VAT in Slovakia: A comprehensive guide for businesses

Navigating VAT in Slovakia can be challenging, especially with recent rate changes and compliance updates. Whether you’re a local business, an e-commerce seller, or a foreign company trading in Slovakia, understanding VAT obligations is crucial. This guide breaks down registration, VAT rates, invoicing rules, and upcoming changes so you can stay compliant and optimize your tax strategy.

- Published on :

- Reading time : 15 min

Introduction to VAT in Slovakia

Slovakia’s Value Added Tax (VAT), or Daň z pridanej hodnoty (DPH), is a key element of its tax system, governed by Act No. 222/2004 Coll. and aligned with EU regulations. Applied to most goods and services across the supply chain, it affects businesses of all sizes operating in this Central European country.

Compliance is critical – failure to adhere to Slovak Tax Authority rules can lead to penalties, while proper management ensures profitability and legality. This guide outlines Slovakia’s VAT basics—rates, registration, and compliance—equipping businesses to navigate the system effectively.

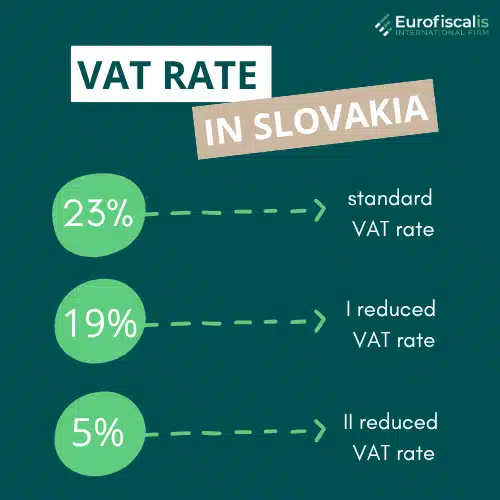

VAT Rates in Slovakia

Slovak standard and reduced VAT rates

Slovakia applies a tiered VAT system, where different types of goods and services are subject to different rates:

Standard VAT rate – 23% (changed from 20%)

- Applies to most goods and services, including electronics, clothing, household products, and professional services.

Reduced VAT rates:

19% VAT Rate applies to:

- food,

- electricity supply,

- restaurant and catering services associated with the serving of beverages, with the exception of the serving excluding alcoholic beverages with over 0.5% alcohol content

5% VAT rate introduced for specific essential goods, including:

- certain food products

- select medical and hygiene products

- the sale of books,

- accommodation services,

- goods and services within the framework of social economy activities,

- selected services such as entrance fees to sports events,

- restaurant and catering services associated with the serving of meals

0% VAT rate applicable to:

- exports of goods outside the EU

- intra-community supplies (B2B transactions between VAT-registered companies in different EU countries)

A reduced 10% VAT rate in Slovakia – was abolished in 2025.

Recent changes in VAT rates in Slovakia - 2025

- Overview of the 2025 VAT rate hike: standard rate increased from 20% to 23% as of January 1, 2025.

- Elimination of the 10% reduced rate, replaced by a new 19% rate, impacting goods like books and restaurant services.

- Context of the change: fiscal consolidation to address Slovakia’s budget deficit, aligning with EU trends.

- Example of impact: books, previously at 10%, now taxed at 23% since earlier adjustments in 2024, with further alignment in 2025.

- Tips for businesses to adjust pricing and communicate changes to customers.

VAT registration in Slovakia

VAT registration is a crucial prerequisite for companies doing business in Slovakia. VAT in Slovakia must be followed if your business surpasses the registration requirements in order to avoid fines.

How to register for VAT in Slovakia?

Step 1. Complete the VAT application form (available via the Slovak Financial Administration portal).

Step 2. Submit supporting documents

- Business registration certificate

- Proof of taxable activity

- Identification of company directors

Step 3. For non-residents, provide a certified trade registration extract (translated into Slovak if needed).

Step 4. Processing time – typically up to 4 weeks for VAT number issuance.

Step 5. Receive VAT Number – The Slovak Tax Office issues a VAT identification number (DIČ) upon approval.

Who needs to register for VAT in Slovakia?

Businesses must register for VAT in Slovakia under the following conditions:

- Resident Businesses (Slovak companies)

- VAT registration is mandatory if annual taxable turnover exceeds €49,790 within 12 months.

- Voluntary VAT registration is available for businesses below this threshold.

- Non-Resident Businesses (Foreign companies with Slovak transactions)

- If providing taxable supplies in Slovakia, VAT registration is required regardless of turnover.

- E-commerce and Distance Selling

- Foreign businesses selling goods to Slovak consumers must register once sales exceed €10,000 per year unless using the EU VAT OSS scheme.

- Intra-Community Acquisitions

- Businesses purchasing goods from EU suppliers exceeding €14,000 annually must register.

You can book a free consultation with our VAT experts in time that is suitable for you!

Slovakian VAT registration thresholds

- Resident businesses – €50,000 annual turnover threshold for mandatory registration, effective next calendar year.

- Higher threshold of €62,500 triggers immediate registration for VAT-exempt suppliers.

- Non-residents – no threshold registration required before commencing taxable activities.

- Distance selling threshold – €10,000 EU-wide limit for e-commerce sales to Slovak consumers (under OSS rules).

- Comparison with other EU countries to highlight Slovakia’s unique approach.

Slovakian VAT compliance and reporting

Maintaining VAT compliance in Slovakia requires precise invoicing, timely VAT returns, and appropriate record-keeping.

Filing VAT returns in Slovakia

Monthly Filing – Most companies with annual revenue above €100,000 must submit this form.

Quarterly Filing – This option is available to companies with yearly sales under €100,000.

