business name, address, VAT number, the date of supply, a description of goods/services, and the total amount including VAT, along with the VAT rate applicable to each item if different rates apply.

Invoicing in Great Britain - credit notes and debit notes

Mistakes happen. If a VAT invoice containing an error has already been issued, you cannot simply alter the original. However, you can issue a credit note to reduce or cancel the amount, or a debit note if you need to increase the amount. These documents must also contain specific information, including a reference to the original invoice number. This ensures correct VAT adjustments Great Britain and maintain accurate records for HMRC.

Source: Invoicing in Great Britain

Our office provides the following services in the United Kingdom:

E-Invoicing in Great Britain

The shift towards digital invoices has come also to Great Britain. Currently, invoicing in Great Britain is evolving with electronic invoicing which is gaining prominence.

What is E-Invoicing and why is it gaining traction in the UK?

Electronic invoicing UK refers to the process of creating, sending, receiving, and processing invoices in a structured digital format between supplier and buyer.

This new system is reducing printing and costs that are associated with traditional, paper invoicing. It also enables faster delivery any payments. Helps with automation, improves data accuracy and makes it easier to store invoices.

Current status and legal acceptance of e-invoices in Great Britain

HMRC e-invoicing UK guidance confirms that electronic invoices are legally acceptable for invoicing in Great Britain, provided they contain all the mandatory information required for paper invoices (including VAT details where applicable).

Throughout the storage period you must ensure the authencity of the origin, integrity of the content, and legibility of the legal e-invoices Great Britain

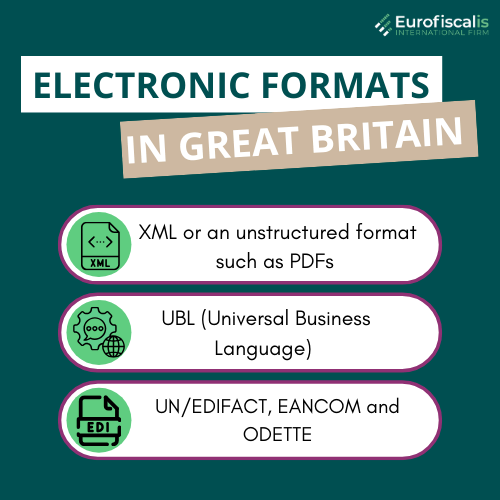

Electronic formats:

- XML or an unstructured format such as PDFs – sent by email

- Structured formats like UBL (Universal Business Language) are also sometimes used

- Traditional EDI standards (UN/EDIFACT, EANCOM and ODETTE)

E-invoices to the healthcare sector must be sent through Peppol.

Is e-invoicing mandatory in Great Britain?

Electronic invoicing is not mandatory at either the B2G or B2B level. The only exception to this rule is the healthcare industry, where electronic invoicing to the National Health Service (NHS) is required.

Key considerations for implementing e-invoicing in your UK business

When transitioning to or implementing e-invoicing in Great Britain, several factors need consideration for a smooth and compliant process. This includes selecting appropriate e-invoicing software UK that suits your business size and complexity, ensuring robust data security measures to protect sensitive invoice information, and establishing clear procedures for digital invoice archiving Great Britain in line with HMRC’s record-keeping requirements (typically 6 years for VAT purposes). Agreement with your customers on the use of e-invoices is also good practice.

If you are interested in a comprehensive guide to VAT registration and compliance for businesses in the United Kingdom, we recommend our article:

Our office provides the following services in the United Kingdom:

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.