VAT returns in Italy: Learn about Italian rules

Italy as a cornerstone of the European Union, it operates based on VAT known in Italy as Imposta sul Valore Aggiunto (IVA) system. Navigating VAT returns in Italy is crucial for any business. From domestic transactions to more complex cross-border dealings, understanding Italian VAT including process, annual declarations, penalties and any deadlines is fundamental for compliance and financial stability.

- Published on :

- Reading time : 12 min

Understanding Italian VAT

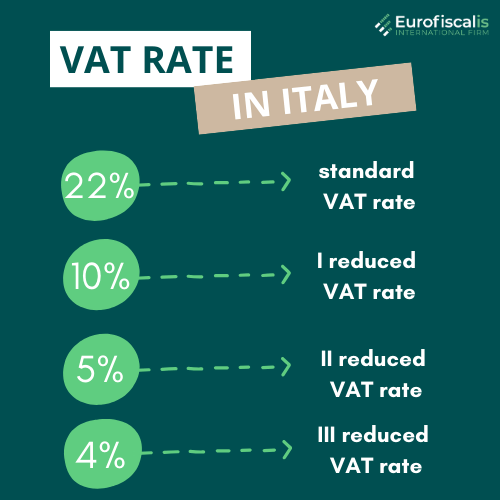

Italian VAT is a consumption tax that is applied to the supply of goods and services, as well as intra-Community acquisitions and imports. In Italy the standard VAT rate is 22%, first reduced rate is 10% and second 5%. The super-reduced rate of 4% apply to specific categories of goods and services, such as foodstuffs, pharmaceuticals, and certain cultural items.

Who needs to file VAT returns in Italy?

VAT returns in Italy is a need for any business, whether they are residents or not that carries out taxable supplies within Italian territory is generally required to register for VAT and, consequently, file VAT returns in Italy. This includes:

- Resident businesses (Regime forfetario – Flat-rate regime):

Businesses and sole proprietors established in Italy that conduct taxable activities. It is always necessary to have a VAT number.

- Non-resident businesses:

Foreign businesses who offer goods or services in Italy, such as those that store items in Italy (for example, through fulfilment systems like FBA) or engage in distance selling to Italian consumers (beyond the €10,000 barrier for cross-border trading across the EU). Generally speaking, non-EU businesses must designate a fiscal representative who bears joint liability for Italian VAT.

- Specific scenarios:

Registration requirements for non-residents when purchasing with reverse charge in Italy

The core of Italian VAT – taxable transactions

Italian VAT applies to a broad range of transactions:

- Supply of goods and services: The sale of tangible goods and the provision of services within Italy.

- Intra-Community acquisitions and supplies: The movement of goods between Italy and other EU member states.

- Imports and exports: The introduction of goods into Italy from outside the EU (imports) and the dispatch of goods from Italy to non-EU countries (exports).

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT returns in Italy - process step-by-step

The process of filing VAT returns in Italy involves periodic such as monthly or quarterly and annual declarations.

VAT returns in Italy: periodic and annual filings

Periodic VAT returns (Liquidazioni periodiche IVA – LIPE)

- LIPE is submitted quarterly, though businesses with a turnover below a certain threshold

- €500,000 for service providers

- €800,000 for other businesses can opt for quarterly filing

VAT returns and related payments:

- Monthly VAT calculations must be paid by the 16th day of the month following the reporting period

- Quarterly VAT calculations must be paid by the 16th day of the second month following the reporting period for the first three calendar quarters

Delay of LIPE:

1Q 30/05

2Q 30/09

3Q 30/11

4Q 29/02

If your annual VAT return is filed before February 29, you can file the LIPE (presumably a specific type of return or declaration) as a quarterly return within your annual VAT return.

If you file your annual VAT return after February 29, the LIPE must be filed separately with the above deadlines.

You have the right to file your annual VAT return by February 1st.

- Periodic returns (LIPE) are primarily for reporting and payment purposes. The periodic communication (LIPE) must be submitted even if the VAT return is zero, but only if a credit from the previous period is carried forward. The annual VAT return must always be submitted even if the VAT return is zero.

Annual VAT return (Dichiarazione annuale IVA)

- All of the VAT transactions for the full fiscal year are compiled in one statement. It is used to calculate the final annual VAT liability or refund and reconciles the periodic reports.

- The annual return is an informative declaration and does not typically involve a payment upon submission, as payments are usually made periodically throughout the year (except for those who pay VAT quarterly).

The yearly VAT return needs to be sent in by:

- holders of VAT numbers, regardless of whether they engaged in taxable activities during the tax period;

- non-resident taxpayers who either directly registered for VAT or designated a tax representative;

- fixed establishments of non-resident companies that are VAT-liable taxpayers.