Deadline for Submission – VAT returns have to be submitted by the 25th of the subsequent month.

VAT payment deadline – unpaid VAT must be settled on the same day as the VAT return submission

VAT ledger reports in Slovakia

Companies are required to keep precise VAT ledgers that contain the following information:

- Issued and received invoices

- VAT collected and deducted

- Transactions that are exempt and reverse charged

Streamlined reporting that permits aggregated submissions for bills under €3,000.

Records must be accessible for audits and kept for a minimum of ten years.

Slovak Invoicing requirements

Invoices must include:

- Supplier’s VAT number

- Customer’s VAT number (for B2B transactions)

- Description of goods/services

- Invoice date and numer (date of supply if different from issuance, plus payment terms if pre-payments apply)

- VAT rate and amount

Electronic invoices permitted with customer consent, adhering to EU standards.

Reverse charge notation required for B2B transactions with foreign suppliers.

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT for foreign businesses in Slovakia

Distance selling and e-commerce in Slovakia

- EU-wide €10,000 threshold for B2C distance sales—beyond this, Slovak VAT applies at 23%.

- Non-EU businesses selling goods/services to Slovak consumers can use the EU VAT OSS (One Stop Shop) scheme to simplify VAT compliance.

- Digital services (e.g., software, streaming) subject to Slovak VAT when sold to non-taxable Slovak consumers.

- Practical tip – track sales by country to determine registration or OSS needs.

- Impact of 2025 rate changes on pricing strategies for e-commerce vendors.

- Non-EU businesses must appoint a fiscal representative to handle VAT compliance.

- Fiscal agents assist with VAT filings, payments, and tax audits.

Importing goods into Slovakia

⇒ VAT is due at importation, usually at a rate of 23%, unless the products are exempt or qualify for lower rates.

⇒ Starting in 2025, some importers will have the option to self-assess, which will move payment to VAT returns.

⇒ VAT is computed depending on the value of the products, including shipping charges, during the customs clearance process.

⇒ Potential refunds through VAT returns in the event that products are used for taxable purposes or are reexported.

⇒ A penalty risk of 1.3% of the VAT owed for breaking the import self-assessment regulations.

You can book a free consultation with our VAT experts in time that is suitable for you!

VAT Exemptions and special cases in Slovakia

Exempt goods and services in Slovakia

Key exemptions:

- healthcare services,

- education services,

- financial transactions,

Specific goods:

- postal services,

- certain cultural events,

- charitable supplies.

Special VAT schemes

⇒ Mini One Stop Shop (MOSS) replaced by broader OSS for e-commerce VAT reporting.

⇒ Small business scheme: exemption for firms with turnover below €50,000, optional from 2025.

⇒ Cash accounting scheme available for eligible Slovak and foreign-managed businesses.

⇒ Reverse charge mechanism for B2B supplies from non-residents—buyer accounts for VAT.

⇒ Leasing contracts: new 2025 rules treat some as goods supply, impacting VAT timing.

Penalties and consequences of non-compliance in Slovakia

Common VAT mistakes to avoid

- Misclassifying goods/services under wrong VAT rates (e.g., 19% vs. 23%).

- Late registration by foreign businesses starting taxable activities in Slovakia.

- Incomplete invoices missing mandatory details, risking audit flags.

- Ignoring Intrastat reporting for intra-EU trade above €1 million thresholds.

- Failing to adjust for 2025 rate changes in pricing or accounting systems.

Penalties for late filing or payment in Slovakia

| Offense | Penalty amount |

|---|---|

| Late VAT registration | Up to €30,000 |

| Late VAT return submission | €30 to €16,000 |

| Failure to pay VAT on time | Interest penalties apply |

→ Unpaid VAT accrues interest at four times the Slovak National Bank rate, with a minimum of 15% per year.

→ Audit penalties up to €32,000 for significant breaches or non-filing upon request.

→ Criminal liability possible for deliberate tax evasion exceeding thresholds.

→ Proactive compliance (e.g., hiring VAT experts) as a safeguard.

Recent and upcoming changes in Slovak VAT legislation

Changes effective from January 1, 2025 in Slovakian tax regulations

- Standard VAT rate rise to 23%, reduced rate shift to 19%, per Slovak Parliament approval.

- Foreign businesses – registration now required within 5 days of becoming a VAT payer, not pre-activity.

- Small business exemption transposed from EU directive, adding “EX” suffix to VAT IDs.

- Financial leasing redefined – some contracts taxed as goods supply, not services.

- New bank transaction taxes (0.4% on transfers, 0.8% on cash withdrawals) complementing VAT changes.

What else can change in 2026?

- Potential e-invoicing mandate to replace control statements, hinted for 2026.

- Adjustments to Intrastat thresholds or reporting frequency under review.

- EU-driven updates to OSS and IOSS schemes to streamline cross-border compliance.

- Possible refinement of reduced rate categories based on economic feedback post-2025.

- Businesses urged to monitor Slovak Ministry of Finance announcements for updates.

Source: VAT in Slovakia

Zosia is a marketing specialist in Eurofiscalis, a company with a well-established position in the field of cross-border VAT compliance. Simultaneously, Zosia continues her academic development as a master’s student in Finance and Accounting, which enables her to stay up-to-date with evolving tax regulations.

Combining her knowledge of marketing with a deep understanding of finance and taxes, creates precise, substantive, and easily accessible content. Her mission is to educate in understanding the complexities of taxation related to doing business in international markets.

With her commitment, Zosia translates complex tax issues into clear language, providing valuable information that genuinely helps companies in their development and international expansion. She aims for tax information to be not only understandable but, above all, helpful in making business decisions.