Information required for VAT returns in Italy

You businesses must maintain accurate and complete documentation for filing Italian VAT declarations.

- Sales and purchase invoices – All detailed records of all outgoing (output VAT) and incoming (input VAT) transactions.

- Input and output VAT figures – Segregation and calculation of VAT charged on sales and VAT incurred on purchases.

- Specific adjustments – Accounting for non-deductible VAT and any other adjustments required by law.

- Company details and VAT number – All identifying information must be correct and consistently used.

VAT declarations in Italy - deadlines and penalties

VAT returns in Italy - deadlines

Periodic returns:

- Monthly payments ⇒ By the 16th day of the month following the reporting period.

- Quarterly payments ⇒ By the 16th day of the second month following the quarter (Q1, Q2, Q3). The payment for the fourth quarter is typically due by March 16 of the following year, often coinciding with the annual VAT return.

Annual VAT return:

- The final date for of submission is April 30 of the following year (for example for the 2024 tax year, the deadline is April 30, 2025).

- The submission window for the annual return typically opens on February 1. All VAT returns in Italy must be submitted electronically via the Italian Revenue Agency’s (Agenzia delle Entrate) portal.

Italian penalties for late or incorrect filings

Late submission of returns:

⇒ A single administrative penalty of 120% (and no longer the statutory range between 120% and 240%) of the tax amount due for the tax period or for the transactions that should have been declared, with a minimum of €250.

Late payment of VAT:

⇒ If there is imposed for late payments – a fine of 25% of the unpaid VAT, along with annual interest of 2%

Errors or omissions:

⇒ If the taxpayer proactively corrects the errors through the “ravvedimento operoso” (voluntary correction) procedure, the penalties for errors or omissions in the returns may be reduced.

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT refunds in Italy - recovering your dues

There are many individuals and businesses that wonder, “How do I get a 22% VAT refund in Italy?”. The answer depends on whether you are a business with excess input VAT or a non-EU tourist.

Eligibility for VAT refunds

- For Businesses

When the input VAT (VAT paid on purchases) for a certain reporting period is more than the output VAT (VAT levied on sales), a VAT refund is issued. Usually, this credit can be applied to future VAT obligations or, in some cases, sought as a reimbursement. Applications are accepted from companies that have an active Italian VAT number as well as those that are registered for VAT in their home country but do not have a permanent location in Italy.

- For non-EU tourists (22% VAT refund)

Non-EU residents visiting Italy are eligible to claim a refund on the VAT paid on goods purchased for personal use, provided certain conditions are met. While the standard VAT rate is 22%, the actual refund amount can vary due to administrative fees and the specific rate applied to the goods, making a “22% VAT refund” an approximation of the potential savings.

The process of claiming a VAT refund

For businesses:

- VAT refunds are primarily requested via the annual VAT return.

- Specific forms and documentation, including invoices, are required to support the refund claim.

- For refunds exceeding €30,000, a bank guarantee is typically required as collateral.

- Businesses may choose to use the TR form to submit quarterly VAT refund claims under specific circumstances; these claims must be made by the last day of the month after the reference quarter. For quarterly applications, the minimum amounts to request a refund using the TR form in the annual VAT return are €2,582.28.

Is there a tax return in Italy beyond VAT?

Beyond VAT returns in Italy, the Italian tax system requires various other tax declarations. The question “Is there a tax return in Italy?” generally refers to income tax returns, which are distinct from VAT returns.

Overview of other Italian tax returns

1. Income tax returns – Dichiarazione dei Redditi

- IRPEF (Imposta sul Reddito delle Persone Fisiche): Personal income tax.

-

- IRES (Imposta sul Reddito delle Società): Corporate income tax.

-

- IRAP (Imposta Regionale sulle Attività Produttive): Regional tax on productive activities.

2. Form 730 – Modello 730: A simplified income tax return.

3. Modello Redditi Persone Fisiche: Comprehensive form used by self-employed individuals, freelancers, or those with complex income structures or foreign investments.

4. Deadlines for Income Tax Returns: The deadline for filing income tax returns electronically is typically September 30 of the following year. Paper filing (for non-residents) usually has an earlier deadline of June 30.

5. Form RW: For tax monitoring purposes and to calculate any wealth tax owed, people who own financial assets or real estate overseas must also file the RW form (IVIE for foreign real estate, IVAFE for foreign financial investments).

Maintaining accurate records in Italy

Diligent Bookkeeping: Establish reliable procedures for keeping track of all credit notes, sales and purchase invoices, and other pertinent financial records.

Digital Solutions: To ensure correct and timely filings, think about utilising digital platforms or accounting software that can help with record-keeping and automate VAT computations.

Source: VAT returns in Italy

You can book a free consultation with our VAT experts in time that is suitable for you!

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.